We can infer that since Schema has been released, ITR utility maybe released anytime soon.

CA Pratibha Goyal | Apr 12, 2023 |

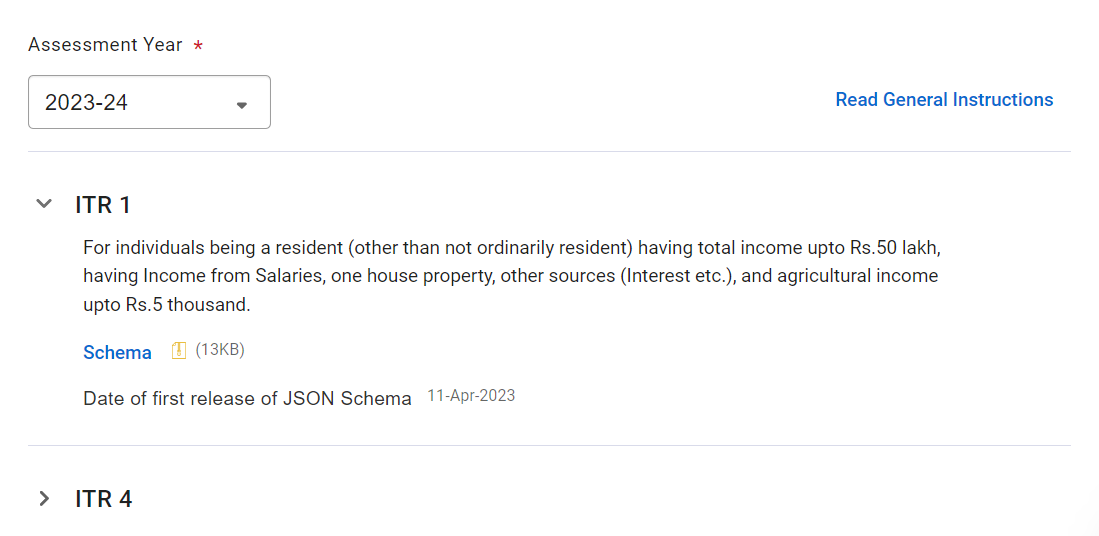

Income Tax Department releases JSON Schema for ITR-1 and ITR 4 for FY 2022-23 | AY 2023-24

The Income Tax Department has released JSON Schema for Income Tax Return (ITR) Forms ITR-1 (Sahaj) and ITR 4 (Sugam) for FY 2022-23 | AY 2023-24.

ITR-1 form is relevant for individuals being a resident (other than not ordinarily resident) having total income upto Rs.50 lakh, having Income from Salaries, one house property, other sources (Interest etc.), and agricultural income upto Rs.5 thousand.

ITR-4 form is relevant for Individuals, HUFs and Firms (other than LLP) being a resident having total income upto Rs.50 lakh and having income from business and profession which is computed under sections 44AD, 44ADA or 44AE and agricultural income upto Rs.5 thousand.

We can infer that since Schema has been released, ITR utility maybe released anytime soon.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"