The monsoon comes with the deadline for taxpayers to file their tax returns for FY 2022-23. And Various representation submitted to extend ITR deadline.

Reetu | Jul 27, 2023 |

Extension of Income Tax Return Filing Due Date for AY 2023-24 will be granted or not?

ITR Filing 2023: The monsoon comes with the deadline for taxpayers to file their tax returns for FY 2022-23. As the deadline approaches i.e. 31st July 2023, which is only 4 days away, the government is urging taxpayers to file their income tax returns before the due date in order to avoid last minute rush.

Also, the topic ‘Income Tax Return’ has been trending on social media. “Income Tax Return” hashtag is trending on no.2 previously at Twitter.

While social media users are tweeting about Income Tax Returns, unlike last year, there is no large clamour for extending the due date this year, but certain associations have requested it. Not much asking for an extension of due date, this is mostly due to the record number of returns filed this year, as well as increased taxpayer knowledge of the benefits of early ITR filing.

The income Tax department shared that, the department has been grateful to the taxpayers and tax professionals for having helped them to reach the milestone of 4 crore Income Tax Returns (ITRs), 4 days early this year, compared to the preceding year!. Over 4 crore ITRs for AY 2023-24 have already been filed as of July 24th this year, compared to July 28th last year.

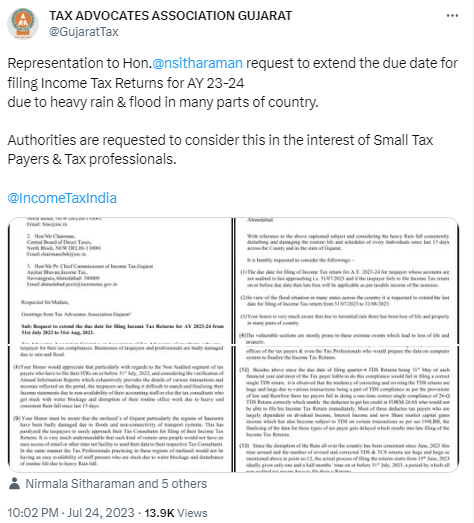

But there is other side also, where various CA Association and Tax Association have submitted representation before the government to extend ITR Filing Due Date for FY 2022-23 for multiple reasons. Let’s take a look into this.

Various CA Association and Tax associations have sent representation to the Finance minister and CBDT Chairman to extend the due date of filing ITR for various reasons.

Tax Advocates Association Gujarat: Read Representation

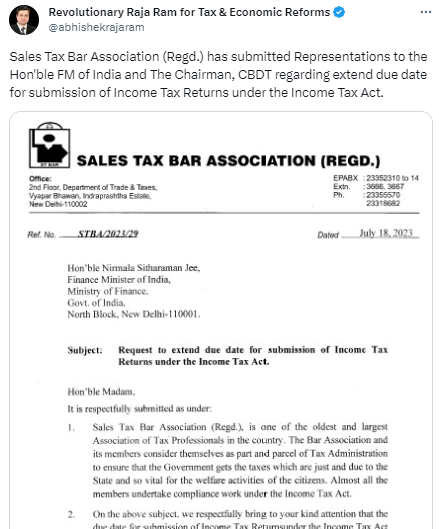

Sales Tax Bar Association: Read Representation

The Sales Tax Bar Association (STBA) has submitted Representations before Hon’ble Finance Minister and CBDT Chairman to extend due date for submission of Income Tax Returns under the Income Tax Act by giving the reason that there was flood crisis in Delhi, and that the Income Tax Office and other ITO offices were closed owing to the extreme circumstances. Last date of filing of ITR is very near, therefore it is practically not possible to submit these documents in the case of large number of taxpayers by the prescribed due dates.

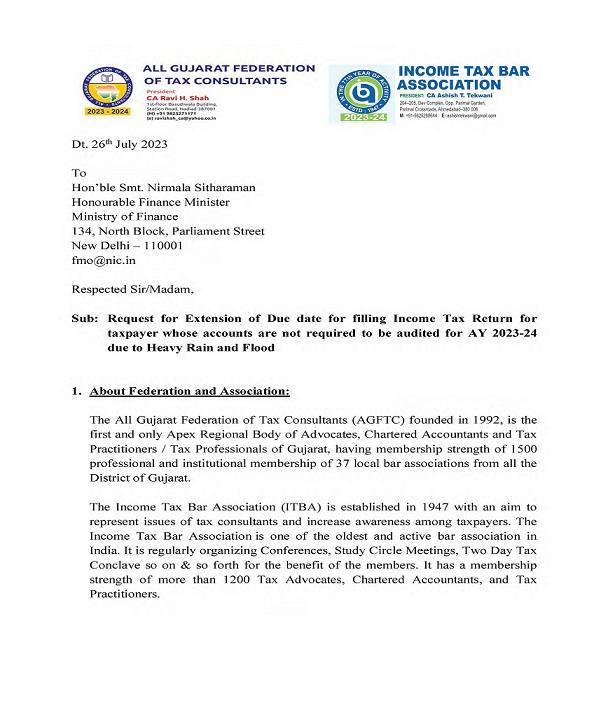

All Gujarat Federation of Tax Consultants: Read Representation

The All Gujarat Federation of Tax Consultants (AGFTC) has made representation before Hon’ble Finance Minister Nirmala Sitharaman to Extend the Due date for filling Income Tax Return for taxpayers whose accounts are not required to be audited for AY 2023-24 due to Heavy Rain and Flood.

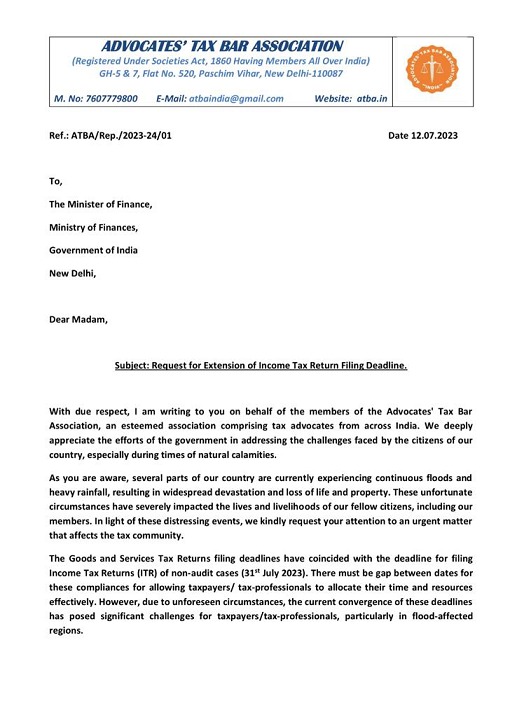

Advocates Tax Bar Association: Read Reprentation

The Advocates Tax Bar Association (ATBA) has made representation before Minister of Finance to extend Income Tax Return Filing Deadline. This Association pointed out the case that several parts of our country are currently experiencing continuous floods and heavy rainfall, resulting in widespread devastation and loss of life and property. These unfortunate circumstances have severely impacted the lives and livelihoods of our fellow citizens, including our members. In the light of the above, ATBA has requested an extension of the income tax return filing deadline.

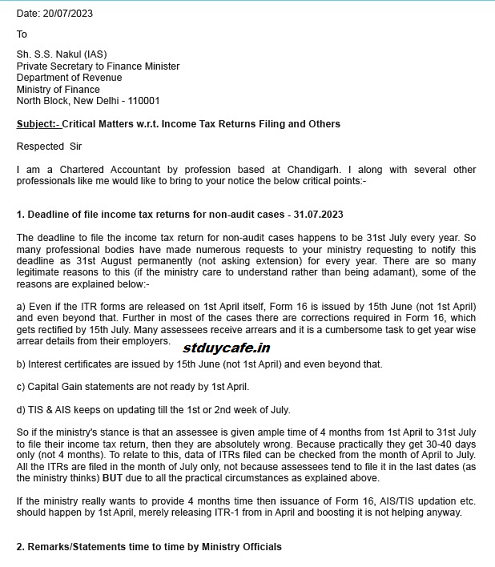

CA writes to Finance Minister Secretary requesting due date extension: Representation Letter

In letter he started by saying, he is a Chartered Accountant by Profession based at Chandigarh and along with serval other professional like him, he would to bring the ministry notice on some critical points.

a) Even if the ITR forms are released on 1st April itself, Form 16 is issued by 15th June (not 1st April) and even beyond that. Further in most of the cases there are corrections required in Form 16, which gets rectified by 15th July. Many assessees receive arrears and it is a cumbersome task to get year wise arrear details from their employers. b) Interest certificates are issued by 15th June (not 1st April) and even beyond that. c) Capital Gain statements are not ready by 1st April. d) TIS & AIS keeps on updating till the 1st or 2nd week of July.

All these above representation made before the government in order to seek ITR Extension. Despite the fact that the government has indicated that it has no intention of moving the date.

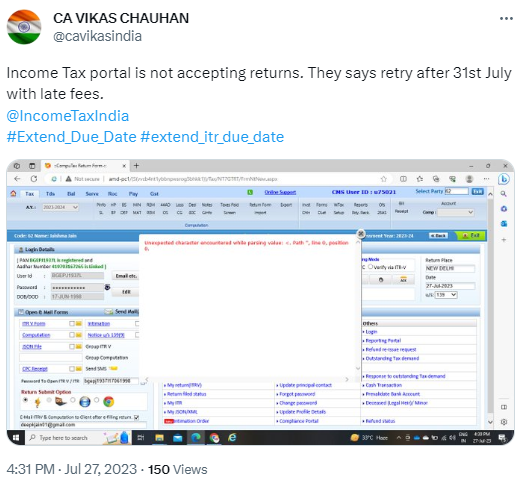

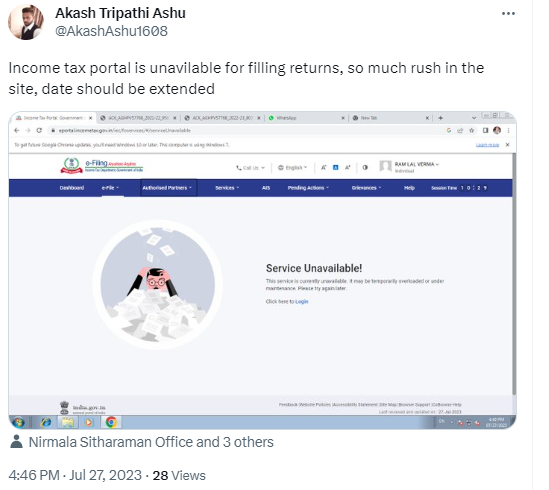

Even though Department is achieving milestone in large number of ITRs Submitted and verified. Still, there are cases we have seen before also, as when the date date of filing is near, the portal started working in very harassed way.

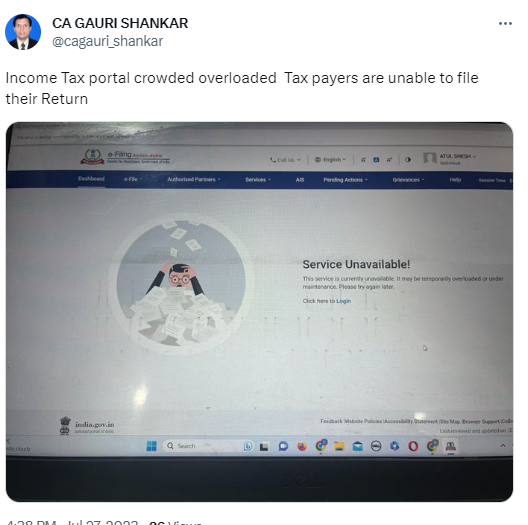

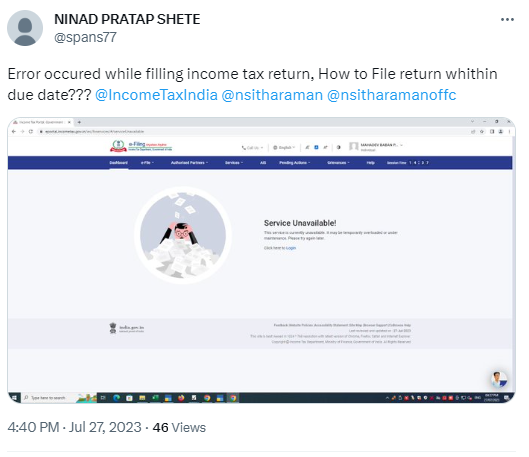

Speculation are still on round that may be govt will extend the deadline in last minute. We are saying this because on social media people are tweeting or posting about the IT portal not working.

All these case of IT Portal not working coming even there are 4 days left to deadline and people are totally mind stuck what they need to do in this situation. If Income Tax portal will continuously work in the way in coming days also, it is impossible for taxpayers to file their income tax return on time correctly. These are few cases we have seen today. Soon we will see many cases.

Government should consider and track the complain and grievances of taxpayers in real time and resolve the problem to ease to filing of Income Tax Returns.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"