AMFI requests that the Finance Minister extend the grandfathering of indexation benefits for debt mutual funds until July 2024 to protect investors from retrospective taxation.

Reetu | Aug 7, 2024 |

Extend grandfathering of Indexation Benefit to Debt Mutual Funds till July 2024: AMFI

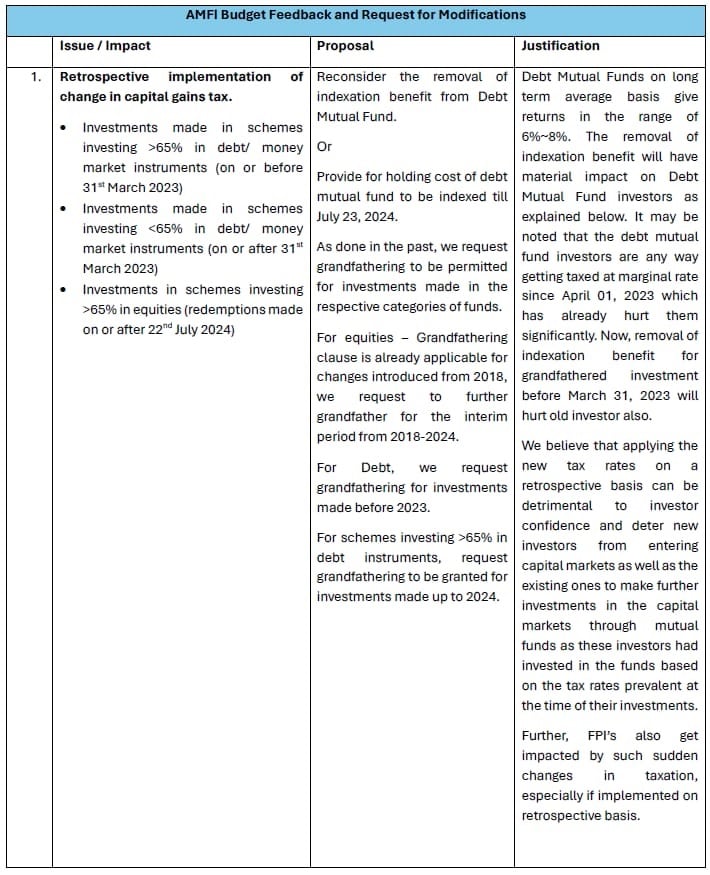

The Association of Mutual Funds in India (AMFI) requests that the Finance Minister extend the grandfathering of indexation benefits for debt mutual funds until July 2024 to protect investors from retrospective taxation.

AHFI Budget Feedback and Request for Modifications

Debt mutual funds provide long-term average returns of 6% to 8%. The elimination of the Indexation benefit will have a significant impact on Debt Mutual Fund investors, as described below. It should be remembered that debt mutual fund investors have been taxed at the marginal rate since April 1, 2023, which has already damaged them severely. The removal of the indexation benefit for grandfathered investments made before March 31, 2023, will also impact older investors.

We believe that applying the new tax rates retrospectively can harm investor confidence and discourage new investors from entering capital markets as well as existing ones from making additional investments in capital markets through mutual funds, as these investors had invested in the funds based on the tax rates in effect at the time of their investments.

Further, FPI’s also get Impacted by such sudden changes in taxation, especially if implemented on a retrospective basis.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"