CA Mayur J Sondagar | Jul 4, 2021 |

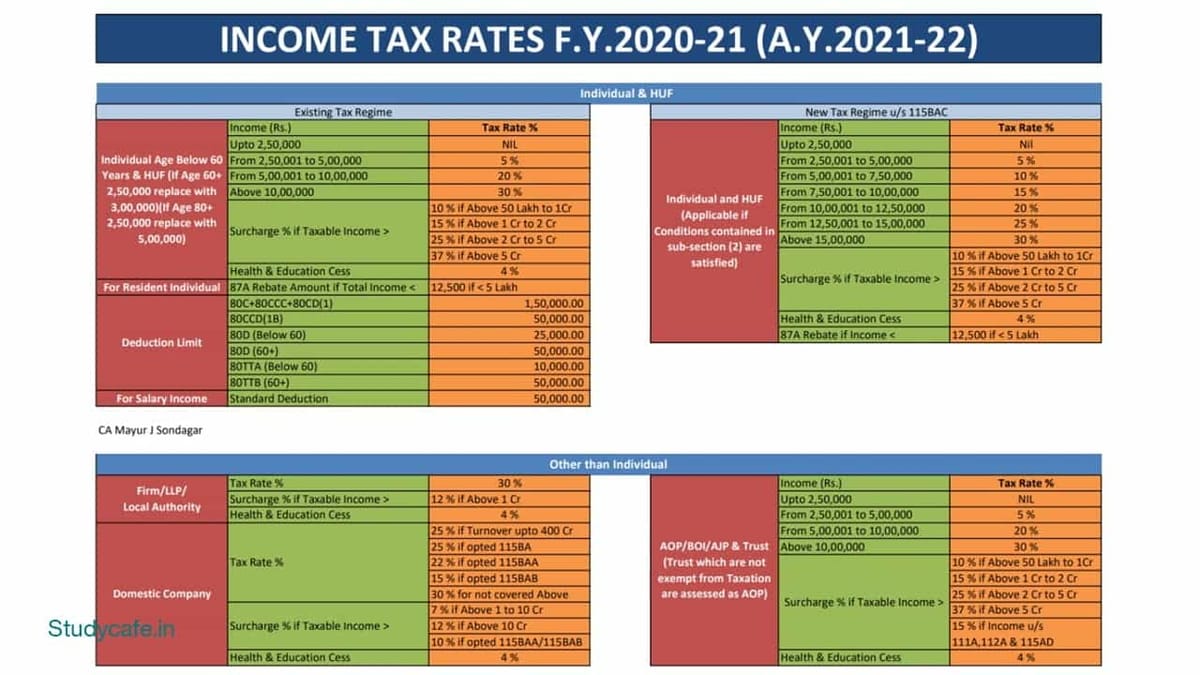

INCOME TAX RATES FY 2020-21 (AY 2021-22)

Individual & HUF

Existing Tax Regime

| Individual Age Below 60 Years & HUF (If Age 60+ 2,50,000 replace with 3,00,000)(If Age 80+ 2,50,000 replace with 5,00,000) | Income (Rs.) | Tax Rate % |

| Upto 2,50,000 | NIL | |

| From 2,50,001 to 5,00,000 | 5 % | |

| From 5,00,001 to 10,00,000 | 20 % | |

| Above 10,00,000 | 30 % | |

| Surcharge % if Taxable Income > | 10 % if Above 50 Lakh to 1Cr | |

| 15 % if Above 1 Cr to 2 Cr | ||

| 25 % if Above 2 Cr to 5 Cr | ||

| 37 % if Above 5 Cr | ||

| Health & Education Cess | 4 % | |

| For Resident Individual | 87A Rebate Amount if Total Income < | 12,500 if < 5 Lakh |

| Deduction Limit | 80C+80CCC+80CD(1) | 1,50,000.00 |

| 80CCD(1B) | 50,000.00 | |

| 80D (Below 60) | 25,000.00 | |

| 80D (60+) | 50,000.00 | |

| 80TTA (Below 60) | 10,000.00 | |

| 80TTB (60+) | 50,000.00 | |

| For Salary Income | Standard Deduction | 50,000.00 |

New Tax Regime

| New Tax Regime u/s 115BAC | ||

| Individual and HUF (Applicable if Conditions contained in sub-section (2) are satisfied) | Income (Rs.) | Tax Rate % |

| Upto 2,50,000 | Nil | |

| From 2,50,001 to 5,00,000 | 5 % | |

| From 5,00,001 to 7,50,000 | 10 % | |

| From 7,50,001 to 10,00,000 | 15 % | |

| From 10,00,001 to 12,50,000 | 20 % | |

| From 12,50,001 to 15,00,000 | 25 % | |

| Above 15,00,000 | 30 % | |

| Surcharge % if Taxable Income > | 10 % if Above 50 Lakh to 1Cr | |

| 15 % if Above 1 Cr to 2 Cr | ||

| 25 % if Above 2 Cr to 5 Cr | ||

| 37 % if Above 5 Cr | ||

| Health & Education Cess | 4 % | |

| 87A Rebate if Income < | 12,500 if < 5 Lakh | |

Other than Individual

| Firm/LLP/Local Authority | Tax Rate % | 30 % |

| Surcharge % if Taxable Income > | 12 % if Above 1 Cr | |

| Health & Education Cess | 4 % | |

| Domestic Company | Tax Rate % | 25 % if Turnover upto 400 Cr |

| 25 % if opted 115BA | ||

| 22 % if opted 115BAA | ||

| 15 % if opted 115BAB | ||

| 30 % for not covered Above | ||

| Surcharge % if Taxable Income > | 7 % if Above 1 to 10 Cr | |

| 12 % if Above 10 Cr | ||

| 10 % if opted 115BAA/115BAB | ||

| Health & Education Cess | 4 % |

OTHER

| AOP/BOI/AJP & Trust (Trust which are not exempt from Taxation are assessed as AOP) | Income (Rs.) | Tax Rate % |

| Upto 2,50,000 | NIL | |

| From 2,50,001 to 5,00,000 | 5 % | |

| From 5,00,001 to 10,00,000 | 20 % | |

| Above 10,00,000 | 30 % | |

| Surcharge % if Taxable Income > | 10 % if Above 50 Lakh to 1Cr | |

| 15 % if Above 1 Cr to 2 Cr | ||

| 25 % if Above 2 Cr to 5 Cr | ||

| 37 % if Above 5 Cr | ||

| 15 % if Income u/s 111A,112A & 115AD | ||

| Health & Education Cess | 4 % |

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"