CA Pratibha Goyal | Mar 13, 2024 |

Due Date to file GST Return under QRMP Scheme: Know More

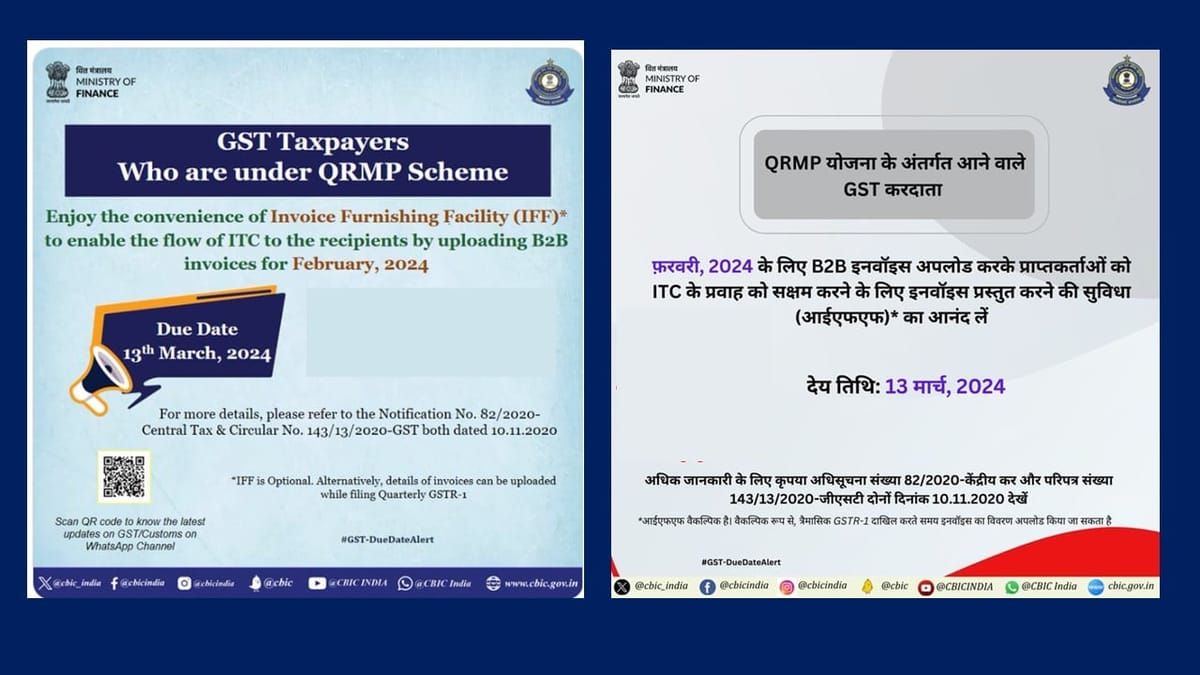

Today i.e. 13th of March is the due date for filing GST returns in Invoice Furnishing Facility (IFF) for Taxpayers who have opted for the Quarterly Return and Monthly Payment Scheme (QRMP) for February 2024.

The Invoice Furnishing facility will help enable the flow of Input Tax Credit (ITC) to Customers who have opted for the QRMP scheme. Otherwise one has to wait for the Quarter end when the Filing of Form GSTR-1 for the quarter ending March 2024 will be enabled.

There is no compulsion or penalty for filing the IFF. However, as per GST rules, your customers will not be able to claim ITC if the same is not reflected in their Form GSTR-2B. ITC will be reflected in GSTR-2B only when the seller files GSTR-1 or the IFF.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"