Deepak Gupta | Oct 1, 2018 |

GST RFD-01A Refund on account of CGST and SGST, refund under gst ppt, export refund under gst, refund process under gst, refund procedure under gst, how to claim refund under gst, gst refund in india, gst refund for exporters, who can claim refund in gst, gst refund process for exporters, gst refund in india, who can claim refund in gst, gst refund for exporters, how to claim gst refund in india, gst refund rules, refund rules under gst, under gst law refund can be for claiming igst cgst sgst, refund process under gst, refund procedure under gst, gst refund in india, who can claim refund in gst, gst refund for exporters, refund of input tax credit under gst, gst refund process for exporters, how to claim gst refund in india

GST RFD-01A Refund on account of CGST and SGST: GST RFD-01A- Refund on account of CGST and SGST paid by treating the supply as intra state supply which is subsequently held as inter-State supply and vice-versa:

The GSTN has introduced the new RFD-01A for Refund on account of CGST & SGST paid by treating the supply as intra state supply which is subsequently held as inter-State supply and vice-versa. In these article we will see the detailed analysis related to the Refund from and how to file the refund form online.

The refund form is applicable as per Section 77 of the CGST Act.

Now we will see the online procedure to file the application through the portal.

1. Login > Services > Refund > Application for refund type, then click on create tab.

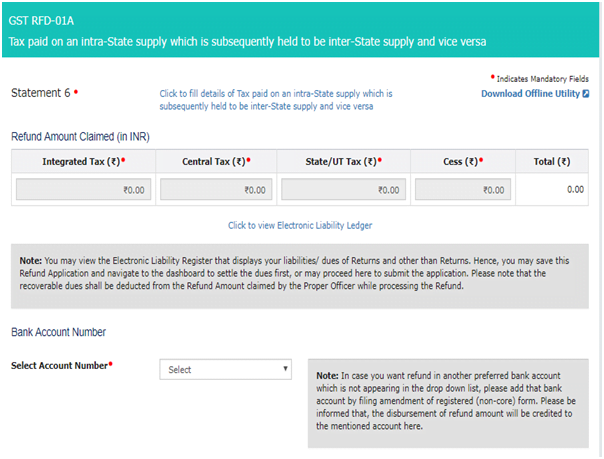

2. After click on create tab the following screen is visible.

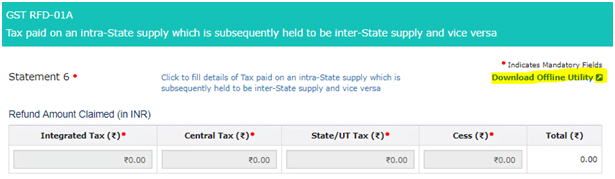

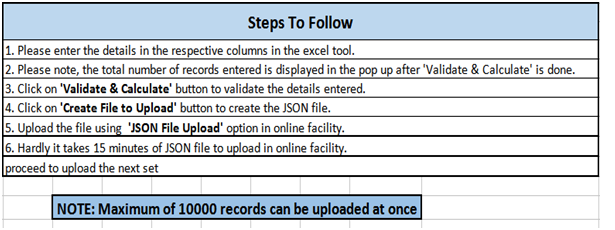

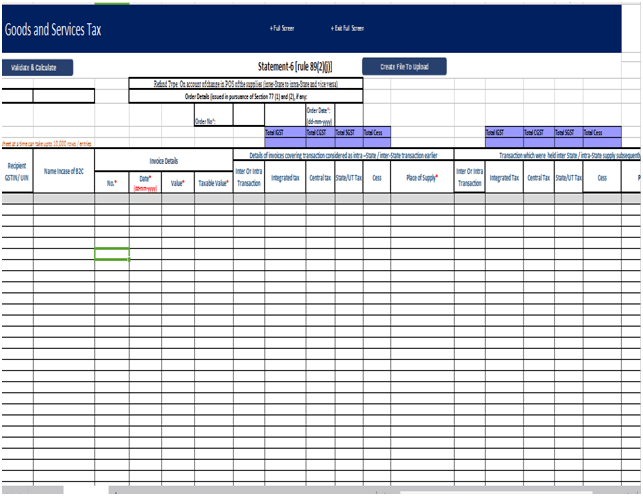

3. Then download the offline utility of Satement-6.

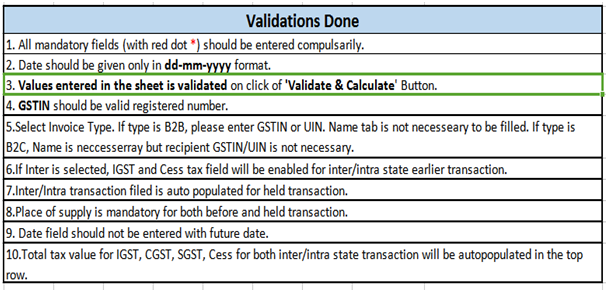

Then fill the mandatory field in excel utility like:

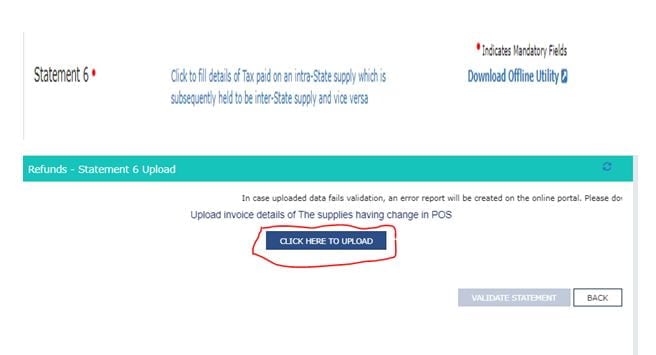

4. Click on Click to fill details of Tax Paid then the following screen is visible, after that click on Click here to Upload to upload the json file.

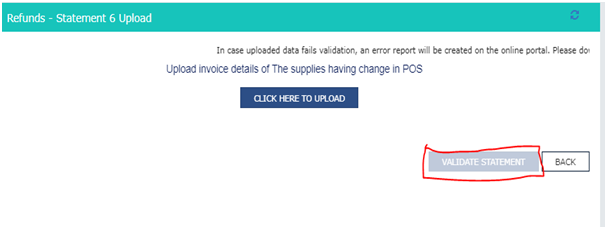

5. After successful uploading the click on Validate Statement to validate the sheet.

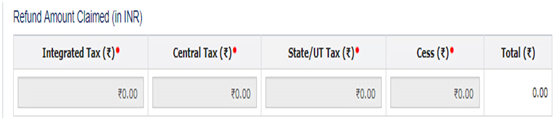

6. After successful validation of sheet, fill the amount in Refund Amount Claimed (in INR) under applicable head.

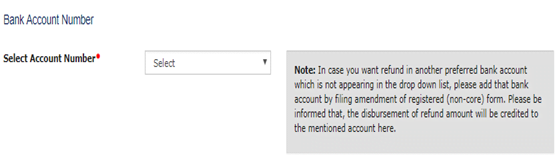

7. After entering the amount then select the Bank Account No to get the refund.

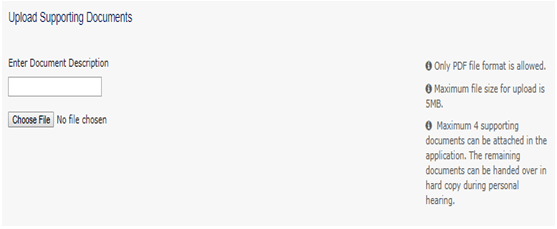

8. Then upload the documents, if any as per Rule 89(2) of CGST Rules,2017.

9. After successful uploading of documents, click on save button.

10. After click on save button, if statement is validated and all the data filed then submit button is enabled.

11. Click on Preview button.

12. After preview click on Submit button, the file the Refund form with DSC or EVC.

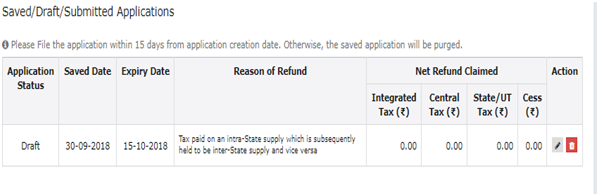

13. After successful filing of Refund Form, the filed refund application can be viewed in Saved/Filed Applications tab:

This article has been written by CS Shashank Kothiyal

You May Also Like:GST FAQ on Stock Brokers Sector as released by CBIC

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"