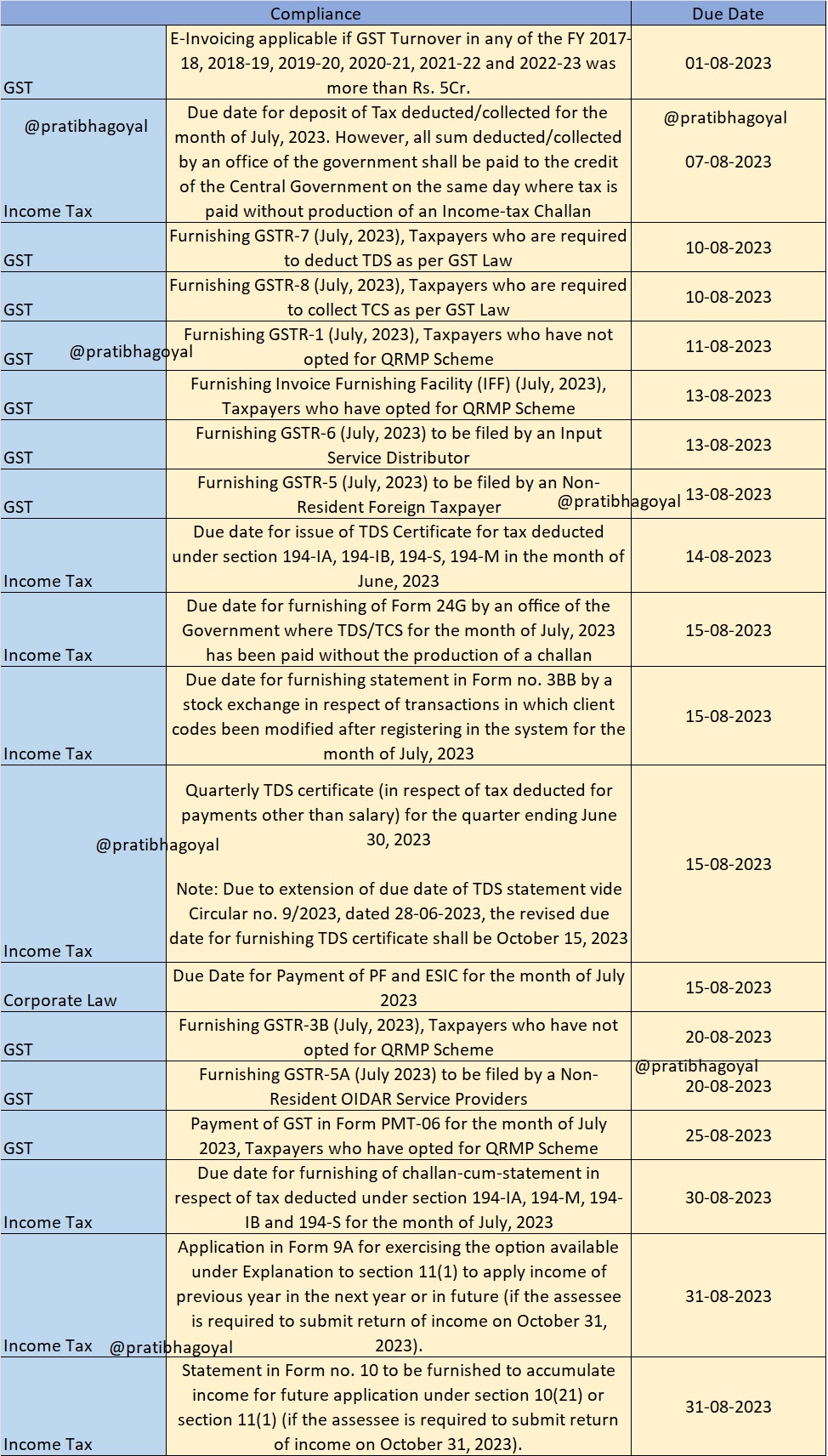

Due Date Compliance Calendar August 2023

Here is the Due Date Compliance Calendar for August 2023 for ease of working.

01-08-2023

E-Invoicing is applicable if GST Turnover in any of the FY 2017-18 (1st July 2017 to 31st March 2018), 2018-19, 2019-20, 2020-21, 2021-22, and 2022-23 was more than Rs. 5Cr.

07-08-2023

Due date for deposit of Tax deducted/collected for the month of July, 2023. However, all sum deducted/collected by an office of the government shall be paid to the credit of the Central Government on the same day where tax is paid without production of an Income-tax Challan

10-08-2023

- Furnishing GSTR-7 (July, 2023), Taxpayers who are required to deduct TDS as per GST Law

- Furnishing GSTR-8 (July, 2023), Taxpayers who are required to collect TCS as per GST Law

- 11-08-2023

Furnishing GSTR-1 (July, 2023), Taxpayers who have not opted for QRMP Scheme

13-08-2023

- Furnishing Invoice Furnishing Facility (IFF) (July, 2023), Taxpayers who have opted for QRMP Scheme

- Furnishing GSTR-6 (July, 2023) to be filed by an Input Service Distributor

- Furnishing GSTR-5 (July, 2023) to be filed by an Non-Resident Foreign Taxpayer

14-08-2023

Due date for issue of TDS Certificate for tax deducted under section 194-IA, 194-IB, 194-S, 194-M in the month of June, 2023

15-08-2023

- Due date for furnishing of Form 24G by an office of the Government where TDS/TCS for the month of July, 2023 has been paid without the production of a challan

- Due date for furnishing statement in Form no. 3BB by a stock exchange in respect of transactions in which client codes been modified after registering in the system for the month of July, 2023

- Quarterly TDS certificate (in respect of tax deducted for payments other than salary) for the quarter ending June 30, 2023 [Note: Due to extension of due date of TDS statement vide Circular no. 9/2023, dated 28-06-2023, the revised due date for furnishing TDS certificate shall be October 15, 2023]

- Due Date for Payment of PF and ESIC for the month of July 2023

20-08-2023

- Furnishing GSTR-3B (July, 2023), Taxpayers who have not opted for QRMP Scheme

- Furnishing GSTR-5A (July 2023) to be filed by a Non-Resident OIDAR Service Providers

25-08-2023

Payment of GST in Form PMT-06 for the month of July 2023, Taxpayers who have opted for QRMP Scheme

30-08-2023

Due date for furnishing of challan-cum-statement in respect of tax deducted under section 194-IA, 194-M, 194-IB and 194-S for the month of July, 2023

31-08-2023

- Application in Form 9A for exercising the option available under Explanation to section 11(1) to apply income of previous year in the next year or in future (if the assessee is required to submit return of income on October 31, 2023).

- Statement in Form no. 10 to be furnished to accumulate income for future application under section 10(21) or section 11(1) (if the assessee is required to submit return of income on October 31, 2023).

StudyCafe Membership

Join StudyCafe Membership. For More details about Membership Click Join Membership Button

Join MembershipIn case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"