Reetu | Mar 24, 2022 |

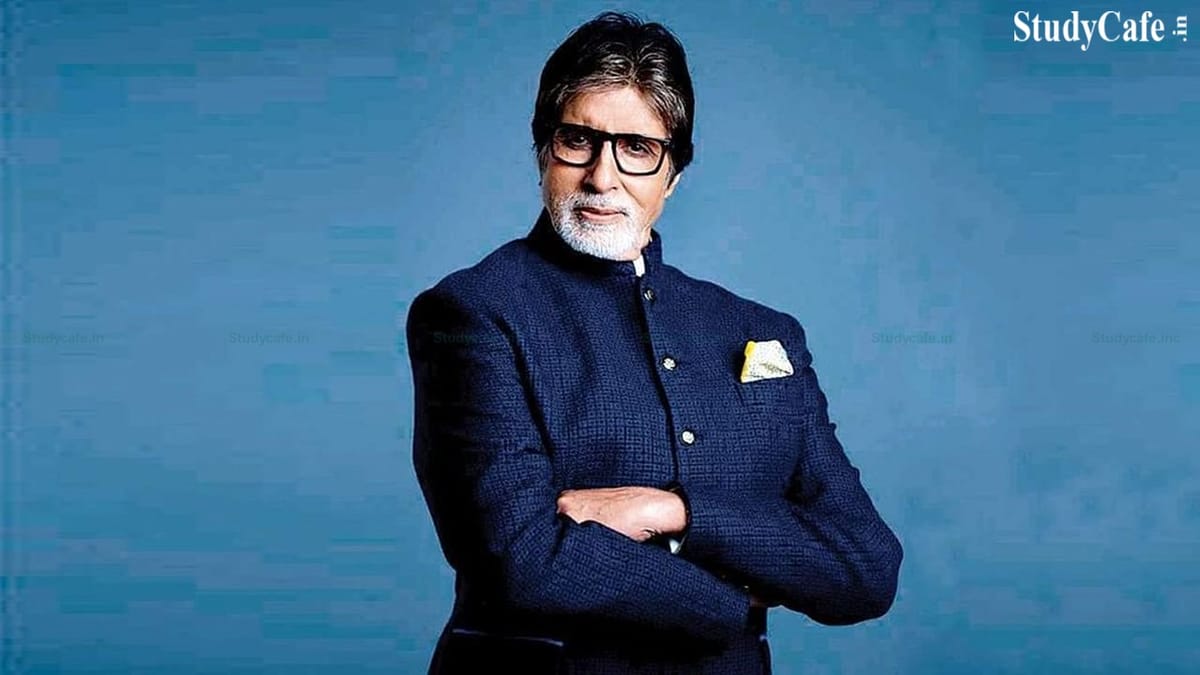

GST Notice of Rs 1.09 crore issued to Actor Amitabh Bachchan for sale of non-fungible tokens

Bollywood Superstar Amitabh Bachchan paid the government Rs.1.09 crore in GST for the sale of non-fungible tokens (NFTs) worth Rs.7.15 crore in an auction in November last year.

According to those familiar with the situation, Bachchan received a notice from the Directorate General of Goods and Services Tax Intelligence (DGGI) regarding payment of dues.

Despite the fact that Bachchan has deposited the money, tax authorities are continuing their inquiry, they stated.

An NFT ecosystem technological framework announced in August 2021 that Bachchan’s NFT collection would be available on its platform. Bachchan had signed an agreement with Rhiti Entertainment to convert his footage into digital assets, making him one of the first performers to support NFTs.

According to reports, these NFTs comprised a recital of Madhushala, a famous collection of poems penned by his father, as well as posters and graphics.

One of the first actors to support NFTs was Amitabh Bachchan

An NFT is a type of digital asset that represents real-world artifacts including art, photography, music, films, and other media. This data unit is kept on a blockchain, a digital ledger that makes it unique and non-transferable.

NFT was sold for Rs.7.15 crore and will be subject to 18 percent IGST. According to sources, the actor’s tax liability from the transaction is Rs.1.09 crore, which he has deposited.

Bachchan did not respond to a request for comment.

Source: Rediff

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"