Reetu | Apr 29, 2023 |

GST Amnesty Scheme 2023 for Non-Filers

The government introduces such amnesty schemes on a regular basis in order to assist taxpayers. Particularly to taxpayers who have not filed returns on time or who have violated GST laws. It initially went into effect in 2018. In which the government waived late costs for taxes filed between July 2017 and September 2018. Second, on 01/06/2021, it was announced that it will give benefits during the COVID Period. This amnesty scheme was in effect from July 2017 to April 2021.

Recently, the GST Council, at its 49th meeting on February 18, 2023, approved a new amnesty scheme for taxpayers who have not filed GSTR-4, GSTR-10, or GSTR-9 forms for the previous fiscal years. In addition, the GST Council proposed offering relief to taxpayers who did not file a revocation against termination of registration in a timely manner. On March 31, 2023, the GST Department initiated this plan by issuing different notices. The new GST Amnesty Scheme 2023 will go into effect on April 1, 2023.

The new GST Amnesty Scheme 2023 is as follows:

The GST Department has issued notice number. 08/2023 dated 31 March 2023 to grant relief to taxpayers who have not filed the GSTR-10 (The Final Return after Surrender of GST Registration) within the time limit. According to the notification, taxpayers can file the GSTR-10 from 01/04/2023 to 30/06/2023 by paying a late fee of Rs. 1000/- (Rs. 500/- each for CGST and SGST). The department shall waive the amount of late fees that exceed Rs. 1000/-.

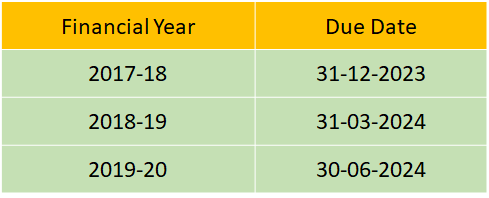

The GST Department issued notice no. 07/2023 dt. 31/03/2023, providing relief to taxpayers who did not file the GSTR-9 (Annual Return) from fiscal years 2017-18 to 2021-22. According to the notification, taxpayers can file the GSTR-9 from 01/04/2023 to 30/06/2023 by paying a late fee of up to Rs. 20,000/- (Rs. 10,000/- each for CGST and SGST). The department will waive the amount of late fees that exceeds Rs. 20,000/-.

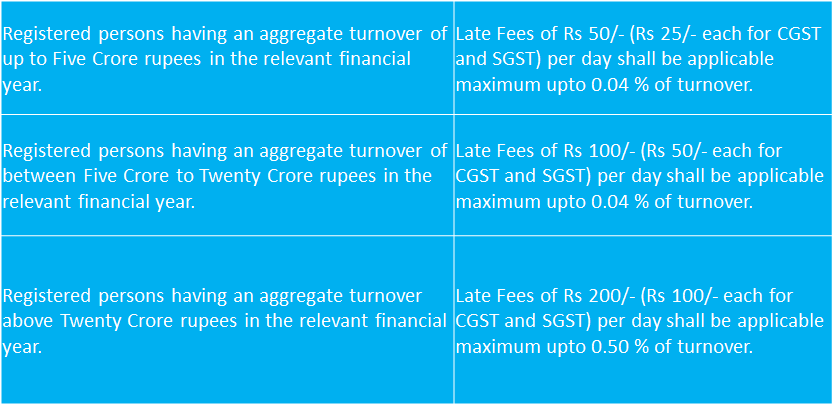

Further the GST Department has notified new rates of late fees from the FY 2022-23 onwards, which are as follows:

The GST Department has issued notice number. 02/2023 dt. 31/03/2023, providing relief to taxpayers who have not filed the GSTR-4 (The Annual Return for Composition Tax Payers) for the quarters of July 2017 to March 2019 and for the fiscal years 2019-20 to 2021-22. According to the notification, taxpayers can file the GSTR-4 from 01/04/2023 to 30/06/2023 by paying a late fee of Rs. 500/- (Rs. 250/- each for CGST and SGST). The department shall waive the amount of late fines that exceed Rs. 500/-.

The GST Department issued notification number. 03/2023 dt. 31/03/2023, providing relief to taxpayers who failed to file Form REG-21 against the cancellation of GST Registration within the time frame.

As per the notification, The Registered Person, whose registration has been cancelled on or before 31/12/2022 and he has failed to apply for revocation within time shall follow the special procedure in respect of revocation of cancellation of such registration:

The Department increased the time period for issuing of order u/s 73 of the Act for recovery of tax not paid or short paid or of ITC wrongfully availed or utilised, as per notification no. 09/2023 dt. 31/03/2023.

The aforementioned amnesty policy is in effect until June 30, 2023, and defaulted registered persons can get benefits and have their defaults removed by paying a small charge. This amnesty scheme is a wise option to help regularise defaulted registered persons, and it is well received by a group of tax payers and professionals. Although there is no benefit or refund available to those registered persons who have already regularised their status by paying large late fees prior to the announcement of this scheme.

Although these schemes benefit registered persons who have committed defaults inadvertently, they also intentionally provoke others to wait for such schemes and not pay late fees, as there is no benefit to those regular and honest registered persons who have already removed their defaults by paying huge late fees.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"