CA Pratibha Goyal | Feb 22, 2020 |

Income Tax Slab Rates for AY 2020-21 (FY 2019-20)

Below are Income Tax Slab Rates for AY 2020-21 (FY 2019-20), along with Rebate under Section 87A, and Income Tax surcharge rates applicable. The Article contains, Income Tax Slab Rates for Individuals, HUF, Local Authority and Tax Rates for Partnership Firm, and Companies.

1. Income Tax Rate for AY 2020-21 (FY 2019-20), in case of an Individual (resident or non-resident) or HUF or Association of Person or Body of Individual or any other artificial juridical person is as follows:

| Taxable Income | Tax Rate |

| Up to Rs. 2,50,000 | Nil |

| Rs. 2,50,000 to Rs 5,00,000 | 5% |

| Rs. 5,00,000 to Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

Less: Rebate under Section 87A [see Note]

Add: Surcharge and Health & Education Cess [see Note]

2. Tax rate in case of a resident senior citizen (who is 60 years or more at any time during the previous year but less than 80 years on the last day of the previous year)

| Taxable Income | Tax Rate |

| Up to Rs. 3,00,000 | Nil |

| Rs. 3,00,000 to Rs 5,00,000 | 5% |

| Rs. 5,00,000 to Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

Less: Rebate under Section 87A [see Note]

Add: Surcharge and Health & Education Cess [see Note]

3. In case of a resident super senior citizen (who is 80 years or more at any time during the previous year)

| Taxable Income | Tax Rate |

| Up to Rs. 5,00,000 | Nil |

| Rs. 5,00,000 to Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

Add: Surcharge and Health & Education Cess [see Note]

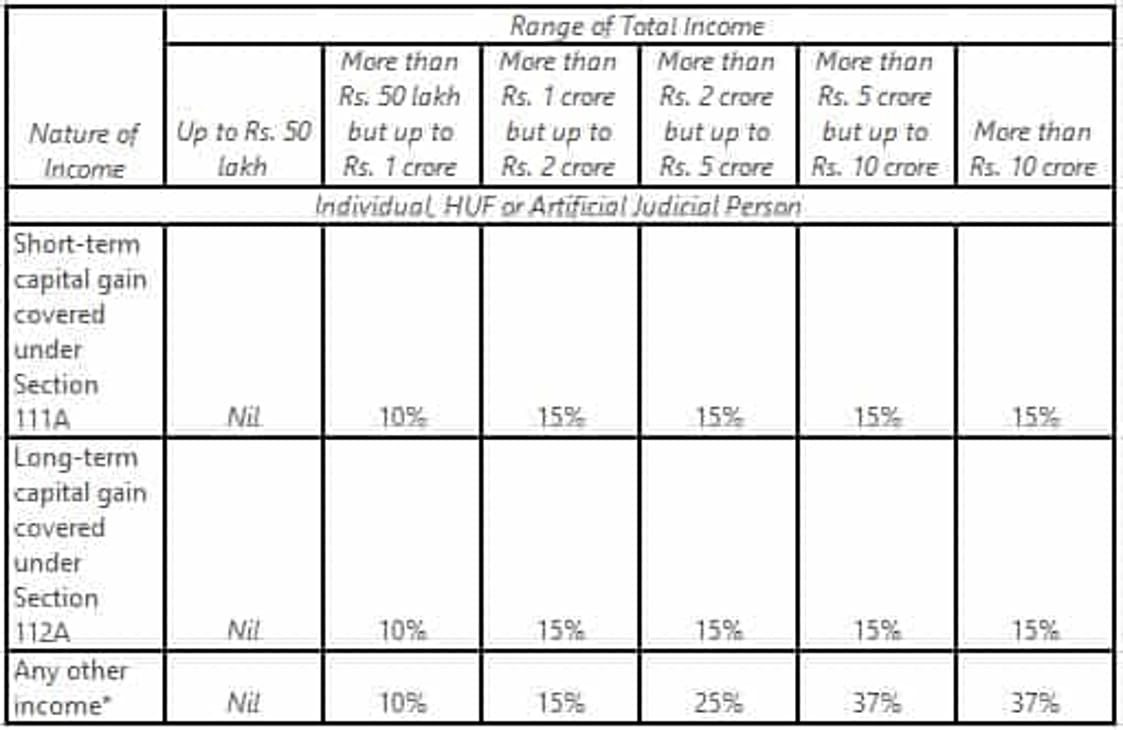

a) Surcharge:

Surcharge is levied on the amount of income-tax at following rates if the total income of an assessee exceeds specified limits:

Income Tax Slab Rates for AY 2020-21 (FY 2019-20)

* The Finance (No. 2) Act, 2019 has been amended to withdraw the enhanced surcharge, i.e., 25% or 37%, as the case may be, from income chargeable to tax under section 111A and 112A. Hence, the maximum rate of surcharge on tax payable on such incomes shall be 15%. However, where other income of a person does not exceed Rs. 2 crores but after including the incomes as referred to in section 111A and 112A, the total income exceeds Rs. 2 crores then irrespective of the amount of other income, surcharge shall be levied at the rate of 15% on the amount of tax payable on both normal income as well as income referred to in section 111A and 112A.

Income Tax Slab Rates for AY 2020-21 (FY 2019-20)

* The Finance (No. 2) Act, 2019 has been amended to withdraw the enhanced surcharge, i.e., 25% or 37%, as the case may be, from income chargeable to tax under section 111A, 112A and 115AD. Hence, the maximum rate of surcharge on tax payable on such incomes shall be 15%. However, where other income of a person does not exceed Rs. 2 crores but after including the incomes as referred to in section 111A, 112A and 115AD, the total income exceeds Rs. 2 crores then irrespective of the amount of other income, surcharge shall be levied at the rate of 15% on the amount of tax payable on both normal income as well as income referred to in section 111A, 112A and 115AD.

The surcharge shall be subject to marginal relief:

i) Where income exceeds Rs. 50 lakhs, the total amount payable as income-tax and surcharge shall not exceed total amount payable as income-tax on total income of Rs. 50 lakhs by more than the amount of income that exceeds Rs. 50 lakhs.

ii) where income exceeds Rs. 1 crore, the total amount payable as income-tax and surcharge shall not exceed total amount payable as income-tax on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore

iii) where income exceeds Rs. 2 crore, the total amount payable as income-tax and surcharge shall not exceed total amount payable as income-tax on total income of Rs. 2 crore by more than the amount of income that exceeds Rs. 2 crore

iv) where income exceeds Rs. 5 crore rupees, the total amount payable as income-tax and surcharge shall not exceed total amount payable as income-tax on total income of Rs. 5 crore rupees by more than the amount of income that exceeds Rs. 5 crore rupees

b) Health and Education Cess: The amount of income-tax and the applicable surcharge, shall be further increased by health and education cess calculated at the rate of 4% of such income-tax and surcharge.

c) Rebate under Section 87A: The rebate is available to a resident individual if his total income does not exceed Rs. 5,00,000. The amount of rebate shall be 100% of income-tax or Rs. 12,500, whichever is less.

4. Partnership Firm

For the Assessment Year 2020-21, a partnership firm (including LLP) is taxable at 30%.

Add:

a) Surcharge: The amount of income-tax shall be increased by a surcharge at the rate of 12% of such tax, where total income exceeds one crore rupees. However, the surcharge shall be subject to marginal relief (where income exceeds one crore rupees, the total amount payable as income-tax and surcharge shall not exceed total amount payable as income-tax on total income of one crore rupees by more than the amount of income that exceeds one crore rupees).

b) Health and Education Cess: The amount of income-tax and the applicable surcharge, shall be further increased by health and education cess calculated at the rate of four percent of such income-tax and surcharge

5. Local Authority

For the Assessment Year 2020-21, a local authority is taxable at 30%.

Add:

a) Surcharge: The amount of income-tax shall be increased by a surcharge at the rate of 12% of such tax, where total income exceeds one crore rupees. However, the surcharge shall be subject to marginal relief (where income exceeds one crore rupees, the total amount payable as income-tax and surcharge shall not exceed total amount payable as income-tax on total income of one crore rupees by more than the amount of income that exceeds one crore rupees).

b) Health and Education Cess: The amount of income-tax and the applicable surcharge, shall be further increased by health and education cess calculated at the rate of four percent of such income-tax and surcharge.

6. Tax Rates for Domestic Company

Income-tax rates applicable in case of companies for Assessment Year 2020-21 are as follows:

| Domestic Company | Assessment Year 2020-21 |

| – Where its total turnover or gross receipt during the previous year 2017-18 does not exceed Rs. 400 crore | 25% |

| – Where it opted for Section 115BA | 25% |

| – Where it opted for Section 115BAA | 22% |

| – Where it opted for Section 115BAB | 15% |

| – Any other domestic company | 30% |

Add:

a) Surcharge: The amount of income-tax shall be increased by a surcharge at the rate of 7% of such tax, where total income exceeds one crore rupees but not exceeding ten crore rupees and at the rate of 12% of such tax, where total income exceeds ten crore rupees. However, the rate of surcharge in case of a company opting for taxability under Section 115BAA or Section 115BAB shall be 10% irrespective of amount of total income.

The surcharge shall be subject to marginal relief, which shall be as under:

i) Where income exceeds Rs. 1 crore but not exceeding Rs. 10 crore, the total amount payable as income-tax and surcharge shall not exceed total amount payable as income-tax on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore.

ii) Where income exceeds Rs. 10 crore, the total amount payable as income-tax and surcharge shall not exceed total amount payable as income-tax on total income of Rs. 10 crore by more than the amount of income that exceeds Rs. 10 crore

b) Health and Education Cess: The amount of income-tax and the applicable surcharge, shall be further increased by health and education cess calculated at the rate of four percent of such income-tax and surcharge.

7. Foreign Company Tax Rates

Assessment Year 2020-21

| Nature of Income | Tax Rate |

| Royalty received from Government or an Indian concern in pursuance of an agreement made with the Indian concern after March 31, 1961, but before April 1, 1976, or fees for rendering technical services in pursuance of an agreement made after February 29, 1964 but before April 1, 1976 and where such agreement has, in either case, been approved by the Central Government | 50% |

| Any other income | 40% |

Add:

a) Surcharge: The amount of income-tax shall be increased by a surcharge at the rate of 2% of such tax, where total income exceeds one crore rupees but not exceeding ten crore rupees and at the rate of 5% of such tax, where total income exceeds ten crore rupees. However, the surcharge shall be subject to marginal relief, which shall be as under:

(i) Where income exceeds one crore rupees but not exceeding ten crore rupees, the total amount payable as income-tax and surcharge shall not exceed total amount payable as income-tax on total income of one crore rupees by more than the amount of income that exceeds one crore rupees.

(ii) Where income exceeds ten crore rupees, the total amount payable as income-tax and surcharge shall not exceed total amount payable as income-tax on total income of ten crore rupees by more than the amount of income that exceeds ten crore rupees.

b) Health and Education Cess: The amount of income-tax and the applicable surcharge, shall be further increased by health and education cess calculated at the rate of four percent of such income-tax and surcharge.

8. Co-operative Society

Assessment Year 2020-21

| Taxable income | Tax Rate |

| Up to Rs. 10,000 | 10% |

| Rs. 10,000 to Rs. 20,000 | 20% |

| Above Rs. 20,000 | 30% |

Add:

a) Surcharge: The amount of income-tax shall be increased by a surcharge at the rate of 12% of such tax, where total income exceeds one crore rupees. However, the surcharge shall be subject to marginal relief (where income exceeds one crore rupees, the total amount payable as income-tax and surcharge shall not exceed total amount payable as income-tax on total income of one crore rupees by more than the amount of income that exceeds one crore rupees).

b) Health and Education Cess: The amount of income-tax and the applicable surcharge, shall be further increased by health and education cess calculated at the rate of four percent of such income-tax and surcharge.

Source : Income Tax

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"