The Central Board of Indirect Taxes and Custom (CBIC) has extended the due date of Amnesty Scheme for Revocation of Cancellation of Registration till 31st August 2023.

Reetu | Aug 23, 2023 |

Few Days left to avail the benefit of GST Amnesty Scheme for cancelled GSTN: Don’t Delay

The Central Board of Indirect Taxes and Custom (CBIC) has extended the due date of Amnesty Scheme for Revocation of Cancellation of Registration till 31st August 2023.

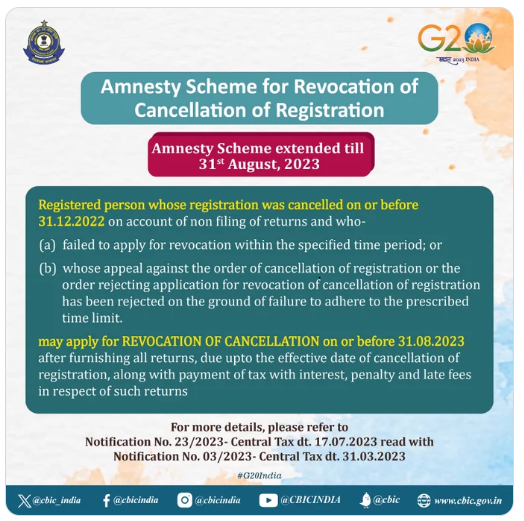

Amnesty Scheme for Revocation of Cancellation of Registration: To provide relief to a large number of taxpayers, the GST Council has recommended this amnesty scheme, which allows such persons to file such application for revocation by a specified date, subject to certain conditions, where registration has been cancelled due to non-filing of returns, but application for revocation of cancellation of registration could not be filed within the time specified in section 30 of the CGST Act.

Registered person whose registration was cancelled on or before 31.12.2022 on account of non filing of returns and who-

(a) failed to apply for revocation within the specified time period; or

(b) whose appeal against the order of cancellation of registration or the order rejecting application for revocation of cancellation of registration has been rejected on the ground of failure to adhere to the prescribed time limit.

may apply for REVOCATION OF CANCELLATION on or before 31.08.2023 after furnishing all returns, due upto the effective date of cancellation of registration, along with payment of tax with interest, penalty and late fees in respect of such returns.

Amnesty Scheme for Revocation of Cancellation of Registration

| No. 22/2023 – Central Tax | 17th July 2023 | Due date of Amnesty Scheme to GSTR-4 non-filers extended to 31st August 2023 | Link |

| No. 24/2023 – Central Tax | 17th July 2023 | Due Date for Amnesty scheme for deemed withdrawal of assessment orders issued under Section 62 extended to 31st August 2023 | Link |

| No. 25/2023 – Central Tax | 17th July 2023 | Due date of Amnesty Scheme to GSTR-9 non-filers extended to 31st August 2023 | Link |

| No. 26/2023 – Central Tax | 17th July 2023 | Due date of Amnesty Scheme to GSTR-10 non-filers extended to 31st August 2023 | Link |

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"