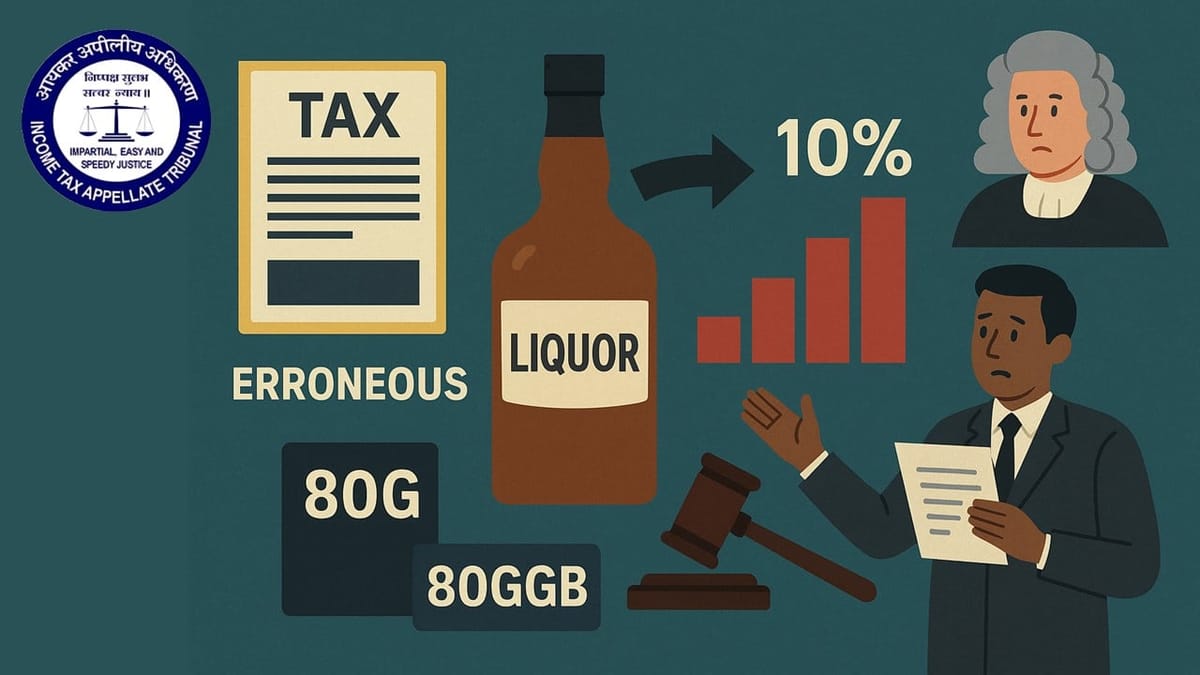

ITAT Chennai upheld the 153C reassessment in a bogus bottle purchase case, confirming a 10% profit estimate instead of full additions and dismissing both appeals.

Saloni Kumari | Dec 4, 2025 |

ITAT Chennai Confirms 10% Profit Estimate in Liquor Firm’s Bogus Bottle Purchase Case

The ITAT Chennai upheld the 153C reassessment and agreed that the company’s books were unreliable, but supported CIT(A)’s 10% profit estimate instead of the full bogus purchase addition. Section 80G donations were allowed, 80GGB disallowed, and both appeals were dismissed.

The DCIT, Central Circle-2(2), Chennai and M/s. Southern Agrifurane Industries Pvt. Ltd. have filed an appeal before the Income Tax Appellate Tribunal (ITAT) Chennai, both challenging orders passed by the Commissioner of Income Tax (Appeals) [CIT(A)] on March 29, 2025, under section 250 of the Income Tax Act 1961. The case is related to the assessment years 2014-15 to 2019-20.

The company is involved in the manufacturing and selling of Indian liquor. On August 6, 2019, a search was conducted at SNJ Group and related entity Ms Crystal Bottles under Section 132 that uncovered possible fake expense claims on old bottles used in production. Evidence was found alleging the assessee inflated expenses using bogus invoices for old empty bottles, with cash returned after a 6% commission. This resulted in the issuance of notices under Section 153C after satisfaction notes linked seized documents (like ledgers, Excel sheets, and statements) to the assessee’s income. The tax department made an addition of the full bogus purchase value to the assessee’s income, plus disallowances under Sections 14A, 80G, and 80GGB.

The dissatisfied assessee filed an appeal before CIT(A), where CIT(A) ruled that the decision of the tax authorities to make an addition of the entire bogus purchase value to the assessee’s income was not justified. In the final decision, CIT(A) rejected books under Section 145(3) and estimated profits at 10% of turnover, and deleted all other separate disallowance(s)/addition(s) on account of Section 14A & sales promotion expenses. Meaning, the CIT(A) partially allowed the additions made by the tax authorities and ruled in favour of the assessee.

The tax authorities, dissatisfied with the ruling of CIT(A), filed an appeal before ITAT Chennai, where the tribunal upheld the reassessment process under section 153C, noting that the tax authority had valid reasons from seized documents linking the company to indeed using fake bills. It agreed that books were unreliable due to errors but supported the 10% profit estimate, referencing earlier rulings for similar liquor firms and company averages of 5-8%. Donations under section 80G were allowed as genuine (no proof of cash kickbacks), while a small political donation claim under 80GGB was dropped. The tribunal had dismissed the appeals of both the assessee and the tax authorities, confirming the balanced profit estimate over extreme additions.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"