No change in due dates for filing returns of income or Tax Audit as per New Income Tax Bill

CA Pratibha Goyal | Feb 15, 2025 |

Income Tax Bill 2025: Has ITR, Tax Audit Filing Due date changed

The New Income Tax Bill was tabled in Parliament on 13 Feb 2025. Since this is a big change in area of Taxation, many questions are there on the same in the minds of Taxpayers and Tax professionals. One such question is: Has ITR, Tax Audit Filing Due date changed?

Income Tax Return Filing due date

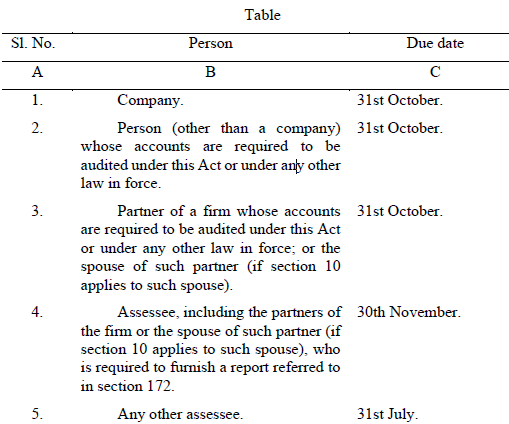

The due dates for filing returns of income for each category of assessees are still the same. The provisions regarding belated returns, revised returns, and updated returns also remain the same as in the Income Tax Act, 1961. Amendments proposed vide Finance Act, 2025 have been included in the Income Tax Bill 2025.

ITR Filing due dates as per the Section 263 of Income Tax Bill 2025

Tax Audit due date

The due date for filing a Tax Audit is also still the same.

As per Section 63 of the Income Tax Bill, the Due Date for Audit relation to the accounts of the assessee of the tax year, is one month prior to the due date for furnishing the return of income.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"