Reetu | Feb 26, 2024 |

DGFT extends Import Period for Yellow Peas without MIP conditions and Port restriction

The Directorate General of Foreign Trade (DGFT) has notified the extension of the Import Period for Yellow Peas without MIP conditions and Port restriction via issuing a Notification.

The Notification is as follows:

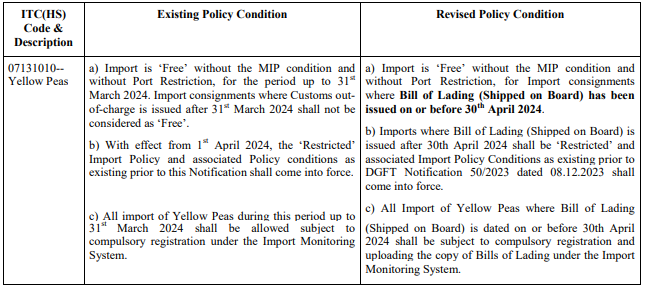

In the exercise of powers conferred by Section 3 and Section 5 of the Foreign Trade (Development & Regulation) Act, 1992, read with paragraphs 1.02 and 2.01 of the Foreign Trade Policy (FTP) 2023, as amended from time to time, and in continuation to Notification No. 50/2023 dated 08.12.2023, the Central Government hereby amends Import Policy conditions for Yellow Peas under ITC(HS) Code 07131010 of Chapter 07 of ITC(HS), 2022, Schedule –I (Import Policy) as under.

Revised Procedures in regard to prior registration of Yellow Peas consignments under the Import Monitoring System shall be notified separately.

Effect of the Notification: Import of Yellow Peas under ITC(HS) Code 07131010 is “Free” without the MIP condition and without Port Restriction, subject to registration under the Import Monitoring system, with immediate effect for all Import Consignments where Bill of Lading (Shipped on Board) is issued on or before 30th April 2024.

This is issued with the approval of the Minister of Commerce and Industry.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"