The ITAT condoned the delay but imposed a cost of Rs 5,000 on the assessee trust to be paid to the Income Tax Department within two weeks.

Nidhi | Jan 23, 2026 |

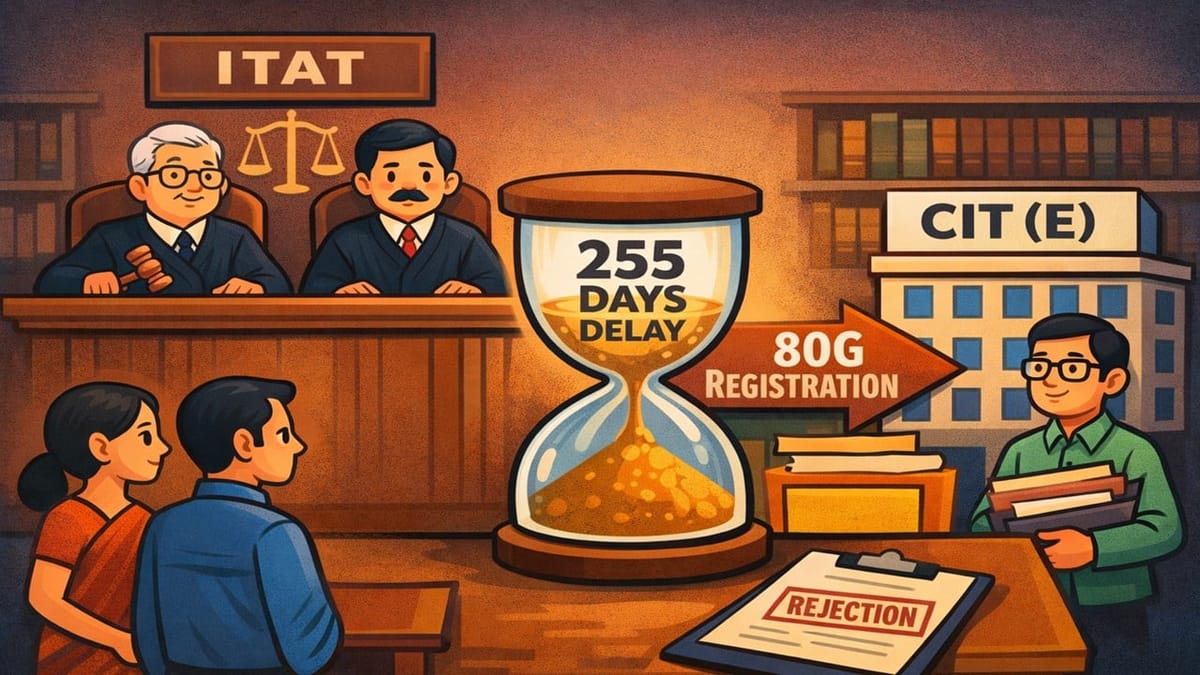

ITAT Condones 255-Day Delay, Sends 80G Registration Issue Back to CIT(E)

The Income Tax Appellate Tribunal (ITAT), Ahmedabad, has given relief to a Charitable Trust by condoning the delay in filing its appeal and sending the matter back to the Commissioner of Income Tax (Exemption) for fresh consideration after imposing a cost on the assessee.

The assessee trust was granted permanent registration under section 12AB of the Income Tax Act. However, the assessee’s applications for registration under section 80G(5) were rejected two times by the CIT(E) through an order dated 16-05-2024 and another ex parte order dated 24-12-2024. The assessee challenged this ex parte order before the ITAT.

However, there was a delay of 255 days in filing the appeal. The Trust explained that it is located in an interior area of the Anand district and was not aware that a separate appeal had to be filed. The Trust also mentioned that it was never involved in income tax litigation in the past and already had permanent registration under Section 12AB of the Income Tax Act.

The Revenue, on the other side, submitted that due to this delay, a cost should be imposed on the trust if the matter is remanded.

After hearing both sides, the ITAT condoned the delay but imposed a cost of Rs 5,000 on the assessee trust to be paid to the Income Tax Department within two weeks.

The Tribunal directed the assessee to submit the proof of payment, the CIT(E) must give one more opportunity of hearing to the Trust and decide the matter as per the law.

Once proof of payment is submitted, the CIT (Exemption) must give one more opportunity of hearing to the Trust and decide the matter again as per the law.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"