Reetu | Oct 20, 2022 |

ICSI Campus Placement Drive for Experienced Company Secretaries; Know Details

The Institute of Company Secretaries of India(ICSI) is constantly making efforts for enhancing placement opportunities for professionals in India and abroad. The Institute is regularly conducting Campus Placement for the members. The primary objective of the Campus Placement is to provide a platform for the Company Secretaries and to offer best talent available to the Corporates.

Details of the Campus Placement Drive (BEML Limited) are as under:

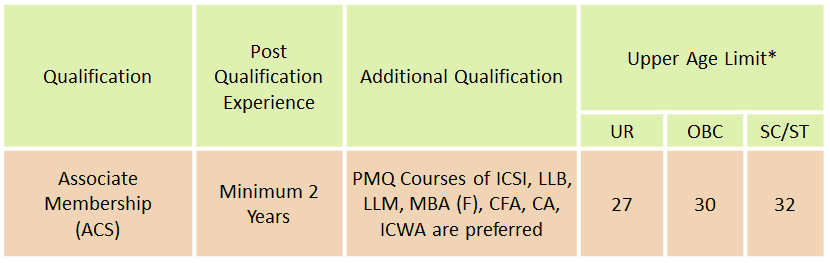

1. Qualifying / Eligibility Parameters are as under (As of 15th October, 2022) :

PwD Candidates will be entitled for additional 10 years relaxation over the Upper age Limit mentioned. Relaxation of age limit would be permissible to candidates with minimum 40% disability.

2. Experience of working or setting up of the Company Secretarial dept. in a Listed Public Limited Company will be preferred.

3. Candidates with higher Experience (both in terms no. of Years and Quality) may be considered for Higher Pay Scale/CTC.

4. Candidates employed in Government / Quasi-Government / PSU should send their online application through proper channel or compulsorily produce NOC at the time of interview.

5. Candidates employed in Government / Quasi-Government / PSU should have worked for at least 1 year in the immediate lower scale.

6. There will be no TA/DA reimbursement for attending the interview.

To Read More Details Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"