The Income Tax Department has clarified that Intimation u/s 143(1) on Account of 80P deduction inadvertently sent.

Reetu | Sep 2, 2023 |

Intimation u/s 143(1) on Account of 80P deduction inadvertently sent: Clarifies Income Tax

The Income Tax Department has clarified that Intimation u/s 143(1) on Account of 80P deduction inadvertently sent.

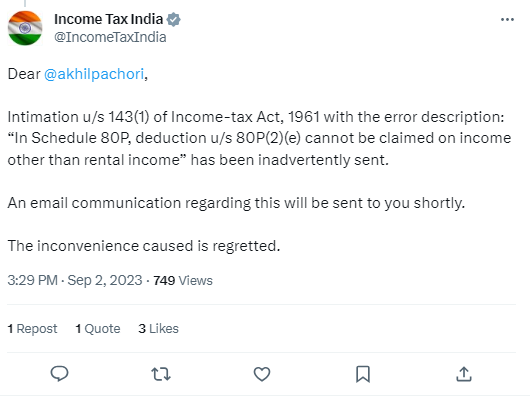

Intimation u/s 143(1) of Income-tax Act, 1961 with the error description: “In Schedule 80P, deduction u/s 80P(2)(e) cannot be claimed on income other than rental income” has been inadvertently sent.

An email communication regarding this will be sent to you shortly.

The inconvenience caused is regretted.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"