Reetu | Aug 30, 2022 |

DGFT Notifies Amendment in Handbook of Procedure of TRQ under FTA/CECA

The Directorate General of Foreign Trade (DGFT) has notified Amendment in Para 2.107 (TRQ under FTA/CECA) of Handbook of Procedure 2015-2020 via issuing Public Notice.

The Notification has provided, “In exercise of powers conferred under paragraph 1.03 and 2.04 of the Foreign Trade Policy, 2015-20, as amended from time to time, the Directorate General of Foreign Trade hereby amends condition(o) of Annexure-IV of Appendix-2A notified earlier vide Public Notice No. 06/2015-20 dated 01.05.2022, in sync with Department of Revenue vide Notification no.43/2022-Customs dated 20th July 2022.”

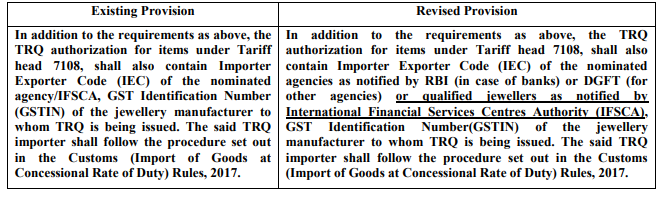

In the said Public Notice, Condition (o) in Annexure IV of Appendix 2A, shall be substituted as under:

Effect of this Public Notice : TRQ imports under ITC(HS) 71081200 under India-UAE CEPA may also be affected through qualified jewellers as notified by International Financial Services Centres Authority(IFSCA)using the India International Bullion Exchange.

For Official Public Notice Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"