The tribunal, after considering the facts of the case, said that the mistake was bona fide and directed the CIT(E) to condone the delay.

Nidhi | Jan 5, 2026 |

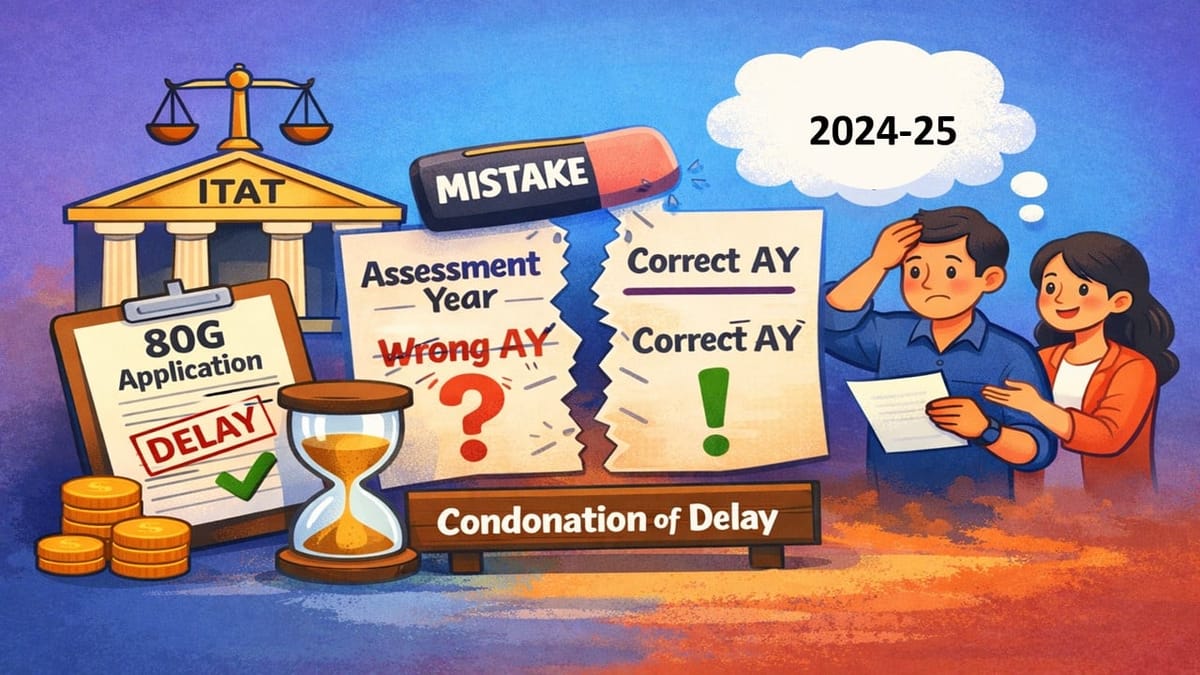

ITAT Allows Condonation of Delay in 80G Application Due to Bona Fide Mistake in Assessment Year Selection

The Income Tax Appellate Tribunal (ITAT), Kolkata, ruled in favour of a Charitable Trust, by directing the Commissioner of Income Tax (Exemption) to condone the delay in filing Form 10AB for approval under section 80G of the Income Tax Act, 1961. The delay was caused by an inadvertent mistake.

The assessee Trust, Sawansukha Foundation, filed an application for final approval under section 80G(5) for the assessment year 2025-26. However, the CIT(E) rejected the trust’s application, saying that the application was filed beyond the prescribed filing due date. The trust had registered under Section 12A and was previously granted approval under Section 80G for assessment years 2022-23 to 2024-25. The trust was required to file Form 10AB for AY 2025-26, but due to an inadvertent mistake, it selected the wrong assessment year (AY 2024-25) while filing Form 10AB, even though the approval for this assessment year was already available to the Trust.

Before the ITAT, the assesse Trust submitted that the staff of the assesse Trust chose the incorrect assessment year in the drop-down menu while filing Form 10AB. The tribunal, after considering the facts of the case, said that the mistake was bona fide and directed the CIT(E) to condone the delay and consider the application for condonation in granting registration under Section 80G.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"