Reetu | Apr 28, 2022 |

DGFT Extends the date of e-filing of Non-Preferential CoO to August 01, 2022

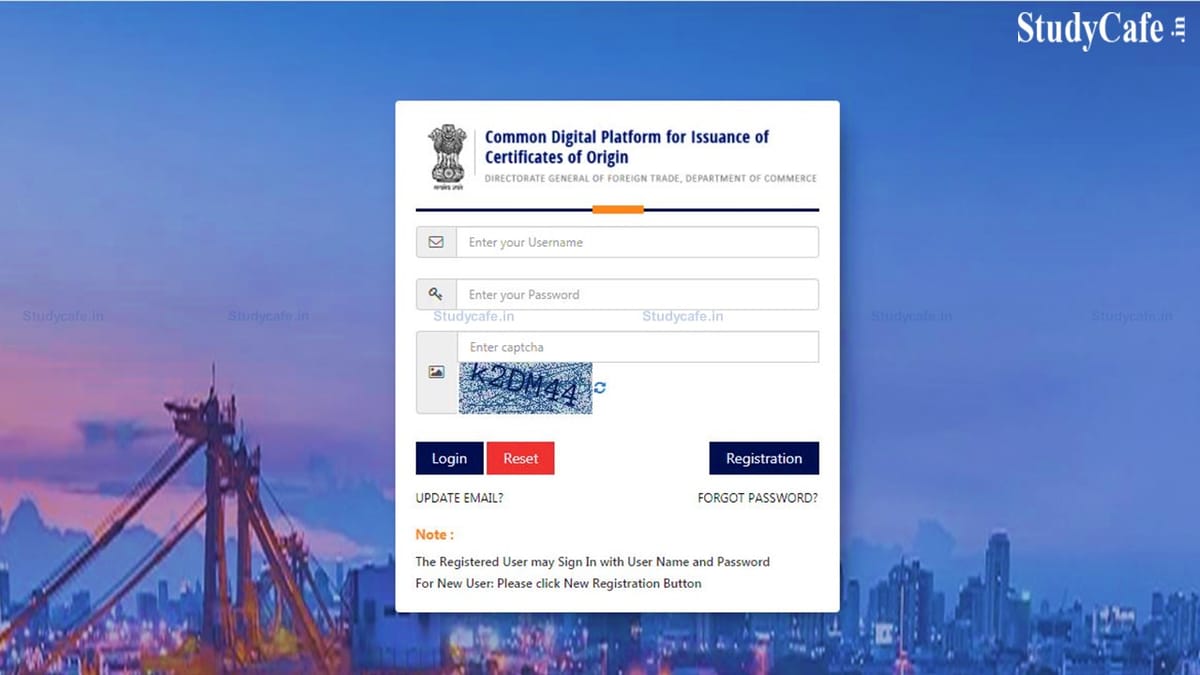

The Directorate General of Foreign Trade (DGFT) extends date for Mandatory electronic filing of Non-Preferential Certificate of Origin (CoO) through the Common Digital Platform vide Trade Notice No. 04/2022-2023 dated 27th April 2022.

The Trade Notice is Given Below:

In continuation to the earlier Trade Notice 24/2021-22 dated 15.11.2021, Trade Notice 42/2020-2021 dated 19.02.2021, 48/2020-2021 dated 25.03.2021, 10/2021-2022 dated 19.07.2021, 19/2021-2022 dated 01.10.2021, 21/2021-22 dated 18.10.2021 and 32/2021-22 dated 24.01.2022, it is informed that the transition period for mandatory filing of applications for Non Preferential Certificate of Origin through the e-CoO Platform has been further extended till 01st August 2022.

2. While the exporters and NP CoO Issuing Agencies would have the option to use the online system, the same shall not be mandatory till 01st August 2022. The existing systems of processing non-preferential CoO applications in manual/paper mode is being allowed. For guidance on registration and online application submission process, the Help Manual & FAQs may be seen on the landing page at https://coo.dgft.gov.in

3. All stakeholders may note that issuing agencies who do not use the Online System for issue of non-preferential CoOs after 1st August 2022 will invite penal action and can be subject to ‘delisting’ as an authorised agency. The authorised agencies are therefore required to sensitize the exporting community and their constituents regarding the Online system and its registration requirements well in time. Any issues relating to the IT system and its implementation may also be brought to our notice for appropriate action.

This issues with the approval of the competent authority.

For Official Trade Notice Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"