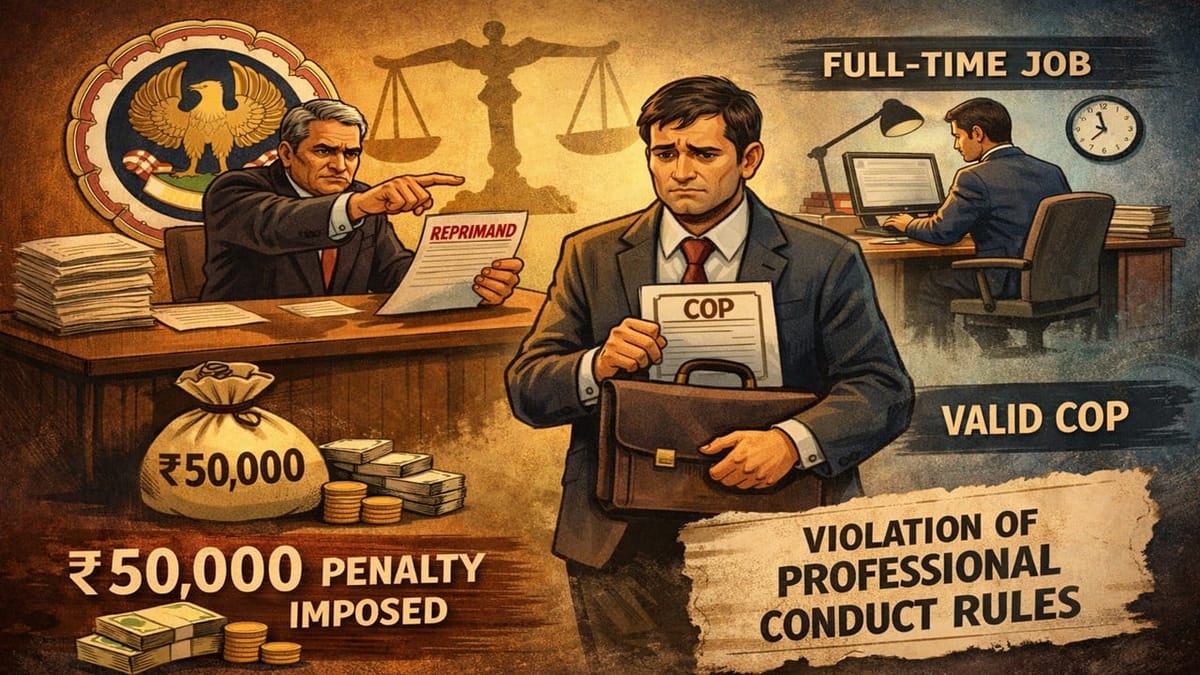

The ICAI has reprimanded CA and imposed a Rs. 50,000 penalty for holding a full-time job while continuing a valid COP in violation of professional conduct rules.

Saloni Kumari | Feb 18, 2026 |

ICAI Disciplinary Committee Reprimands CA for Holding Full-Time Job While Retaining COP, Penalty Levied

The Institute of Chartered Accountants of India (ICAI), Disciplinary Committee (Bench–IV), has taken action against a Chartered Accountant (CA) vide an order dated February 10, 2026.

CA Krishna Chandra Gupta (Complainant) had filed a complaint against the CA. Megha Ishwar Sharma (Respondent) raised allegations that she was in full-time employment with HSBC Electronic Data Processing India Pvt. Ltd. from FY 2013-14 to FY 2018-19; however, she simultaneously held a full-time Certificate of Practice (COP). She also paid annual COP fees continuously from the year 2014 to 2019. During the year in consideration, she was also seen working as a partner in M/s MIS & Associates and later in M/s Rajguru & Associates. A further allegation was raised that she gave incorrect declarations to ICAI in bank empanelment forms and annual records.

The respondent CA, in her defence, argued that she had applied for the surrender of her COP in February 2014 and believed it was effective. Therefore, whatever happened was not intentional. She further claimed that she did not perform any professional work, did not receive professional income, and did not present herself as a practising chartered accountant. She also claimed that payment of COP fees was procedural and did not mean she was in practice.

However, the Disciplinary Committee noted that, as per the records of ICAI, she continued to hold a full-time COP and also paid COP fees from 2014 to 2019. Further, her income tax return (ITR) and Form 16 demonstrated that she worked as a full-time salaried employee during the period. It was further observed that she also did not answer the ICAI email sent to seek clarification on her COP surrender and failed to provide strong evidence to support her claims.

Considering the aforesaid findings, the ICAI Disciplinary Committee held the Chartered Accountant (CA) Megha Ishwar Sharma guilty of professional misconduct under Clause (11) of Part I of the First Schedule and Clause (3) of Part II of the Second Schedule of the Chartered Accountants Act, 1949. She has been reprimanded, and a penalty amounting to Rs. 50,000 has been imposed, payable within 60 days.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"