The MCA has extended the deadline for filing CRA-4 for the financial year until December 31, 2025. Therefore, companies can file the CRA-4 (Cost Audit Report) up to December 31, 2025, without having to pay any additional fees.

Nidhi | Oct 29, 2025 |

Government Extends Deadline for Filing CRA-4 Up to December 31, 2025

To ease the compliance burden on companies, the Ministry of Corporate Affairs (MCA) has issued an important circular announcing the extension of the deadline for filing the Cost Audit Report, i.e., CRA-4, for the financial year ending March 31, 2025.

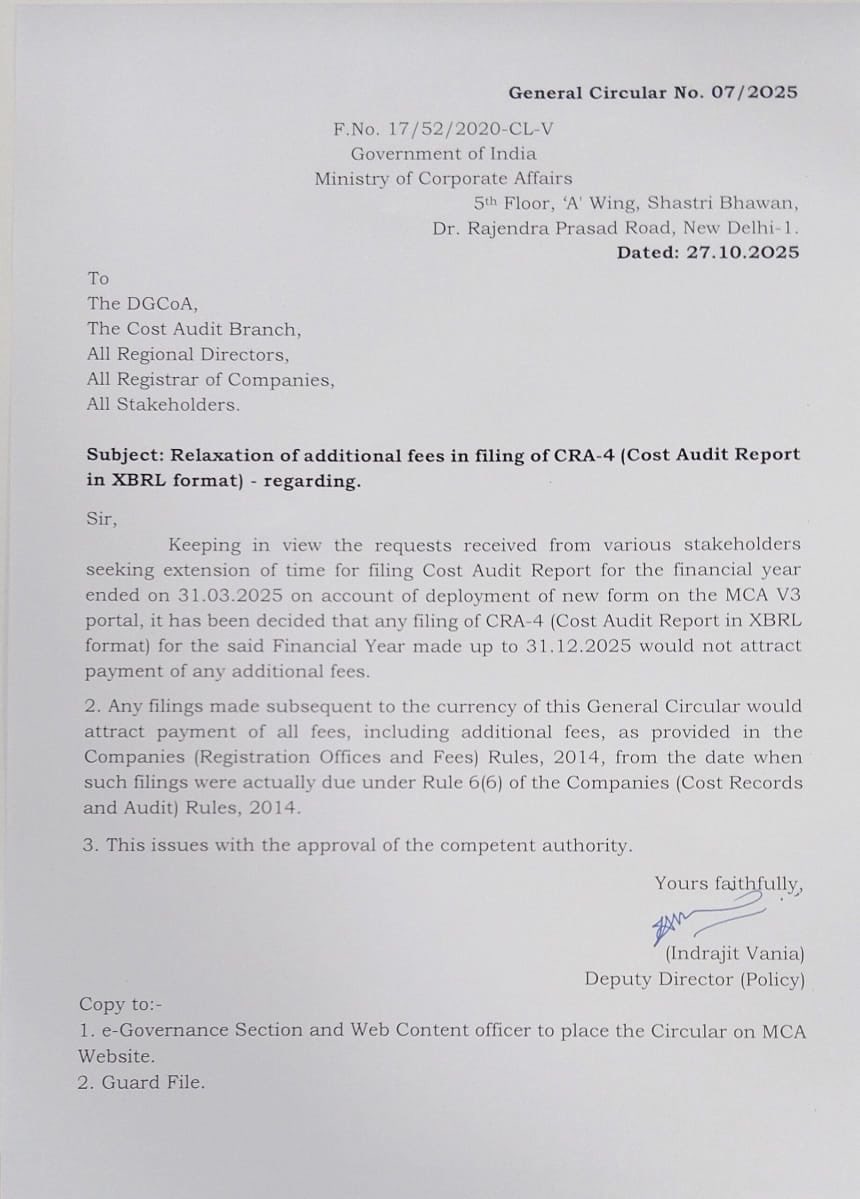

As per the circular (General Circular Number No. 07/2025 Dated 27.10.2025), many stakeholders sent requests for the extension, raising concerns about the new filing form on the MCA V3 portal. Therefore, considering these requests, the MCA has extended the deadline for filing CRA-4 for the financial year until December 31, 2025. Therefore, companies can file the CRA-4 (Cost Audit Report) up to December 31, 2025, without having to pay any additional fees.

The MCA has clearly stated in the circular that once the deadline of December 31, 2025 passes, companies will be required to pay regular fees, including any additional fees, per the Companies (Registration Offices and Fees) Rules, 2014 from the date when the filings were due under Rule 6(6) of the Companies (Cost Records and Audit) Rules, 2014. This is a great opportunity, and companies should not wait for the last minute to file CRA-4 and should file as soon as possible to avoid any unnecessary extra charges.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"