Deepak Gupta | Aug 16, 2021 |

GSTR-9C Reconciliation Statement Available for Filing on GST Portal

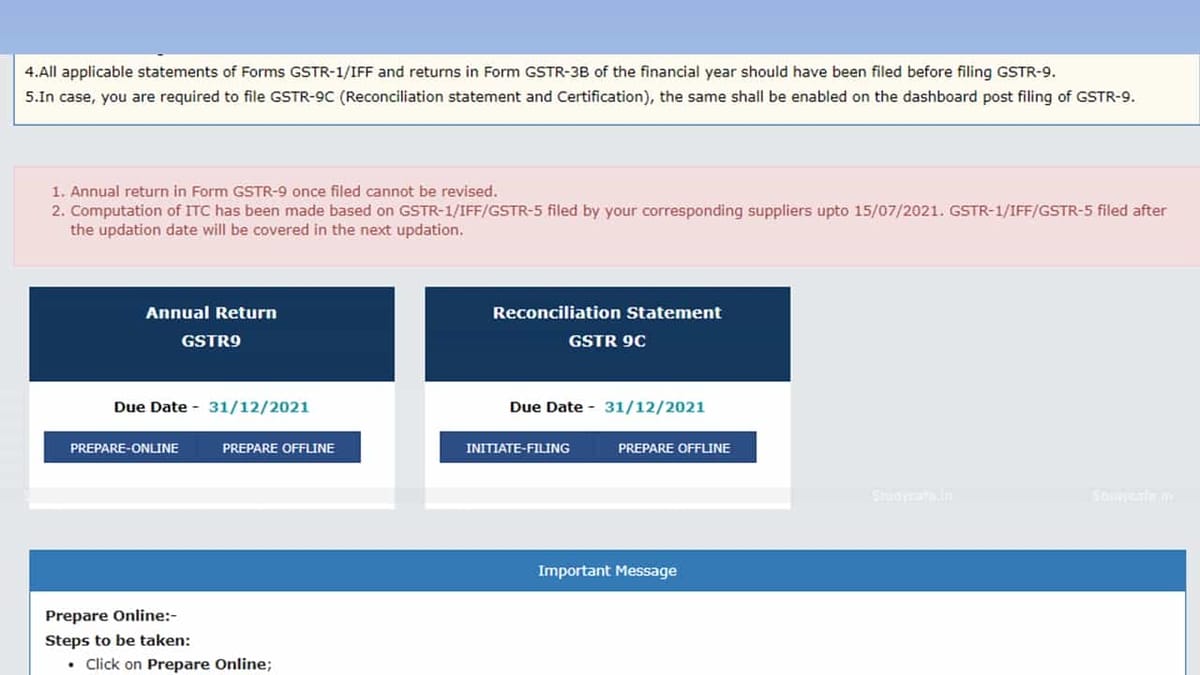

Please note that GSTR-9C Reconciliation Statement is Available for Filing on GST Portal.

The Due Date of filing the GSTR-9C for FY 2020-21 is 31st December 2021. For Filing GSTR-9C First you need to file GSTR-9 (GST Annual Return).

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"