The Income Tax Department has come with new update for taxpayers, now Form 26AS will show if your PAN is Active and Operative or not, if the case is.

Reetu | Jul 6, 2023 |

Form 26AS now shows if your PAN is Active and Operative

The Income Tax Department has come with new update for taxpayers, now Form 26AS will show if your Permanent Account Number(PAN) is Active and Operative or not, if the case is.

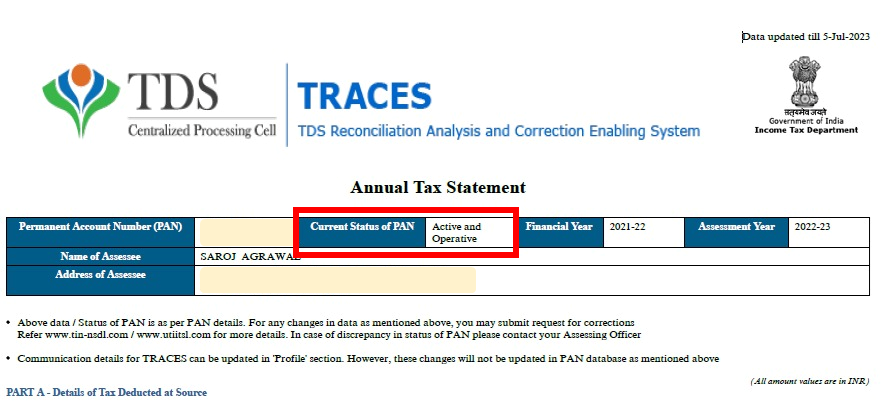

On Traces portal when you login and download your Annual Tax Statement, there on the tab of current status of PAN, it will show whether you PAN status is active and operative or not.

Recently, the deadline of linking of PAN with Aadhaar is gone, i.e. 30th June 2023. And if taxpayers has not linked their PAN with Aadhaar, their PAN will become inoperative. CBDT also issued clarification on this hours before the deadline expires. According to the income tax department’s tweet, persons who have paid their penalty for linking their PAN with Aadhaar and consent has been obtained but the process of linking is not completed by June 30, 2023, would be reviewed by the income tax department before deeming the PAN inoperative. It should be noted that if PAN is not linked to Aadhaar by June 30, 2023, it would become inoperative. This means that an individual will not have a valid PAN when citing it is required.

Form 26AS contains critical information concerning the tax deducted/collected and paid with the government tax authorities by authorised deductors/ collectors. Form 26AS allows a taxpayer to see all financial transactions involving TDS/TCS for the applicable financial year.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"