CA Pratibha Goyal | Dec 5, 2022 |

GSTR-1 Late Fees: GST Department Starts issuing notice for Payment of Late Fees

One of the Tax professionals took his Twitter handle to share that GST Department has started issuing Notices for payment of Late Fees on Late Filing of GST Return GSTR-1.

Ashish Dange on his Twitter handle wrote “GST1 Late Fees Notice started, who else have received.” He has also shared the photo of the Notice received by him. The Notice was of the period March 2019 to November 2021. Department demanded late fees of Rs. 208800 in the Notice.

GST1 Late Fees Notice started, who else have received.#gst @abhishekrajaram @CAChirag @Swapnasneha pic.twitter.com/SKBpbfaDJQ

— Ashish Dange (@AshishRDange) December 5, 2022

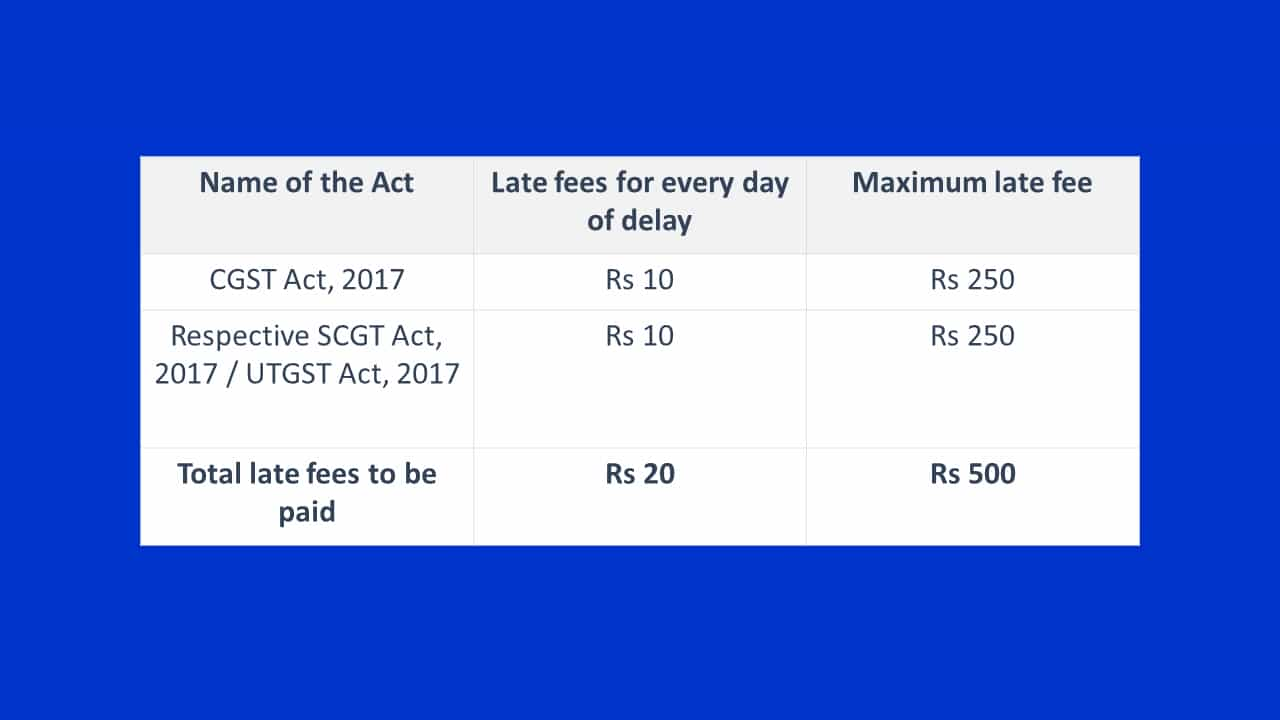

The original late fees on GSTR-1 was Rs.100 per day under each CGST Act and respective SGST/ UTGST Act. Also, the original late fee for Nil return filers used to be Rs. 25 per day under each CGST Act and respective SGST/ UTGST Act.

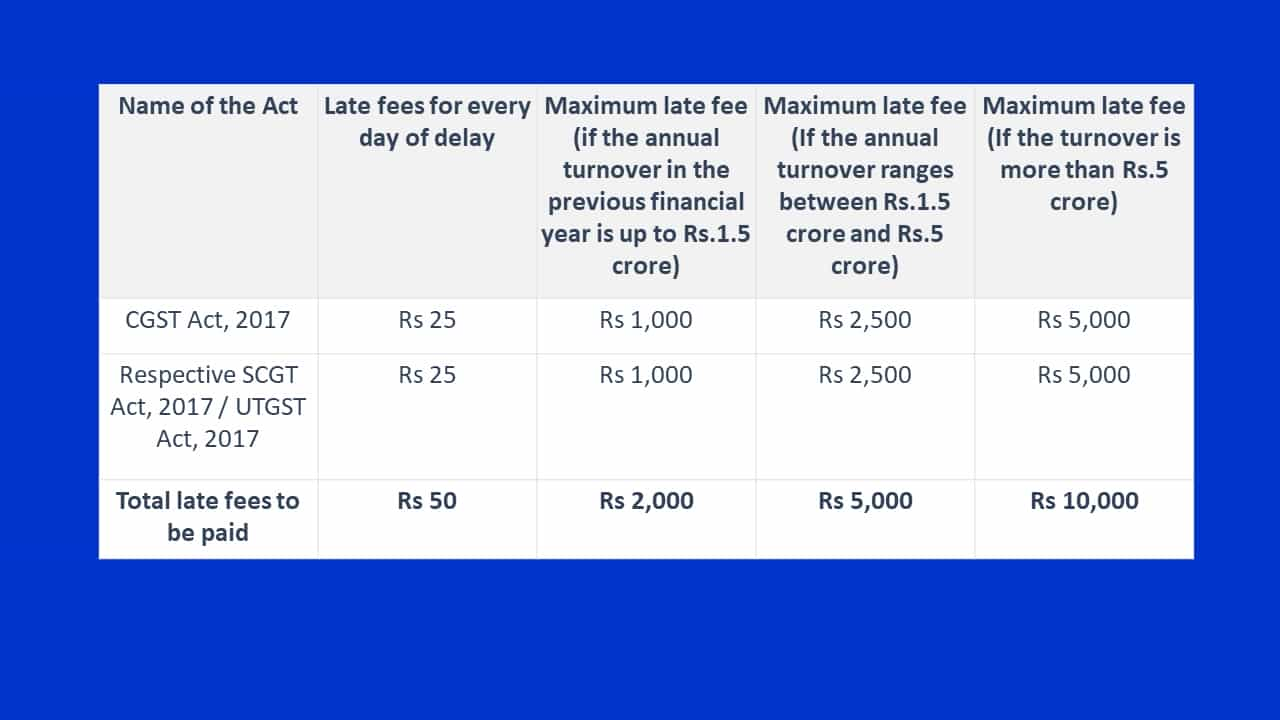

However, CBIC has notified reduced late fees to provide relief for businesses having difficulties in GST return filing.

Also, the CBIC issued notification 20/2021 dated 1st June 2021, to cap the maximum late fee chargeable from June 2021 onwards.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"