CBDT has officially extended the Tax Audit Due Date, bringing relief to taxpayers and professionals.

Nidhi | Sep 25, 2025 |

Income Tax Breaking: Tax Audit Due Date Extended by CBDT

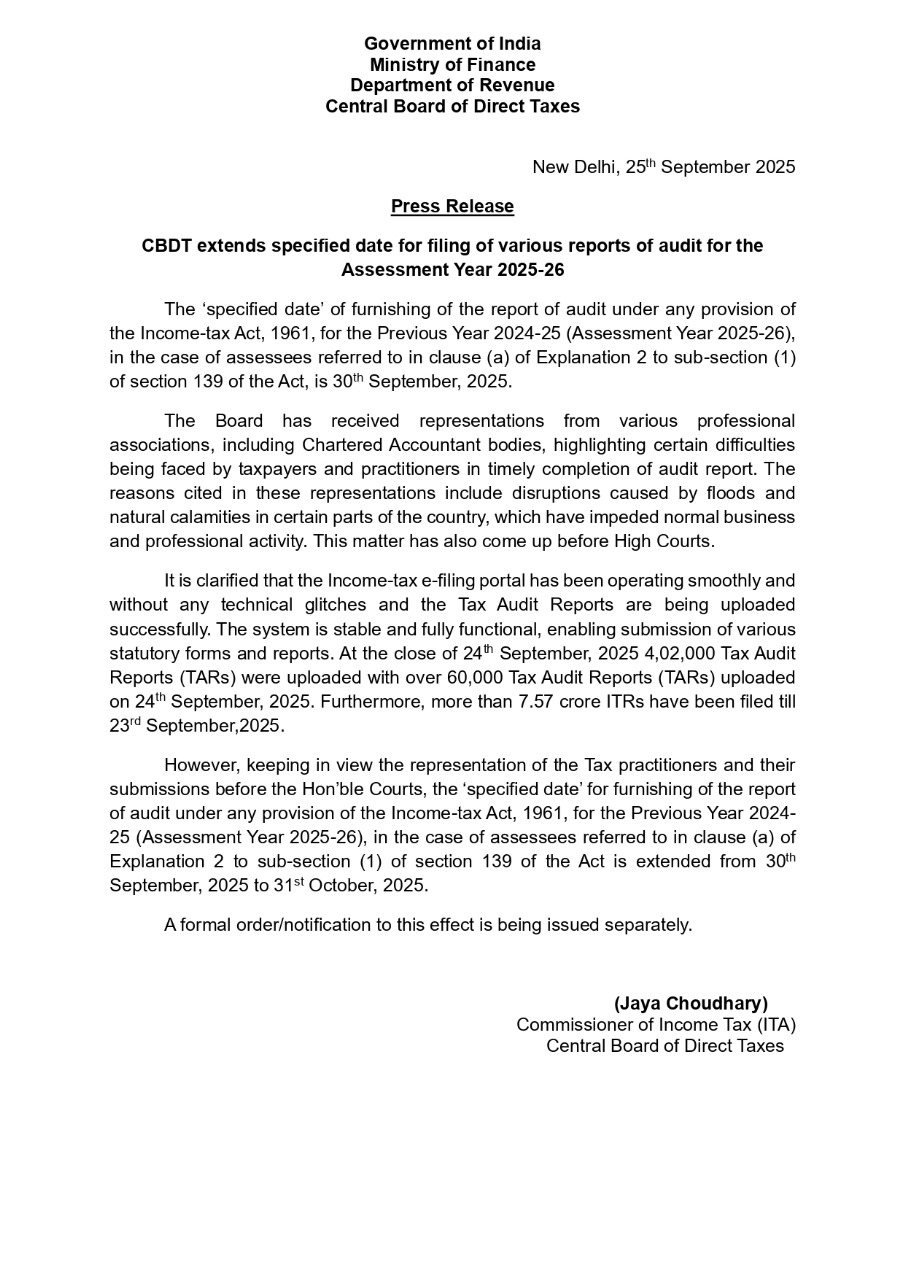

In a significant relief to the chartered accountants and taxpayers, the Central Board of Direct Taxes (CBDT) has extended the due date for filing the Tax Audit Report. As per the notification released by CBDT, the due date of filing the tax audit report for the financial year 2024-25 (Assessment Year 2025-26) has been extended to October 31, 2025.

This decision is followed by several requests, representations, and writ petitions before the High Court. Chartered Accountant community, taxpayers and other professionals raised concerns regarding the technical glitches on the Income Tax e-filing portal. Recently, on September 24, many CAs held a pen-down strike, demanding the extension.

Thanks to the CA community and other tax bodies, which repeatedly sent representatives to the government and also filed writ petitions. Multiple High Courts directed CBDT to extend the due date, after which it released a nationwide extension notification.

The new extended due dates offer much-needed relief for accurate and compliant filings. It will reduce the stress among CAs and ensure quality compliance.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"