Reetu | Mar 2, 2023 |

ICAI Notifies Standards and Guidance Notes applicable for CA Foundation May 2023 Examination

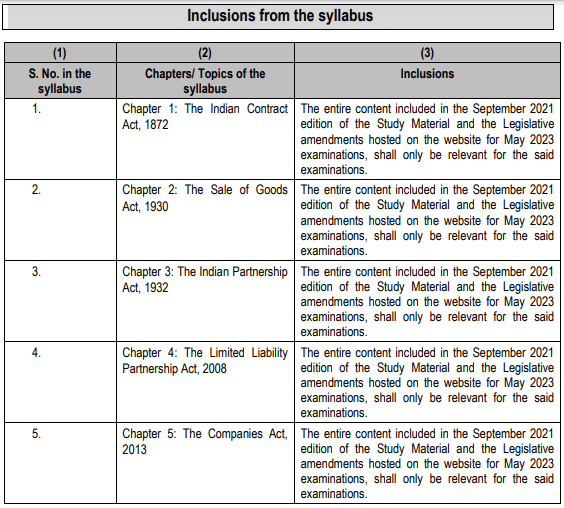

The Institute of Chartered Accountants of India(ICAI) has notifies Applicability of Standards/ Guidance Notes/ Legislative Amendments etc. for May, 2023 – Foundation Course Examination.

Note: September 2021 edition of the Study Material is relevant for May 2023 examinations. The amendments – made after the issuance of this Study Material – i.e. for period 1st of May 2021 to 31st October, 2022 shall also be relevant. The relevant Legislative amendments for May 2023 will be available on the BoS Knowledge Portal.

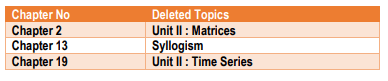

The following topics are deleted from the syllabus of Foundation Paper 3: Business Mathematics, Logical Reasoning and statistics from May 2022 examinations:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"