Even in serious GST fraud allegations, custody is not automatic when the maximum punishment under the CGST Act is only five years, rules HC

Meetu Kumari | Jan 12, 2026 |

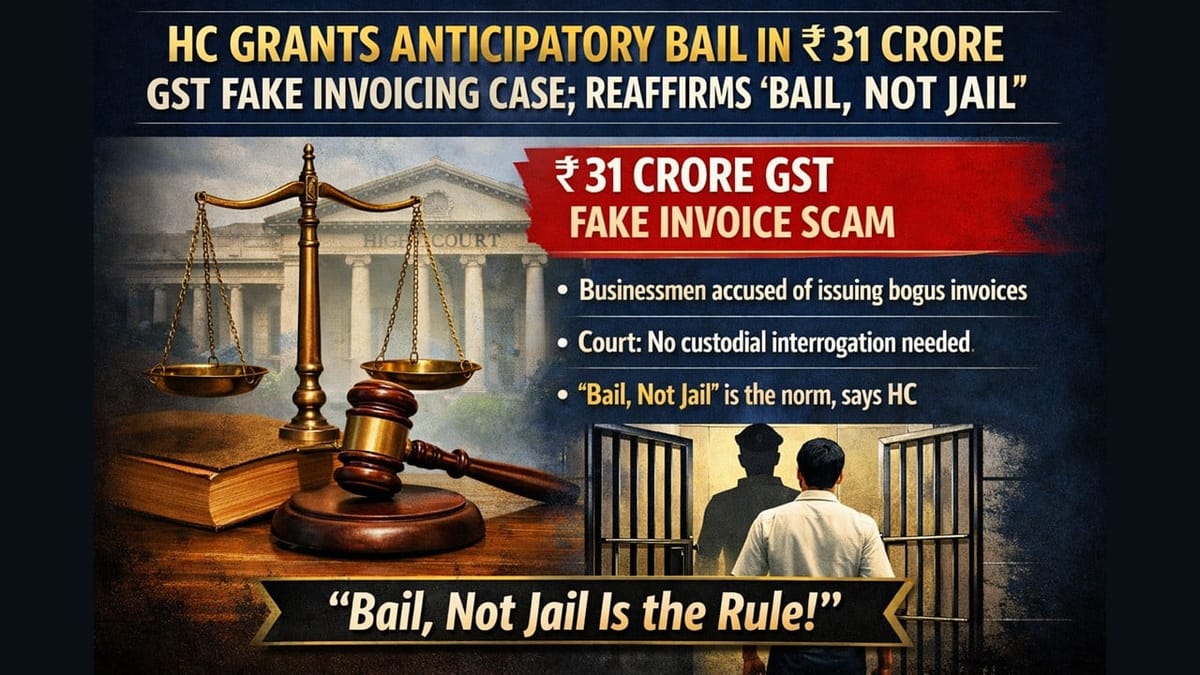

HC Grants Anticipatory Bail in Rs. 31 Crore GST Fake Invoicing Case; Reaffirms ‘Bail, Not Jail’

The petitioner, Sri Akram Pasha, proprietor of M/s. A.R. Steel, was accused by the Directorate General of Goods and Services Tax Intelligence (DGGI) of being part of a syndicate allegedly created to fraudulently avail Input Tax Credit (ITC) through bogus entities. The department accused that fake invoices were issued without any actual movement of goods or services and wrongful availment of ITC amounting to Rs. 31.62 crore from 36 non-existent or cancelled suppliers. Searches were conducted at 13 locations, after which the DGGI issued six summons to the petitioner under Section 70 of the CGST Act.

Apprehending arrest under Section 69, and after rejection of his anticipatory bail plea by the Sessions Court, the petitioner approached the High Court.

Issue Before HC: Whether anticipatory bail can be granted in a GST fake invoicing case involving alleged tax evasion exceeding Rs. 500 lakh, punishable under Section 132(1)(b) and (c) of the CGST Act, which classifies the offense as cognizable and non-bailable.

HC’s Decision: The Hon’ble High Court granted anticipatory bail to the petitioner. The Court acknowledged that economic offences are serious in nature but emphasised that the maximum punishment prescribed under Section 132 of the CGST Act is five years’ imprisonment. It noted that the offences are compoundable under Section 138 of the Act, which reduces their severity. The Court established that GST law is mainly a fiscal statute made for revenue collection not for incarceration.

Applying the “triple test” and the settled principle of “bail, not jail,” the Court held that custodial interrogation is not a sine qua non when statutory punishment is limited. The petitioner was directed to cooperate with the investigation, comply with summons, and share his Google Map PIN to enable location tracking by the authorities.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"