Due Date for Reporting ITC Opening Balance: Electronic Credit and Reclaimed Statement Reportable until November 30, 2023

The Goods and Services Tax Network (GSTN) has notified that Electronic Credit and Reclaimed Statement are Reportable until November 30, 2023.

Some viewpoints regarding Electronic Credit and Reclaimed Statement:

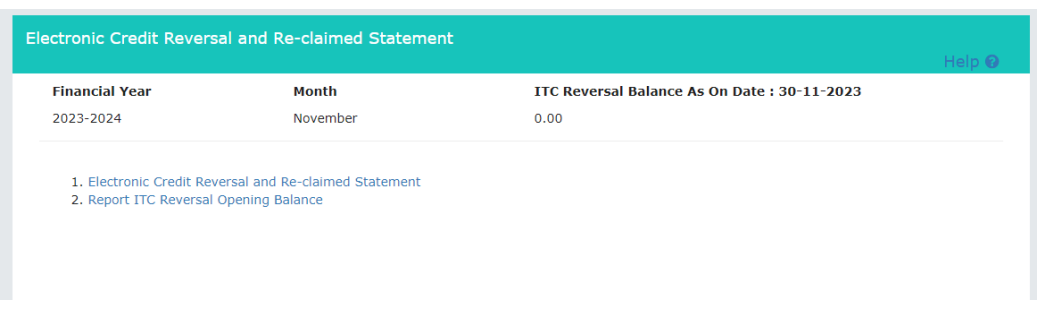

- ITC already reversed in Table 4B (2) of GSTR 3B, which will not be reclaimed till July 2023 for monthly filers and April-June 2023 for quarterly filers, is the initial amount for the “Electronic Credit Reversal and Reclaimed Statement.”

- The due date for reporting this opening balance is November 30, 2023, with the provision for up to three amendments until December 31, 2023.

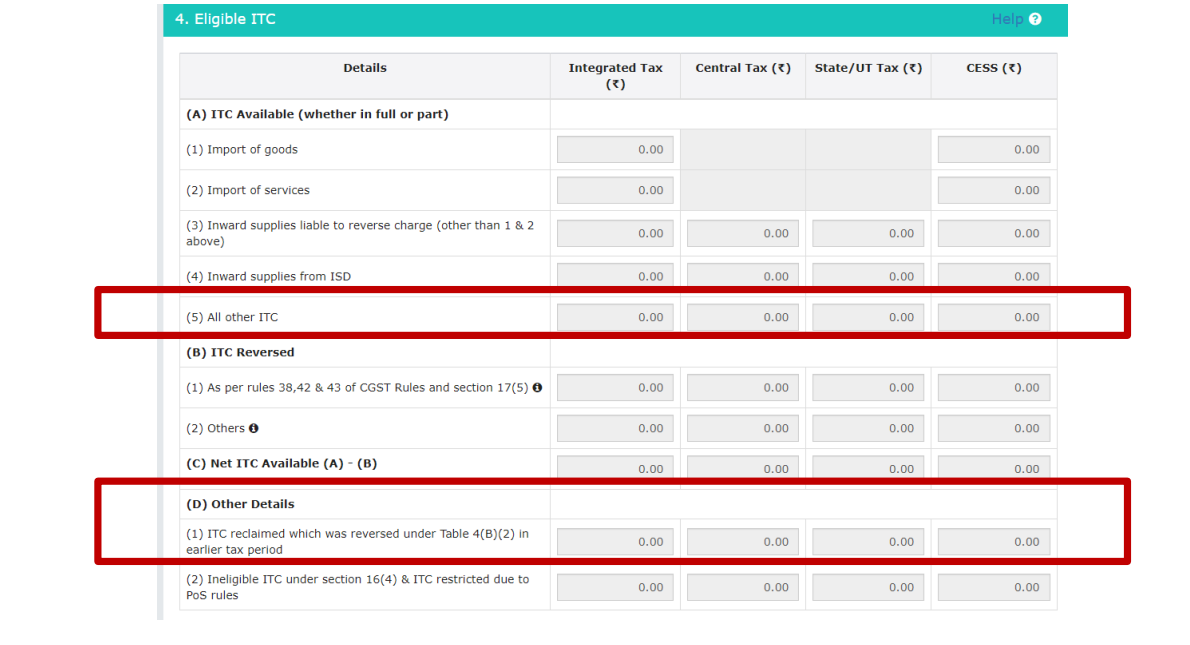

- On a return period basis, the portal will keep a detailed record of reversal and reclaimed amounts. If a taxpayer attempts to reclaim excess ITC in Table 4D (1) compared to the available ITC reversal balance in the statement, a validation mechanism included in the GSTR 3B return will issue a warning, along with ITC reversals made in the current return period under Table 4B (2).

- After 31st December 2023, the updated value shall be frozen with no further attempts provided to the taxpayers to amend their ITC Reversal Balance and this ITC Reversal value will be sent to the Jurisdictional Tax Officer for review.

- Due diligence should be done while reporting/amending the ITC reversal opening balance because only 3-time amendment is allowed.

- Taxpayers should only utilize this functionality if they have an ITC reversal balance that is eligible for re-claim but has not yet been re-claimed.

- The opening balance that has been reported or amended by the taxpayers shall be credited to the “Electronic Credit Reversal and Re-claimed Statement”.

- This statement will be used to validate the taxpayer’s ITC Re-claimed amount in Table 4A(5) & 4D(1) of form GSTR-3B.

To Read More Download the PDF Given Below:

StudyCafe Membership

Join StudyCafe Membership. For More details about Membership Click Join Membership Button

Join MembershipIn case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"