The Income Tax Department has acknowledged the mismatches in AIS (Annual Information Statement) Data and urged reporting entities to submit revised data.

Reetu | Mar 11, 2024 |

IT- Department acknowledges mismatches in AIS Data: Reporting Entity to submit revised data

The Income Tax Department has acknowledged the deficiencies/ mismatches in AIS (Annual Information Statement) Data and urged reporting entities to submit revised data.

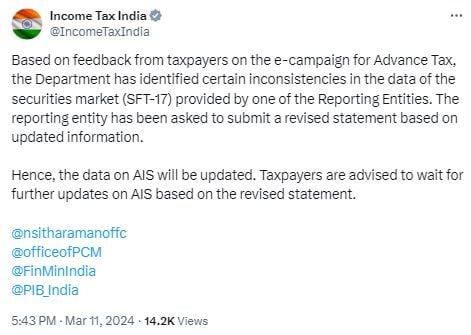

Based on feedback from taxpayers on the e-campaign for Advance Tax, the Department has identified certain inconsistencies in the data of the securities market (SFT-17) provided by one of the Reporting Entities. The reporting body has been asked to submit a revised statement with updated information.

Therefore, the data on AIS will be updated. Taxpayers are recommended to await additional details on AIS based on the updated statement.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"