Reetu | Mar 24, 2023 |

DGFT Amends Export Policy of Bio-fuels

The Directorate General of Foreign Trade(DGFT) has made Amendments in Export Policy of Bio-fuels under Chapter 27 of Schedule 2 (Export Policy) ITC (HS) classification of Export and Import via issuing Notification.

The Notification Stated, “In exercise of powers conferred by Section 3 read with section 5 of the Foreign Trade (Development & Regulation) Act. 1992 (No. 22 of 1992), as amended, read with Para 1.02 and 2.01 of the Foreign Trade Policy 2015-20, the Central Government hereby amends Notification No. 29/2015-20 dated 28.08.2018.”

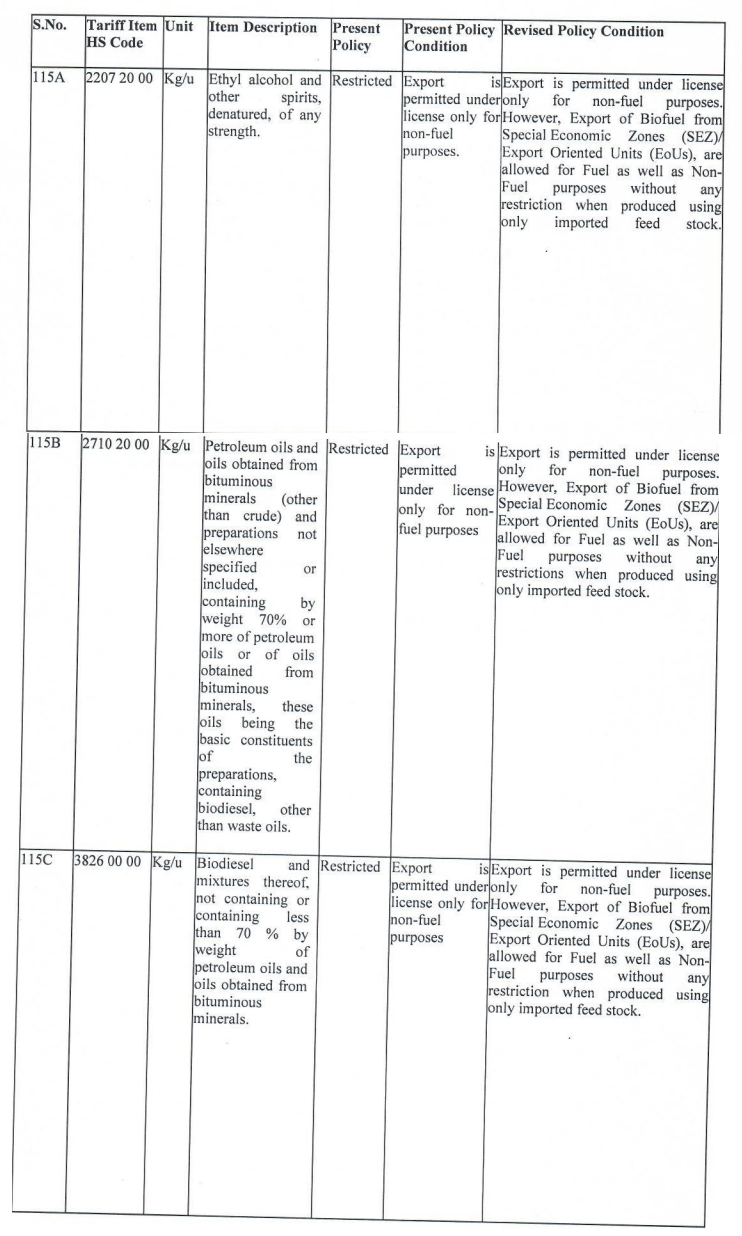

The revised policy conditions of Bio-Fuels under SL. No. 115A, 115B and 115C under Chapter 27 of Schedule 2 of ITC (HS) Classification of Export Import Items will be as follows:

The Notification no. 29/2015-20 dated 28.08.2018 is amended to the extent that Export of Biofuel from Special Economic Zones (SEZ)/ Export Oriented Units (EoUs), are allowed for Fuel as well as Non-Fuel purposes without and restriction when produced using only imported feed stock.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"