Meetu Kumari | Feb 18, 2026 |

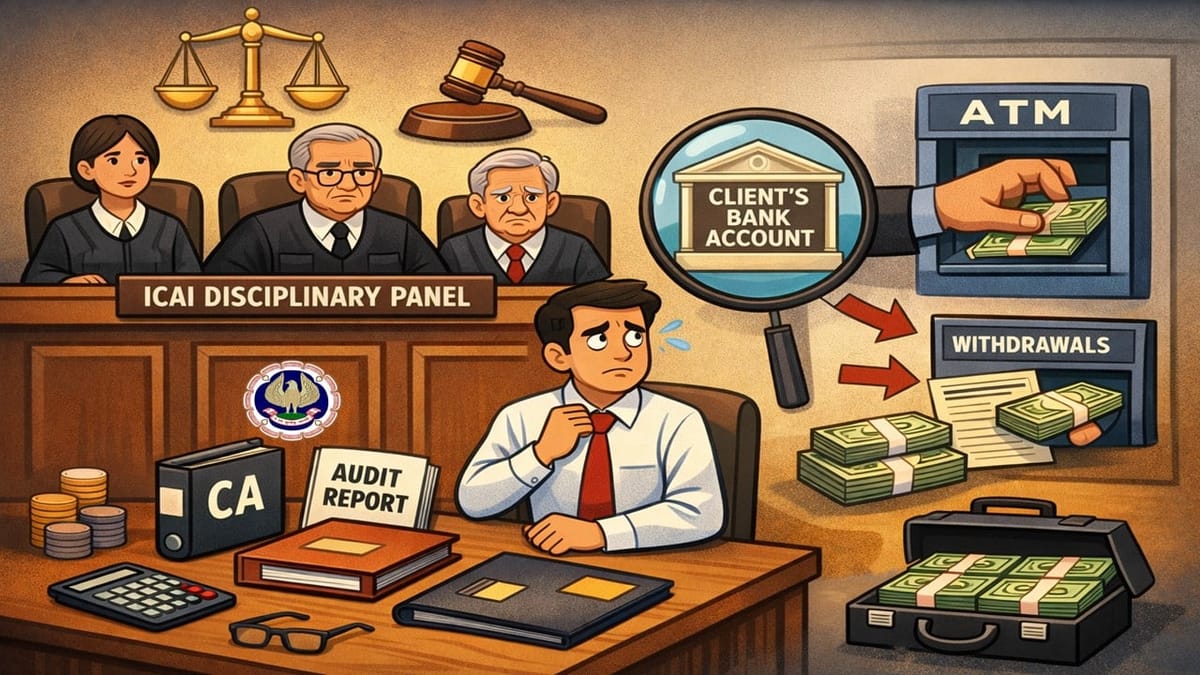

ICAI Reprimands CA for Cash Withdrawals from Client’s Bank Account During Audit Tenure

A complaint was filed by the Central Bureau of Investigation against CA Nagesh Kumar regarding alleged financial irregularities in M/s Mayurath Films Private Limited, which had availed credit facilities from Canara Bank between 2003-2007. It was alleged that funds were siphoned off through cash withdrawals and certification of invoices for loan disbursement.

During his tenure as statutory auditor, the Respondent withdrew Rs. 29.88 lakh in his own name and Rs. 13.87 lakh through his associate from the company’s ODBD account on cheques issued by the director. He admitted withdrawing the cash at the director’s request due to illness but produced no documentary proof showing proper accounting or legitimate use. The Director (Discipline) held him prima facie guilty under Clause (2) of Part IV of the First Schedule and Clause (7) of Part I of the Second Schedule to the Chartered Accountants Act, 1949.

Main Issue: Whether the Respondent’s act of withdrawing substantial cash from the client’s bank account, while acting as statutory auditor, amounted to conduct bringing disrepute to the profession under Clause (2) of Part IV of the First Schedule.

Committee’s Ruling: The Committee rejected the limitation objection and reiterated that disciplinary proceedings are independent of criminal trials. It found that the Respondent’s admitted involvement in withdrawing Rs. 43.75 lakh during his audit tenure compromised auditor independence and crossed professional boundaries.

In the absence of evidence supporting his explanation, the Committee concluded that the conduct brought disrepute to the profession. Thus, he was held Guilty of Other Misconduct and was reprimanded with a fine of Rs. 25,000, payable within 60 days.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"