Reetu | Aug 9, 2022 |

DGFT Amends Export Policy of Flour items under HS Code 1101

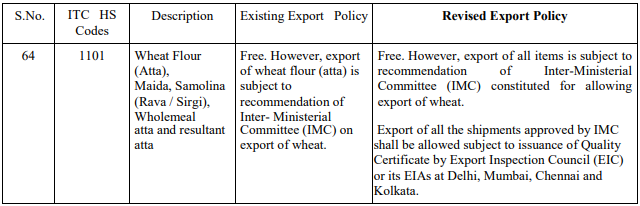

The Directorate General of Foreign Trade (DGFT) Notifies Amendment in Export Policy of Flour items under HS Code 1101 via Notification.

The Notification Stated, “The Central Government, in the exercise of powers conferred by Section 3 read with section 5 of the Foreign Trade (Development & Regulation) Act, 1992 (No. 22 of 1992), as amended, read with Para 1.02 and 2.01 of the Foreign Trade Policy, 2015-20, hereby amends export policy of items under HS code 1101 of ITC (HS), Schedule – II, 2018 as under:”

The provisions as under Para 1.05 of the Foreign Trade Policy, 2015-2020 regarding transitional arrangement shall not be applicable under this Notification. The Notification will come into effect from the 14th of August, 2022.

During the period from 8th August 2022 till 14th August 2022 the following consignments of Maida, Samolina (Rava / Sirgi), will be allowed to be exported: (i) where loading of above-mentioned items on the ship has commenced before this Notification; and (ii) where above-mentioned consignment has been handed over to the Customs before this Notification and is registered in their system.

Export Policy of items [Wheat Flour (Atta), Maida, Samolina (Rava / Sirgi), Wholemeal atta and resultant atta] under HS Code 1101 remains ‘Free’, but export shall be subject to the recommendation of InterMinisterial Committee (IMC) constituted for allowing export of wheat. The provisions as under Para 1.05 of the Foreign Trade Policy, 2015-2020 regarding transitional arrangement shall not be applicable under this Notification. Necessary modalities with regard to the quality of these items will be notified separately.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"