Reetu | Jul 1, 2023 |

GST Revenue Collection of Rs.1,61,497 Crore in June 2023; Growth of 12% Year on Year

The Finance Ministry has notified that since the implementation of GST, it is for the fourth time when gross gst collection has hit the Rs.1.6 Crore mark. The revenue collected had crossed break the record of Rs.1.50 lakh crore for the seventh time since GST came into existence.

The gross GST revenue collected in the month of June, 2023 is Rs.1,61,497 crore of which CGST is Rs.31,013 crore, SGST is Rs.38,292 crore, IGST is Rs.80,292 crore (including Rs.39,035 crore collected on import of goods) and cess is Rs.11,900 crore (including Rs.1,028 crore collected on import of goods).

The government has settled Rs.36,224 crore to CGST and Rs.30269 crore to SGST from IGST. After normal settlement, the total income of the Centre and the States in the month of June 2023 is Rs.67,237 crore for CGST and Rs.68,561 crore for SGST.

The revenues for the month of June 2023 are 12% more than the GST revenues for the same month last year. Domestic transaction revenues (including service imports) increased by 18% during the month compared to the same month previous year.

It is for the fourth time, the gross GST collection has crossed Rs.1.60 lakh crore mark. The average monthly gross GST collection for the first quarter of the FY 2021-22, FY 22-23 & FY 23-24 are Rs.1.10 lakh crore, Rs.1.51 lakh crore and Rs.1.69 lakh crore respectively.

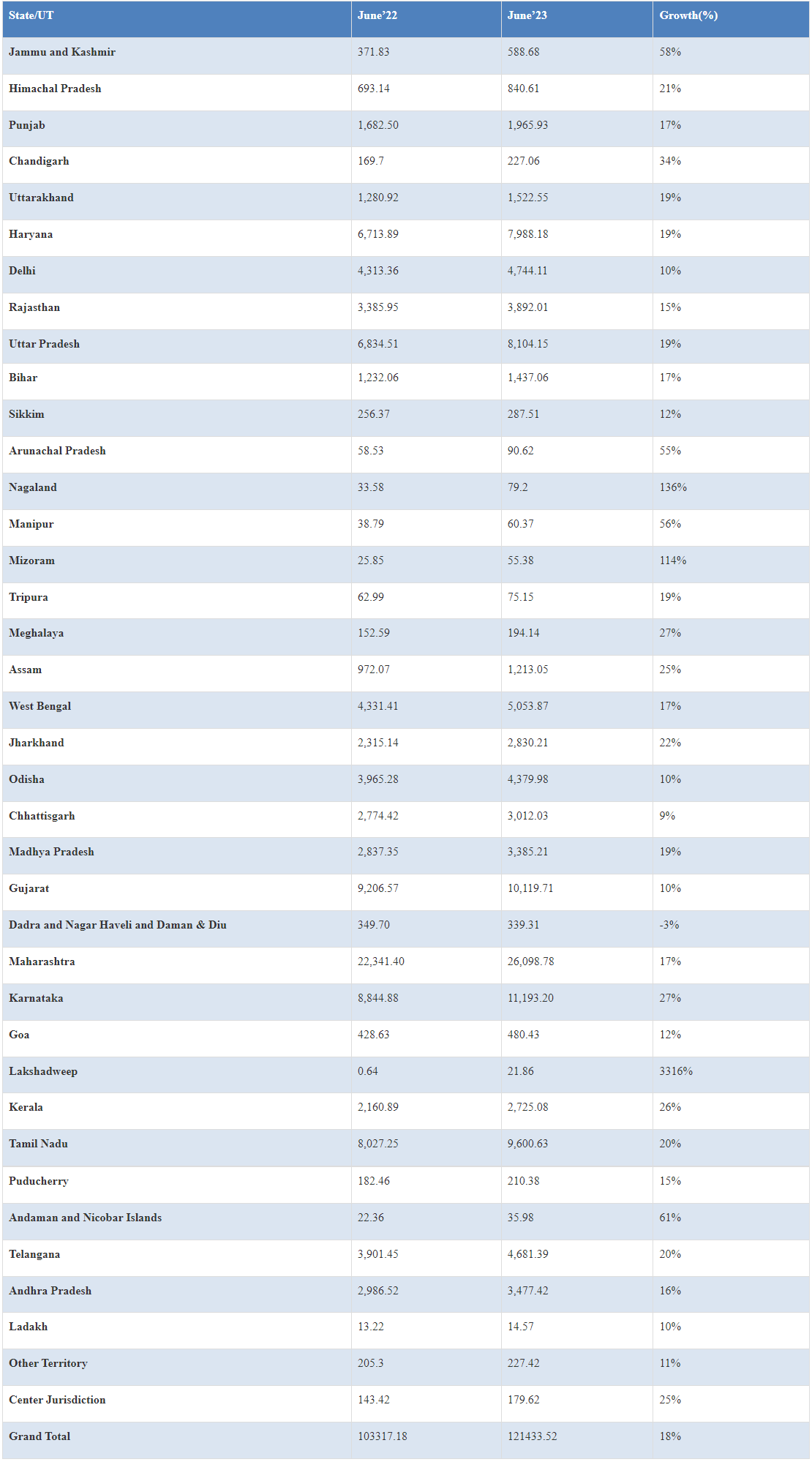

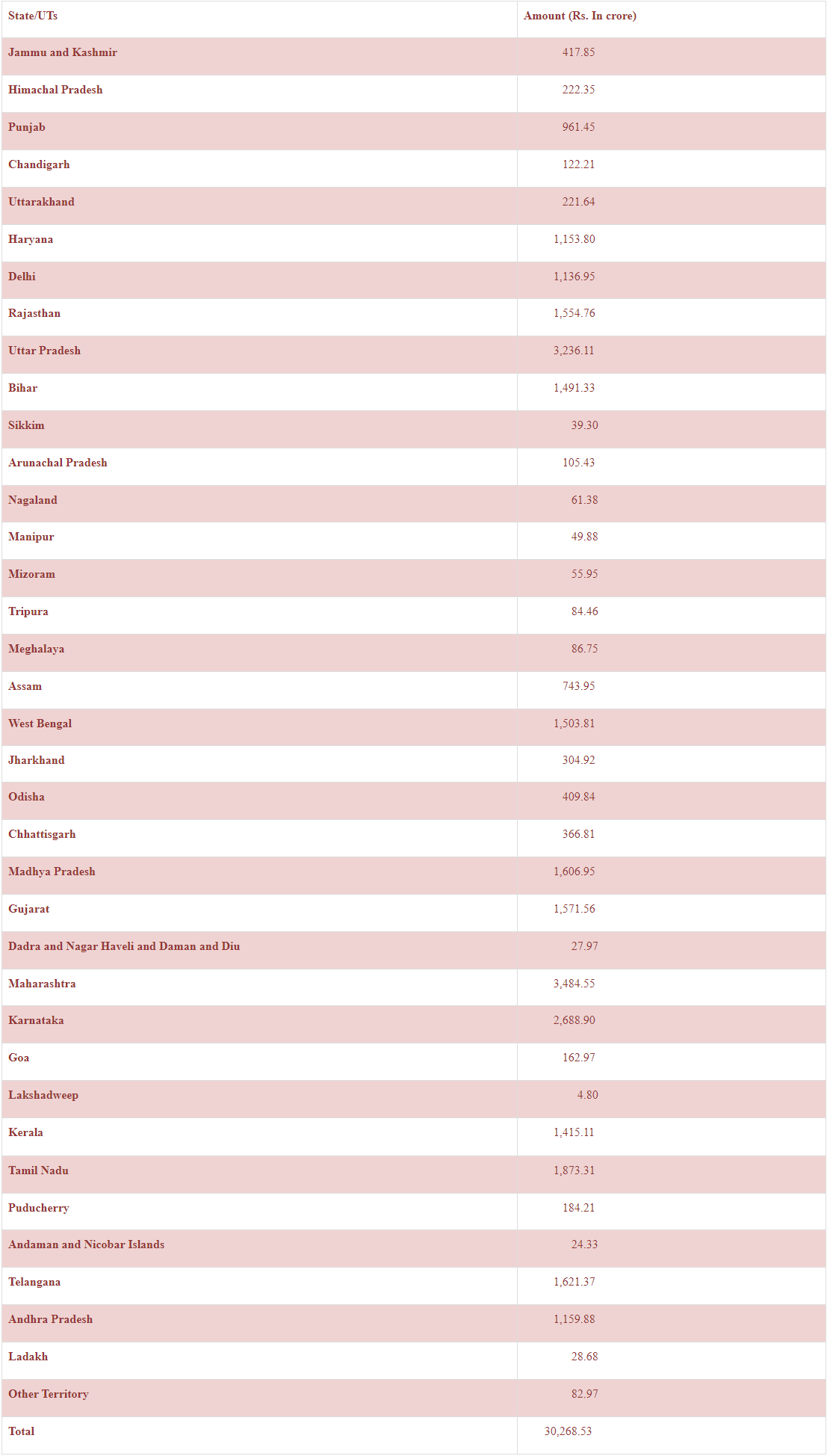

The chart below shows trends in monthly gross GST revenues during the current year. The table-1 shows the state-wise figures of GST collected in each State during the month of June 2023 as compared to June 2022 and table-2 shows the SGST portion of the IGST received/settled to the States/UTs in June’2023.

chart

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"