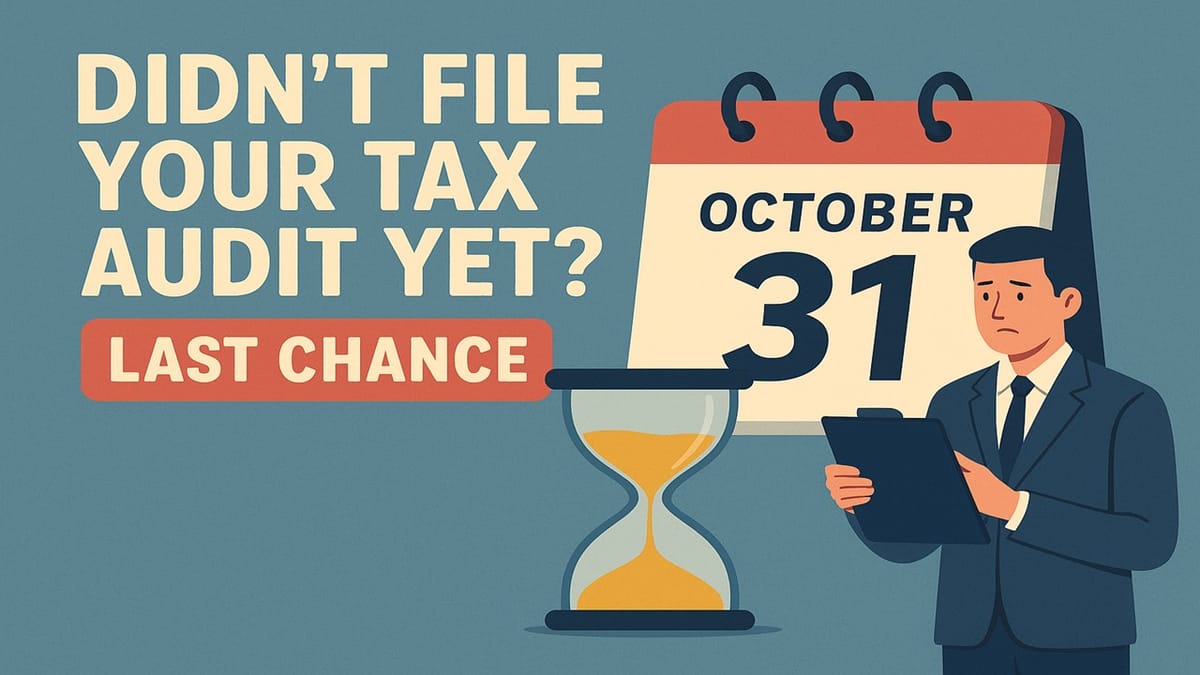

The Income Tax Department has extended the Tax Audit filing deadline to October 31, 2025, giving taxpayers extra time to submit without penalties.

Vanshika verma | Oct 27, 2025 |

Extended Tax Audit Date: Here’s Your Last Chance To File!

The Income Tax department has extended the last date for filing the tax audit report for the financial year 2024-25. However, the previous deadline was September 30, 2025, which has now been extended to October 31, 2025.

This decision will greatly benefit taxpayers who couldn’t submit their documents on time due to natural disasters or technical issues. Taxpayers now only have 4 days left to file their Tax Audit Report.

The Central Board of Direct Taxes (CBDT) made this decision by considering flood situations in several parts of the country and e-portal technical issues. Due to the extension of the deadline, taxpayers who could not file their tax audit reports can now submit them in a timely manner without any rush. This extension is an important opportunity for taxpayers to avoid penalties and consequences.

According to section 44AB of the Income Tax Act, 1961, a tax audit is mandatory for the following taxpayers:

For businesses:

An audit is mandatory if the total sales turnover exceeds Rs 1 crore in the financial year.

For professionals:

A tax audit is compulsory for professionals, including doctors, lawyers, architects and chartered accountants, if their gross receipts cross Rs. 50 lakh annually.

If any taxpayer fails to file a tax audit report within the above mentioned time, they may attract a penalty under Section 271B of the Income Tax Act. The penalty can be up to Rs 1.5 lakh or 0.5% of the firm’s total turnover, whichever is lower. Therefore, all taxpayers are urged to file their reports on time.

Taxpayers must keep all their financial information, bank statements and other documents of expenses and income ready. The process of submission of reports is done through the e-filing portal.

With the new deadline, taxpayers will be able to file their tax audit reports easily. This extension provides relief to them. Taxpayers are advised to submit reports on time and without any rush.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"