The Income Tax portal has added a new 'Authenticate Insight DIN' tool, which is designed to improve taxpayer security and convenience.

Reetu | Jan 16, 2024 |

IT Department introduces Authenticate Insight DIN feature for Enhanced Communication Security and Verification

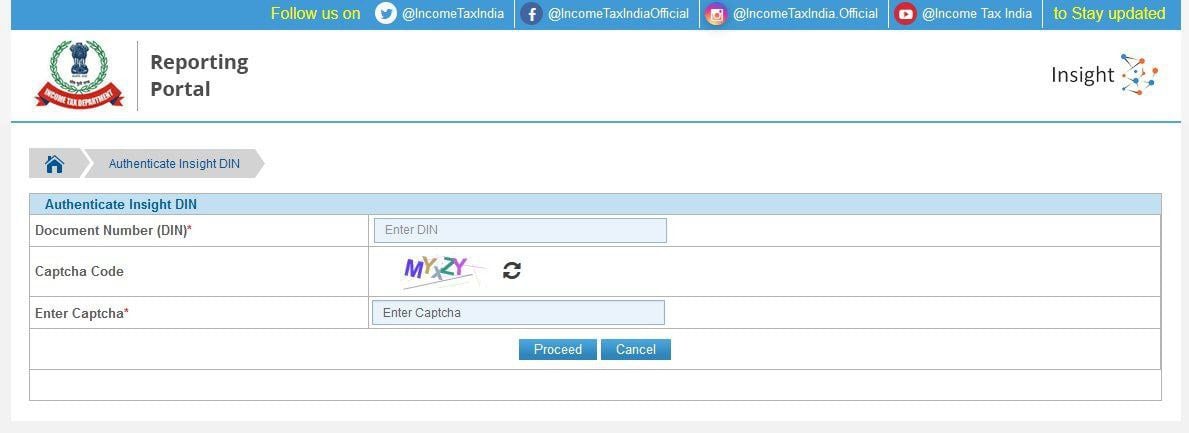

The Income Tax portal has added a new ‘Authenticate Insight DIN’ tool, which is designed to improve taxpayer security and convenience. This new feature allows taxpayers to effectively verify communications from the income tax department, adding a degree of protection and legitimacy to the notifications they receive.

The ‘Authenticate Insight DIN’ feature, which can be used straight from the AIS Home Page, is intended to streamline communication between taxpayers and the income tax department. Users can now authenticate messages received, ensuring the integrity of notifications and protecting themselves from potential fraudulent activity.

One of the primary benefits of this new feature is its user-friendly interface and accessibility. By seamlessly integrating into the AIS Home Page, taxpayers can navigate and use the ‘Authenticate Insight DIN’ option with ease. This decision is consistent with the government’s aim to make tax processes more user-friendly and safe.

Furthermore, the Income Tax Portal has added Single Sign-On (SSO) capabilities to the Compliance Portal and Reporting Portal services. This connection enables customers to access these services directly from the e-filing site, reducing the need for multiple logins and streamlining the user experience.

With this Single Sign-On functionality, taxpayers may easily access a variety of features such as the Annual Information Statement, e-Campaigns, e-Verifications, e-Proceedings, and DIN Authentication. This convergence of services not only saves time but also provides a seamless movement between different portals, resulting in a more efficient and user-friendly tax compliance system.

The introduction of Single Sign-On for the Compliance and Reporting Portals complements the government’s ongoing efforts to digitise and modernise tax-related activities. It demonstrates a dedication to using technology to the benefit of taxpayers, providing them with a comprehensive platform to meet their compliance responsibilities.

To summarise, the ‘Authenticate Insight DIN’ feature and the Single Sign-On connection for Compliance and Reporting Portals are key steps towards a more secure, efficient, and user-friendly tax ecosystem. These upgrades not only provide taxpayers with tools for verifying communications, but they also streamline access to critical services, building a digital tax environment that prioritises security and simplicity.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"