The GST Council in its meeting has decided to exempt the hostels and accommodation services, which primarily benefitted students.

Reetu | Jun 24, 2024 |

GST Council exempts Hostels and Accommodation Services: Benefit primarily given to Students; Says FM

The GST Council in its meeting has decided to exempt the accommodation services, which primarily done for the benefit students.

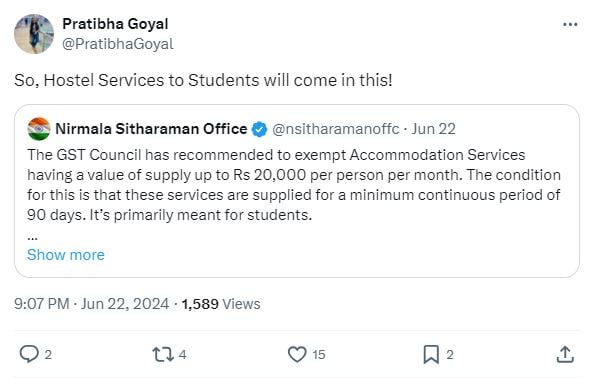

GST Council has recommended for the inclusion of a separate entry in the notification No. 12/2017- CTR dated 28.06.2017 under heading 9963 to exempt accommodation services with a value of up to Rs. 20,000 per month per person, subject to the condition that the accommodation service should be provided for a minimum continuous period of 90 days.

The Finance Minister has confirmed in one of her tweets that this change was primarily meant for students.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"