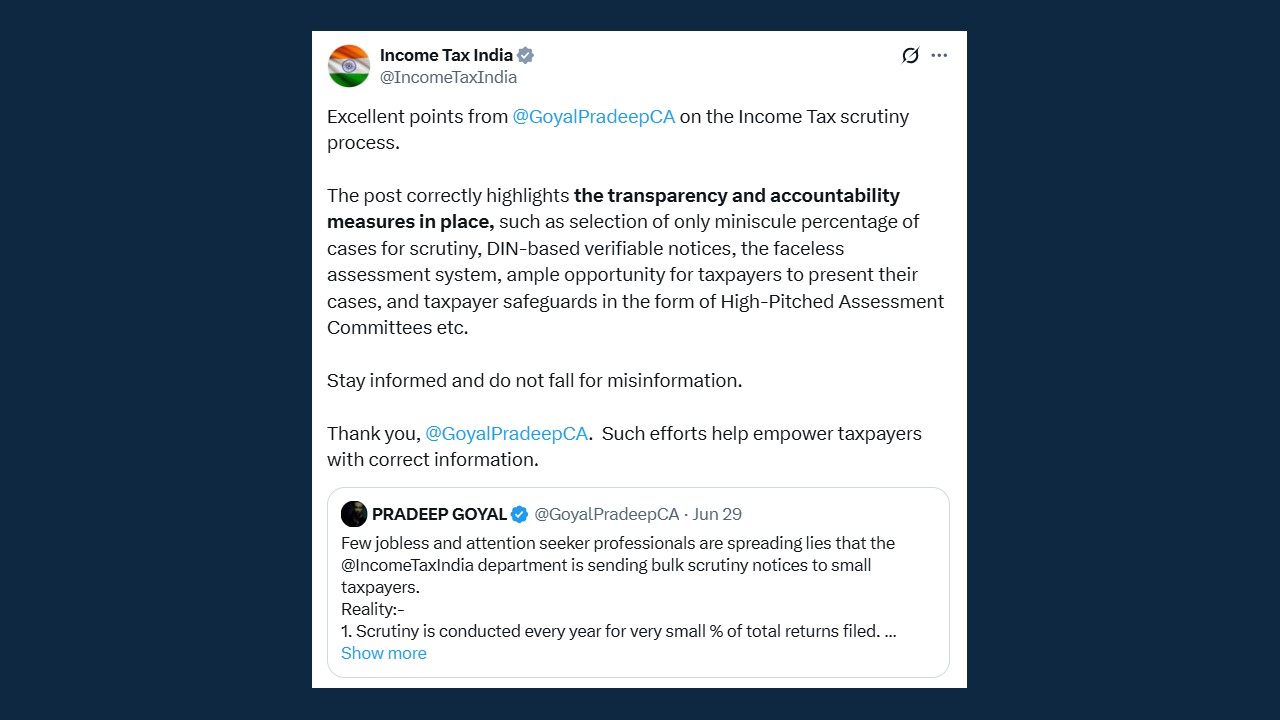

The Income Tax Department has not issued bulk scrutiny notices to small taxpayers. The rumor was being spread about the said notice on social media platforms.

Shriya Mishra | Jun 30, 2025 |

Income Tax Dept Breaks Silence: No Mass Scrutiny for Small Taxpayers

There had been previous rumors that the Income Tax Department is sending bulk scrutiny notices to small taxpayers, but these were all fallacious rumors.

Scrutiny notice is issued by the Income Tax Department to a taxpayer when the said department finds certain issues in the ITR filed by the taxpayer. The department requires the taxpayer to provide further clarification.

Income Tax Clarification on Mass Scrutiny Notices

Reality behind the said rumor:

It is advised to taxpayers to not pay money to anyone who claims to be an officer.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"