Reetu | May 24, 2022 |

DGFT amends import policy condition under Chapter 29 and 30 of ITC of Oxytocin reference standards

The Directorate General of Foreign Trade (DGFT) vide Notification No. 09 /2015-2020 dated 23.05.2022 amends import policy condition under Chapter 29 and 30 of ITC (HS) 2022, Schedule – I of Oxytocin reference standards.

The Notification is Given Below:

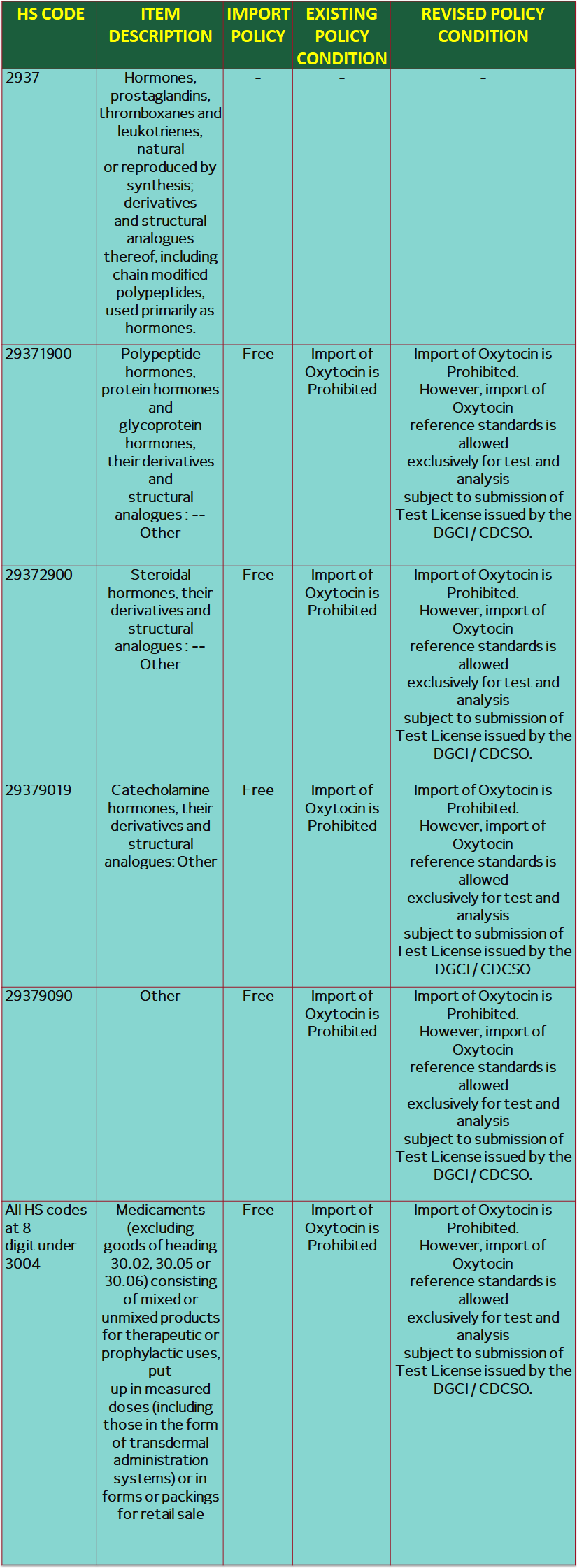

S.O. 2357(E).—In exercise of powers conferred by Section 3 and Section 5 of FT (D&R) Act, 1992, read with paragraph 1.02 and 2.01 of the Foreign Trade Policy, 2015-2020, as amended from time to time, the Central Government hereby makes amendment in the item description in accordance with the Customs Tariff of India 2022 and policy condition of the following HS codes of Chapter 29 and 30 of ITC (HS), 2022, Schedule – I (Import Policy):

2. Effect of this Notification:

Import of Oxytocin shall remain “Prohibited”. However, import of Oxytocin reference standards falling under HS Codes 29371900, 29372900, 29379019, 29379090 and all HS Codes at 8 digit level under 3004 is permitted exclusively for the purpose of test and analysis subject to submission of Test License issued by the DGCI / CDCSO.

This issues with the approval of Minister of Commerce & Industry.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"