The Institute of Chartered Accountants of India (ICAI) has issued Clarification on the requirement of Advanced IT and MCS for Final (Old) Course Students.

Reetu | Dec 23, 2023 |

ICAi gives Clarification on requirements of Advanced IT and MCS for Final (Old) Course Students

The Institute of Chartered Accountants of India (ICAI) has issued Clarification on the requirement of Advanced IT and MCS for Final (Old) Course Students.

In terms of Regulation 29D(1)(iii) and 51E/72E of the CA Regulations 1988, students registered under the New Scheme of Education and Training (implemented with effect from 1st July 2023) are required to complete the Advanced Integrated Course on Information Technology and Soft Skills (Advanced ICITSS) successfully for being eligible to appear in the Final (New) examination to be held under the syllabus approved by the Council under Regulation 31(v) of the CA Regulations 1988, the first examination of which is to be held in May, 2024.

Advanced ICITSS is a mix of Management and Communication Skills and an Advanced IT Course that will be available beginning July 1, 2023, with the adoption of the New Education and Training Scheme.

After finishing the Advanced Information Technology component of the aforementioned course, candidates must take the Advanced ICITSS-Advanced IT test, which is administered by the ICAI Exam Dept.

Furthermore, it is clarified that students who have completed only one component of the Final (Old) course, namely GMCS/GMCS-II/MCS or Advanced ITT, must complete the remaining component, namely Advanced ICITSS(Adv. IT) or Advanced ICITSS(MCS). They are not required to complete the entire Advanced ICITSS (Advanced IT and MCS).

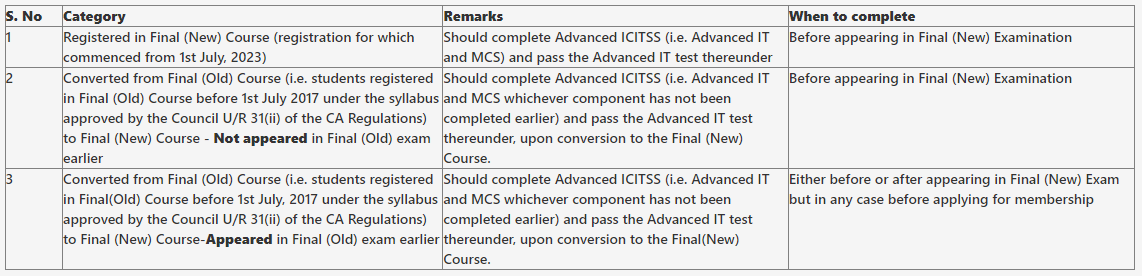

It is further clarified that the following is the position in respect of different categories of students who are required to undergo Advanced ICITSS and pass the Advanced IT test thereunder, with reference to their eligibility to appear in the Final examination.

Final (New) Examination to be held under the syllabus approved by the Council under Regulation 31(v) of the CA Regulations, 1988.

Students must be aware of the foregoing and act accordingly.

For any clarifications on Advanced ICITSS-Advanced IT Test, candidates may write to the Exam Dept. at [email protected] or call any of Help Desk numbers given below: 0120 -3054851 / 3054835

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"