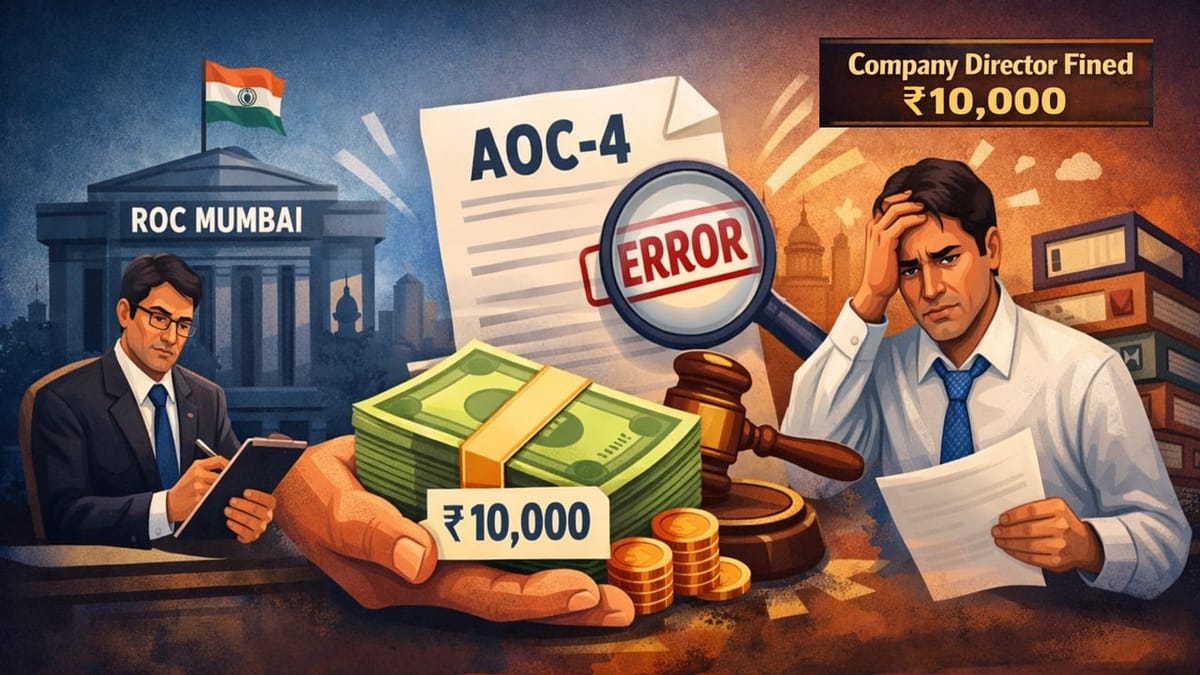

ROC Mumbai fined a company director Rs. 10,000 for an incorrect AOC-4 filing due to a clerical error under the Companies Act, 2013.

Saloni Kumari | Jan 24, 2026 |

ROC Penalises Director for Incorrect E-form AOC-4 Filing

The Registrar of Companies (ROC) Mumbai has issued an order of adjudication dated January 23, 2026, imposing a penalty amounting to Rs. 10,000 on the director of Sub Zero Insulation Technologies Private Limited, named Rashmi Anand, having DIN 00366258. The penalty has been levied under Section 454 of the Companies Act 2013 for the contravention of Section 450 of the Act.

The company had voluntarily filed an adjudication application dated November 28, 2025, under Section 454 of the Companies Act, 2013, adding the incorrect filing of E-form AOC-4 for the Financial Year 2024-25. The ROC asked for clarification on December 11, 2025, and replied on December 22, 2025.

The key default in the present case was that a required field related to the rebate/drawback of taxes and duties was mistakenly left empty due to a clerical mistake. The form was required to be digitally signed and declared by the company’s director, i.e., Ms Rasmi Anand.

Under the provisions of the company rules, the individual who signs and certifies an electronic form is also responsible for the correctness of its details and attachments. Since the disputed forms include mistakes in them, the director is held responsible for non-compliance and hence also entitled to the required penal action under Section 450 of the Companies Act, 2013. In conclusion, the ROC Mumbai imposed a penalty of Rs. 10,000 on the director. Additionally, directed to pay the penalty amount and rectify the default within 90 days from receipt of the order.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"