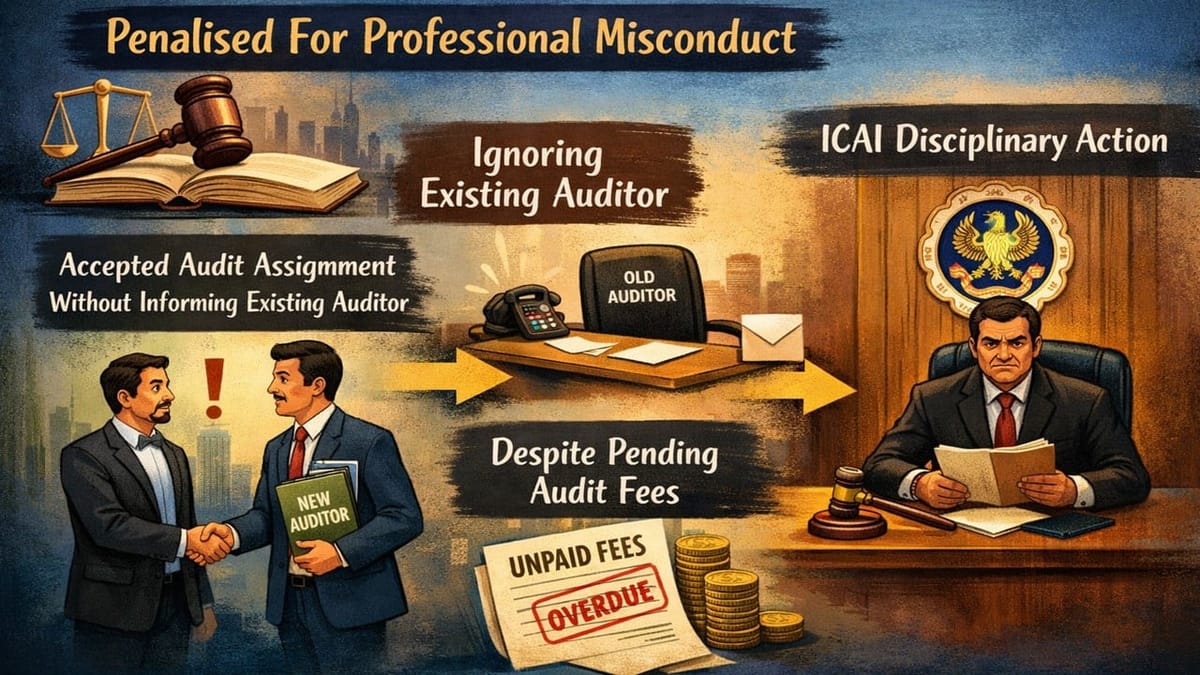

ICAI penalised a CA for professional misconduct after he accepted an audit assignment without informing the existing auditor and despite pending audit fees.

Saloni Kumari | Feb 18, 2026 |

ICAI Holds CA Guilty Under Clause (8) for Accepting Audit Without Informing Previous Auditor; Penalty Imposed

The Institute of Chartered Accountants of India (ICAI) Disciplinary Committee (Bench-IV) has held a CA guilty of professional misconduct for contravention of Clause (8) of Part I of the First Schedule to the Chartered Accountants Act, 1949. The final order on the matter was issued on February 10, 2026.

CA Varun Gupta (Complainant) had filed a complaint against CA. Manoj Kumar Jain (Respondent) raised allegations that in the financial year 2019-20, the respondent CA had conducted an audit of M/s Nambirajan Finance Private Limited. The complainant’s company was the statutory auditor of the company since FY 2010-11. In FY 2019-20, respondent CA accepted the company’s audit; however, till then, the complainant’s firm had not resigned or been removed.

The Committee noted that, as per Clause (8) of Part I of the First Schedule to the Act, the respondent should have communicated with the previous auditor in writing before accepting the audit. However, the respondent failed at the same time. The Committee highlighted that this is a compulsory requirement under the ICAI norms to ensure professional transparency and independence, not just a formality.

It was further noted that at the time when the company’s audit was accepted by the respondent CA, the previous audit had not paid its outstanding audit fees. According to the Council’s General Guidelines, 2008, an incoming auditor is not permitted to accept an audit of a firm if the previous auditor had not received its outstanding audit fees.

Considering the aforesaid findings, the ICAI Disciplinary Committee held the Chartered Accountant (CA) Manoj Kumar Jain guilty of professional misconduct under Clause (8) of Part I of the First Schedule and Clause (1) of Part II of the Second Schedule to the Chartered Accountants Act, 1949. Also, reprimanded CA and imposed a penalty amounting to Rs. 1 lakh, which is required to be paid within 60 days from the date of receiving the order.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"