CA Pratibha Goyal | Feb 7, 2023 |

GST Portal changes related to GSTR-1, GSTR-3B and GSTR-2B

Now, if you have not filed GSTR-1, the GST portal will not allow the filing of GSTR-3B.

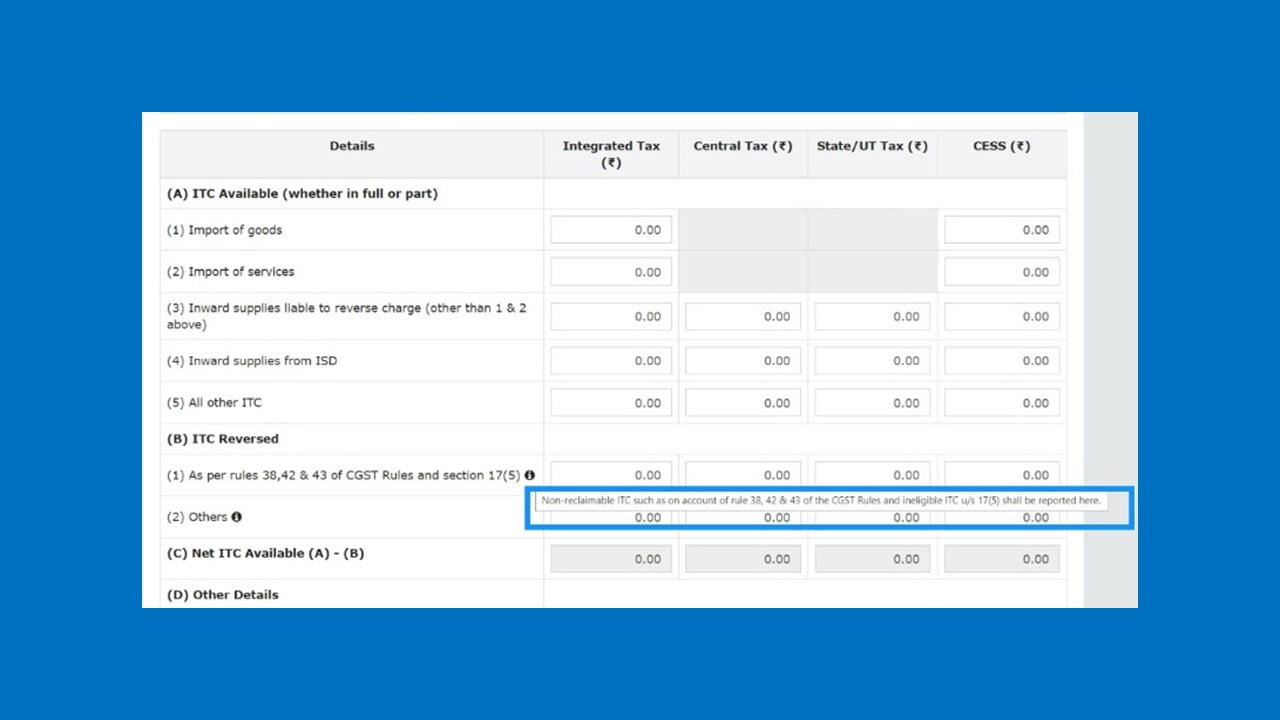

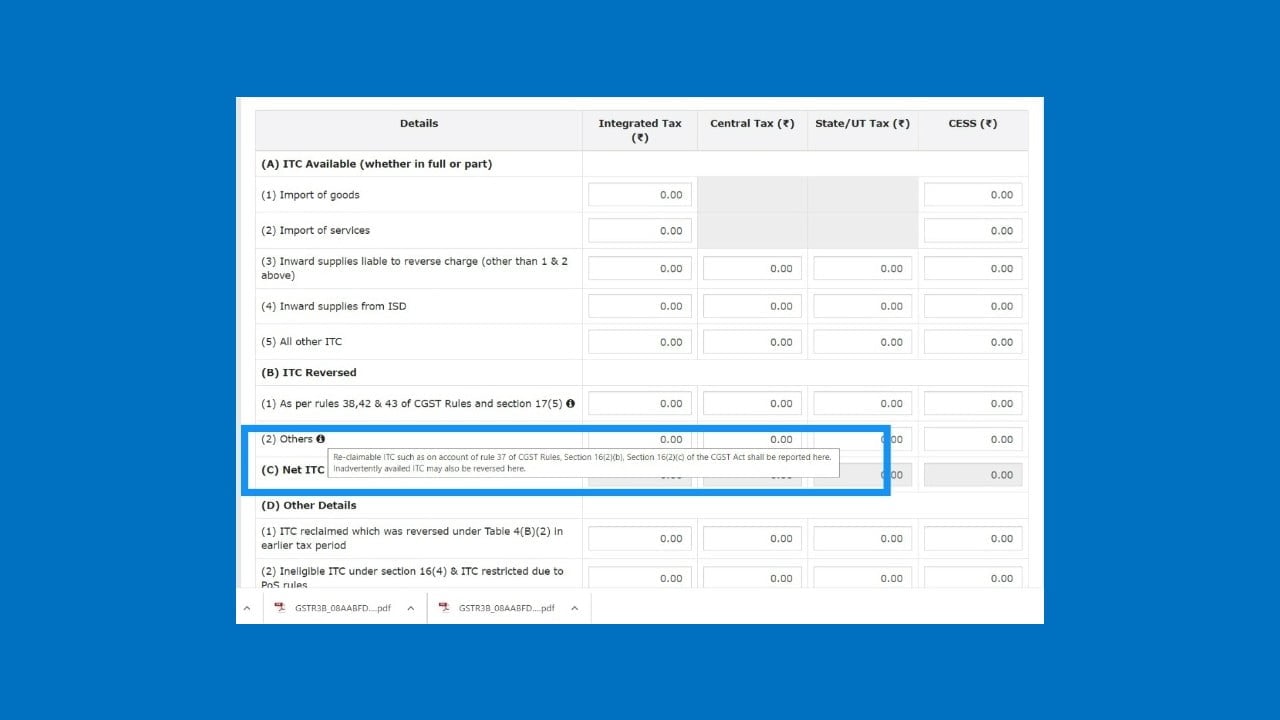

An information button has been added to Table ITC Reversed, for ensuring correct reporting:

4B(1) – Non reclaimable ITC such as R.38,42,43 & Ineligible ITC u/s 17(5)

4B(2) – R37, S16(2)(b)/(2)(c)

INADVERTENTLY AVAILED ITC to be reversed here.

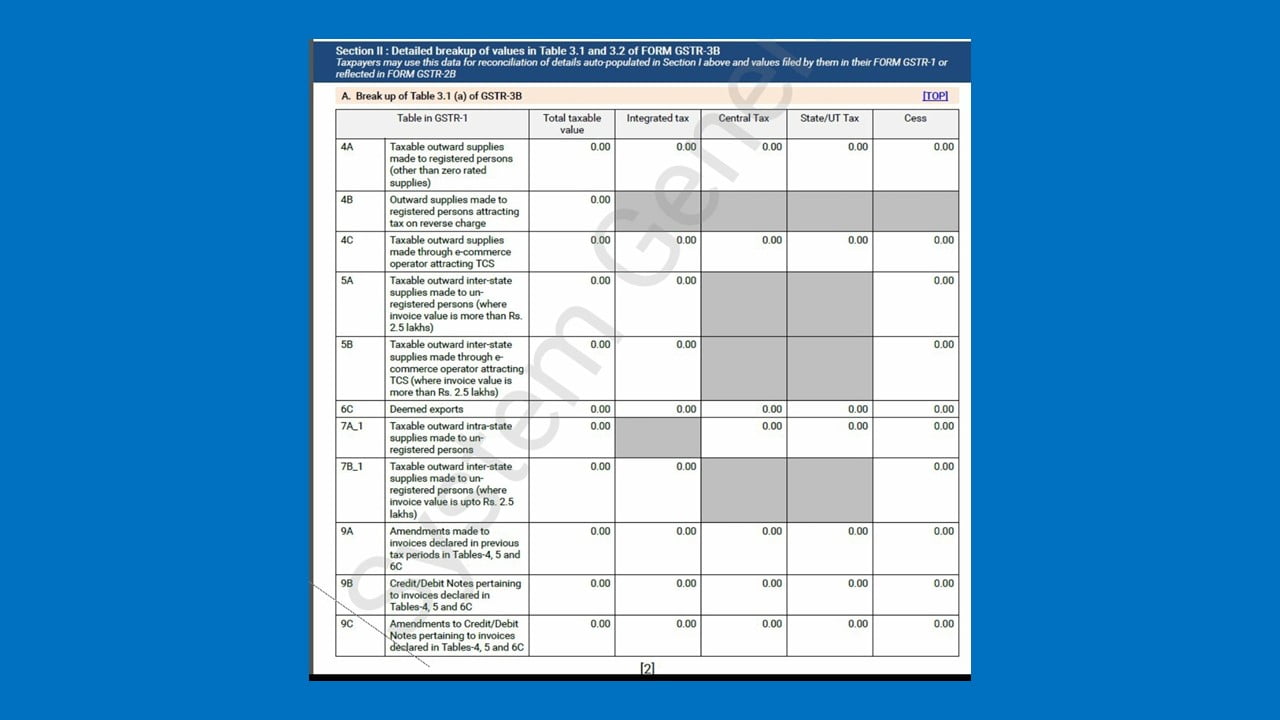

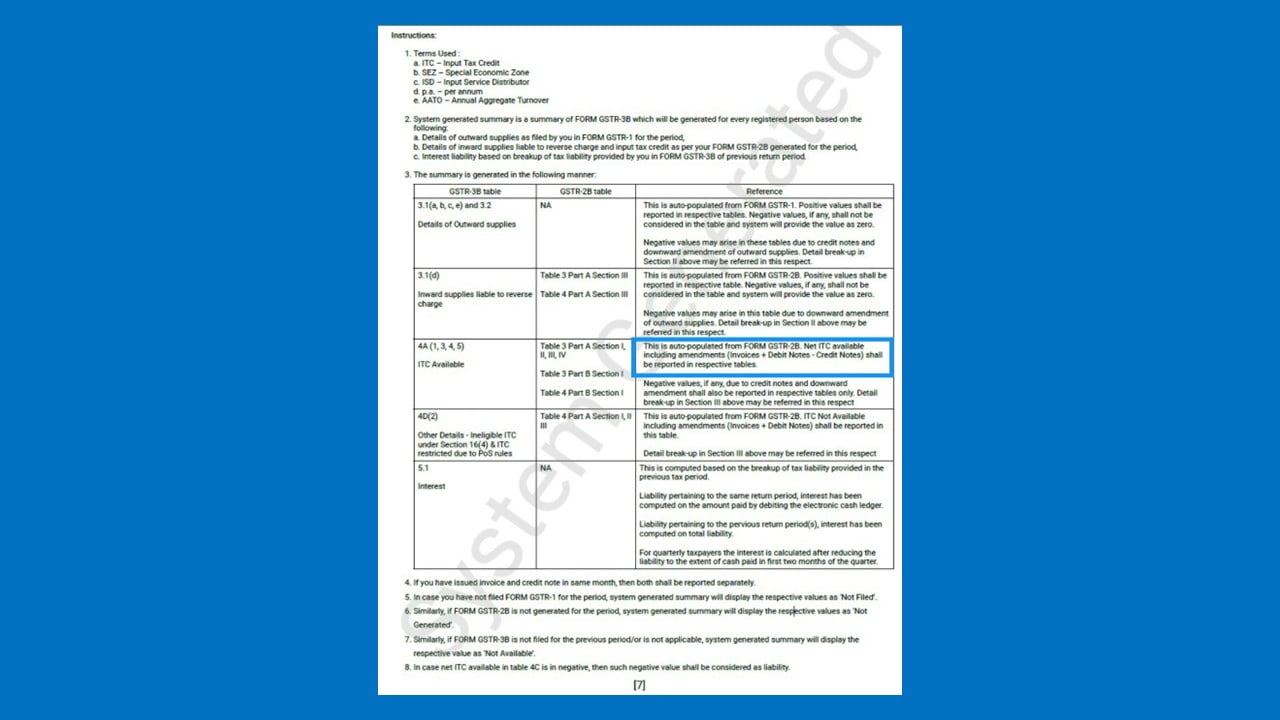

Detailed Break up of values in Table 3-Outward Supplies, Table 4-ITC, Table 5-Interest as populated from GSTR-1 & 2B

Detailed Break up of values in Table 3-Outward Supplies, Table 4-ITC, Table 5-Interest as populated from GSTR-1 & 2B.

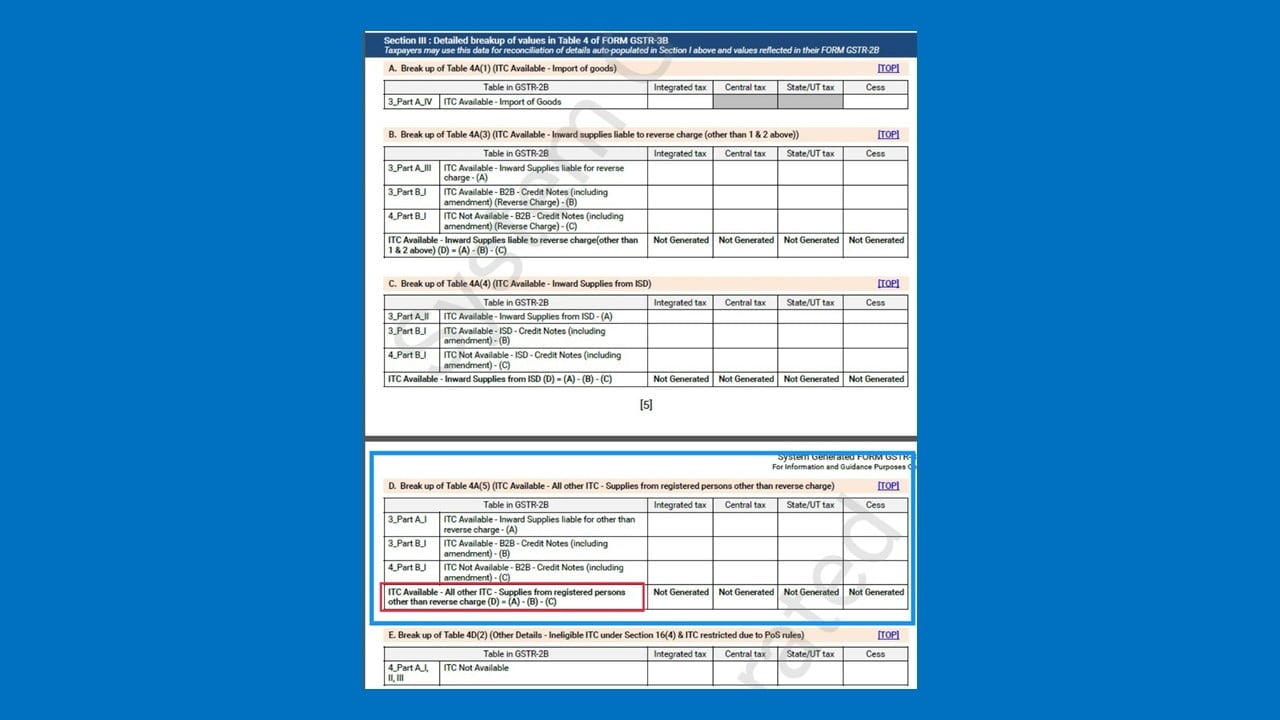

Detailed Break up of values in Table 3-Outward Supplies, Table 4-ITC, Table 5-Interest as populated from GSTR-1 & 2B.

ITC in Table 4 will appear as NET OF CREDIT NOTES.

Images and information compiled from Tweet of CA Abhas Halakhandi.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"