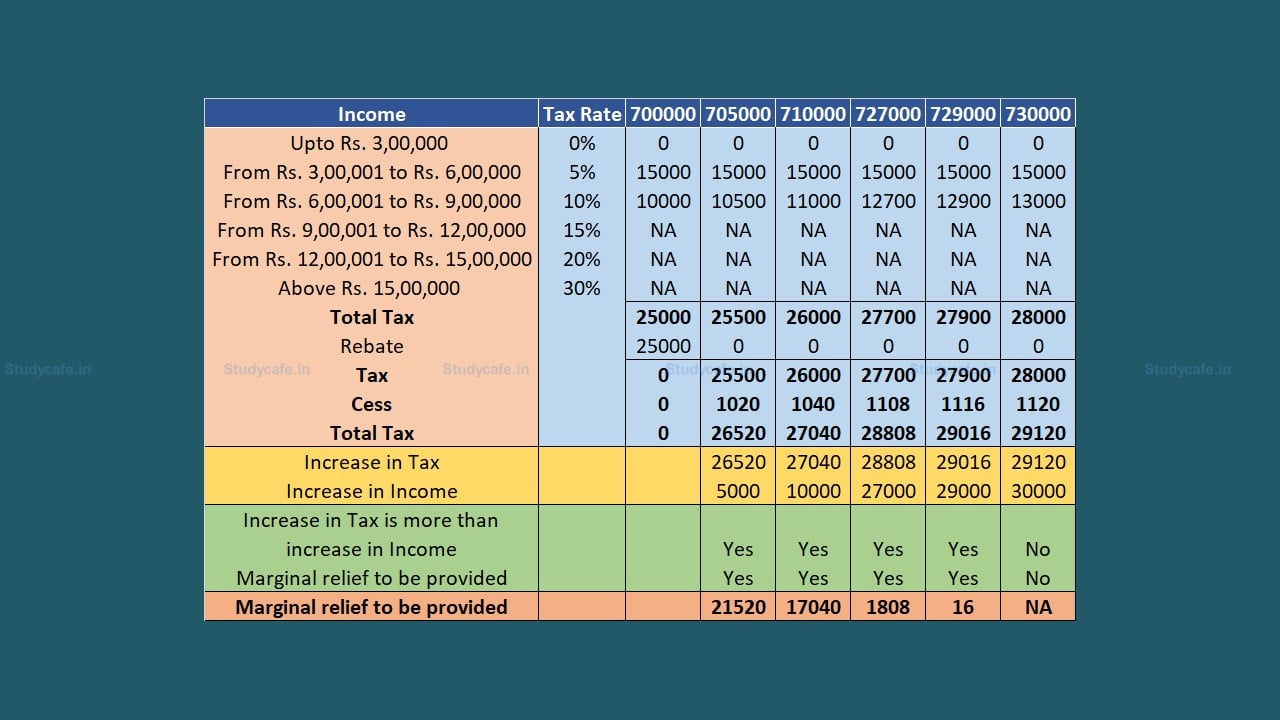

There was no marginal relief prescribed with the implication that the once the income exceeds Rs. 7 lakh (say Rs. 7.05 lakh). This would mean that increase in Income Tax would be more than the increase in Income.

CA Pratibha Goyal | Mar 24, 2023 |

Income Tax Slab FY 2023-24: What is new Marginal relief given in Finance Bill passed from Lok Sabha

Marginal relief is provided when an increase in Tax is more than the increase in Income.

As per the Finance Bill, 2023, it was proposed that there would be no requirement to pay tax under the new regime in case the income does not exceed 7 lakhs.

Know the new rebate under section 87A: Budget 2023

However, there was no marginal relief prescribed with the implication that the once the income exceeds Rs. 7 lakh (say Rs. 7.05 lakh). This would mean that increase in Income Tax would be more than the increase in Income.

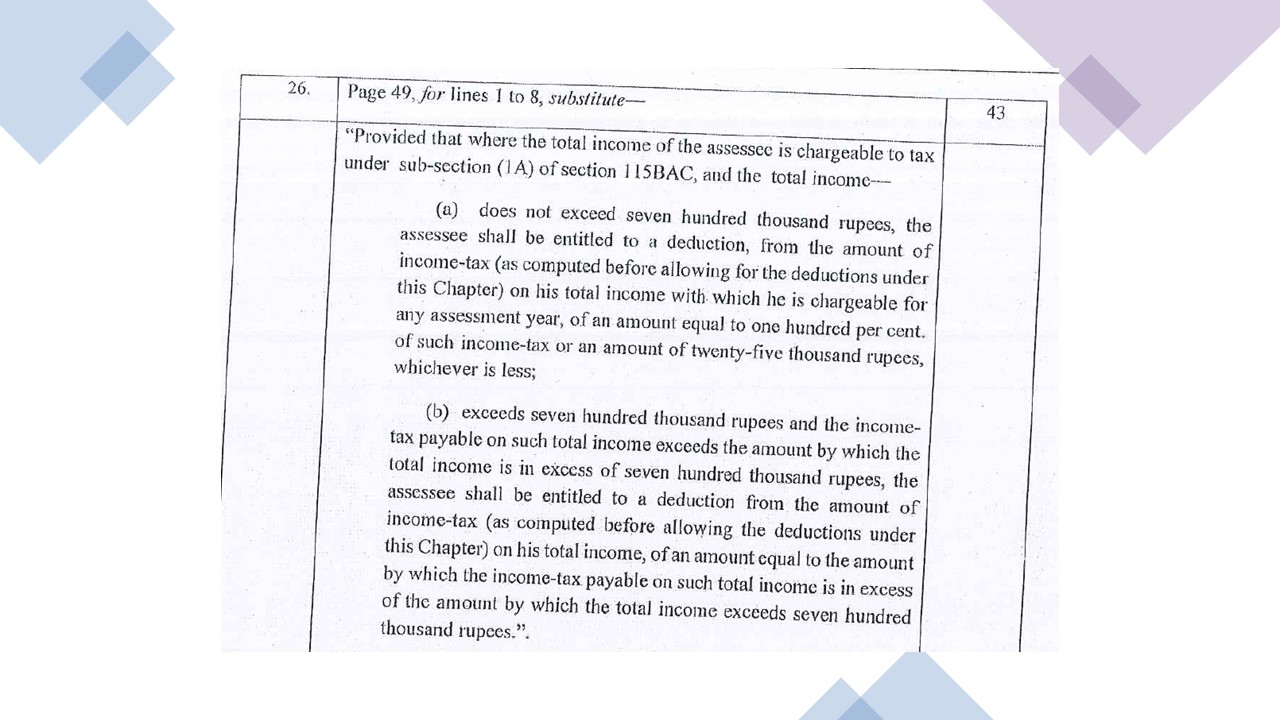

To remove this anomaly, marginal relief has now been proposed to be prescribed which would mean that the tax payable shall not exceed the income exceeding Rs. 7 lakhs.

Let’s try to analyze the impact of this.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"