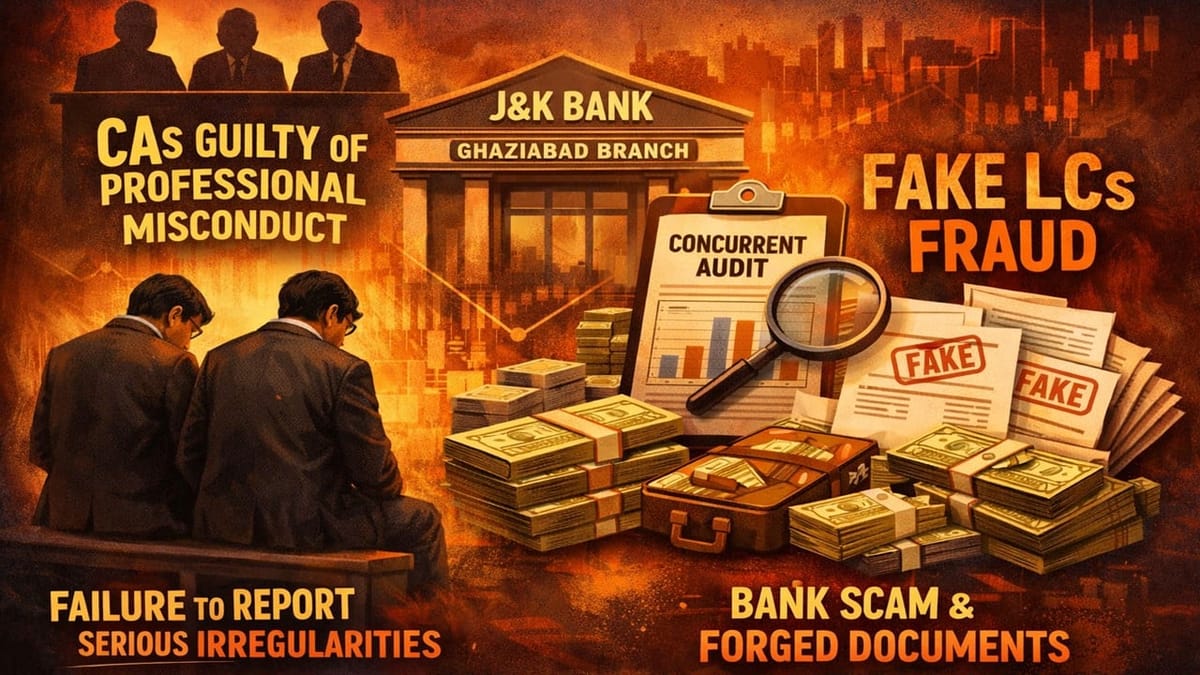

ICAI held two CAs guilty of professional misconduct for failing to report serious irregularities during the concurrent audit of J&K Bank’s Ghaziabad branch linked to a fake LCs fraud.

Saloni Kumari | Feb 10, 2026 |

ICAI Disciplinary Committee Holds CAs Guilty in J&K Bank Ghaziabad Branch Concurrent Audit Fraud Case

The Institute of Chartered Accountants of India (ICAI) Disciplinary Committee (Bench-IV) has taken action against M/s Sudan Kapoor & Associates and certain Chartered Accountants (CAs) in relation to the concurrent audit of Jammu & Kashmir Bank’s Ghaziabad branch for the period from May 2014 to April 2015.

The committee started the proceedings when the bank reported major fraud involving fake letters of credit that caused heavy financial losses. The bank raised allegations against the auditors that they failed to detect and report serious irregularities like high-value Letters of Credit (LCs) being discounted beyond the allowed limits, suspicious same-day transactions, and manual handling of documents instead of using proper banking systems.

Originally, the Director (Discipline) formed a prima facie opinion, claiming that the auditors were not guilty because the bank failed to furnish relevant evidence such as an investigation report or audit records to prove the allegations. However, the ICAI Board of Discipline disagreed with these arguments, considering the seriousness of allegations raised by the bank, and sent the case to the ICAI Disciplinary Committee for detailed examination and inquiry.

Thereafter, the hearing on the matter was conducted; however, all three directors disputed their roles in the audit process. One claimed non-involvement in the audit process, another argued limited participation and loss of documents, while a third claimed to have left the firm before the audit period. When the inquiry was conducted, the committee noted that during the period of audit, two partners were active, and therefore, they both are liable for answering during the hearing. However, proceedings against the third respondent were closed since she was not associated with the firm during the period of audit.

The committee further noted that despite serious irregularities identified later, the audit reports contained only routine remarks and failed to highlight risks relating to LC transactions. This omission was viewed as a significant lapse in professional diligence under the Chartered Accountants Act, 1949. Considering the same, the two respondents named (CA. Rajesh Sudan, M. No. 092352 and CA. Sachin Kumar Sharma, M. No. 420705) were held guilty of professional misconduct under Clause (5), (6), (7), and (8) of Part I of the Second Schedule to the Chartered Accountants Act, 1949.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"