Accumulated income under Section 11(2) held validly applied where expenditure is wholly towards charitable educational purposes

Meetu Kumari | Dec 20, 2025 |

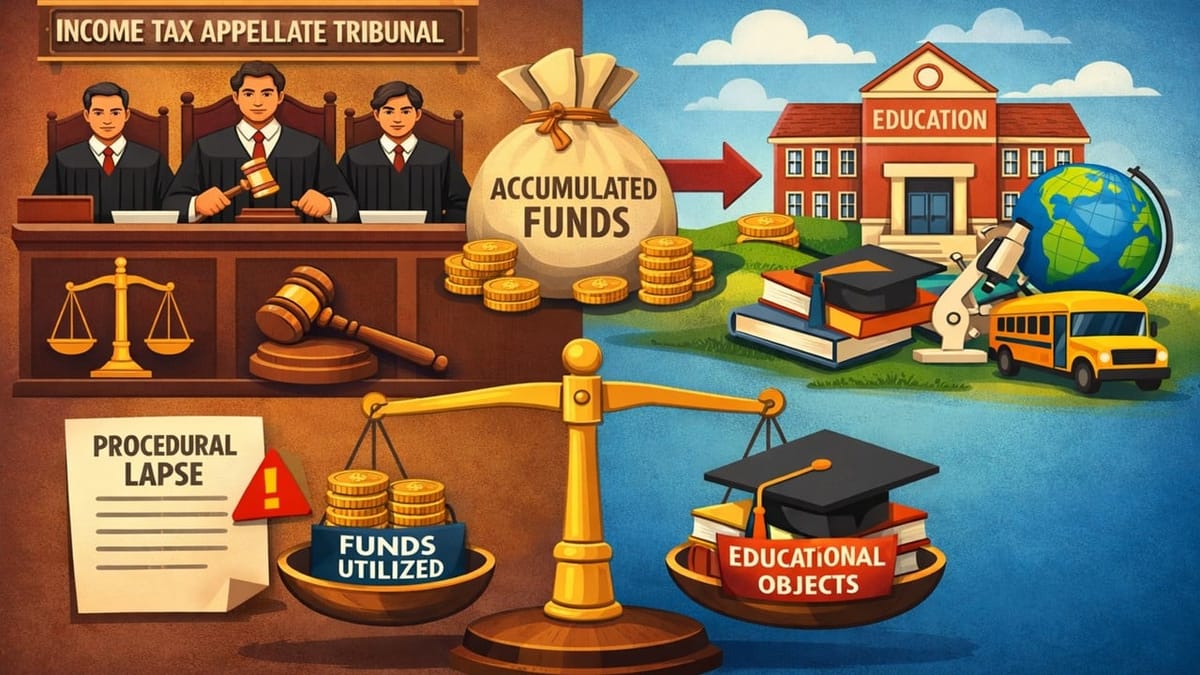

ITAT Allows Application of Accumulated Funds Spent on Educational Objects; Procedural Lapse Not Fatal

Salwan Education Trust, a charitable trust registered under Section 12A, filed its return for AY 2018-19 declaring NIL income. The Trust runs multiple schools and claimed exemption under Section 11. It had earlier accumulated an income of Rs. 4.44 crore in AY 2013-14 by filing Form 10 for the construction of school buildings at Gurgaon and Tronica City. During the financial year, Rs. 3.94 crore remained unutilised at the beginning of the year.

In AY 2018-19, the Trust incurred capital expenditure of Rs. 5.47 crore across various schools for educational purposes. The Assessing Officer held that only Rs. 1.30 crore was applied for the specific purpose mentioned in Form 10 and treated the balance of Rs. 2.63 crore as taxable under Section 11(3), alleging non-utilisation for the specified purpose and failure to seek approval to apply funds for other objects. The CIT(A) upheld the addition.

Issue Before Tribunal: Whether accumulated income under Section 11(2), specified in Form 10 for the construction of school buildings, can be treated as validly applied when spent on other educational objects of the Trust, without a separate application to the Assessing Officer.

ITAT Held: The ITAT allowed the assessee’s appeal. It held that where the sole object of the Trust is education, and the accumulated funds are spent wholly for educational purposes, exemption under Section 11 cannot be denied merely due to procedural or technical defects in Form 10 or because the expenditure was spread across multiple schools.

The Tribunal relied on binding precedents holding that Section 11(2) does not prohibit plurality of purposes, provided they are charitable and fall within the objects of the trust. The matter was restored to the Assessing Officer only for limited verification of the actual incurring of expenditure.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"