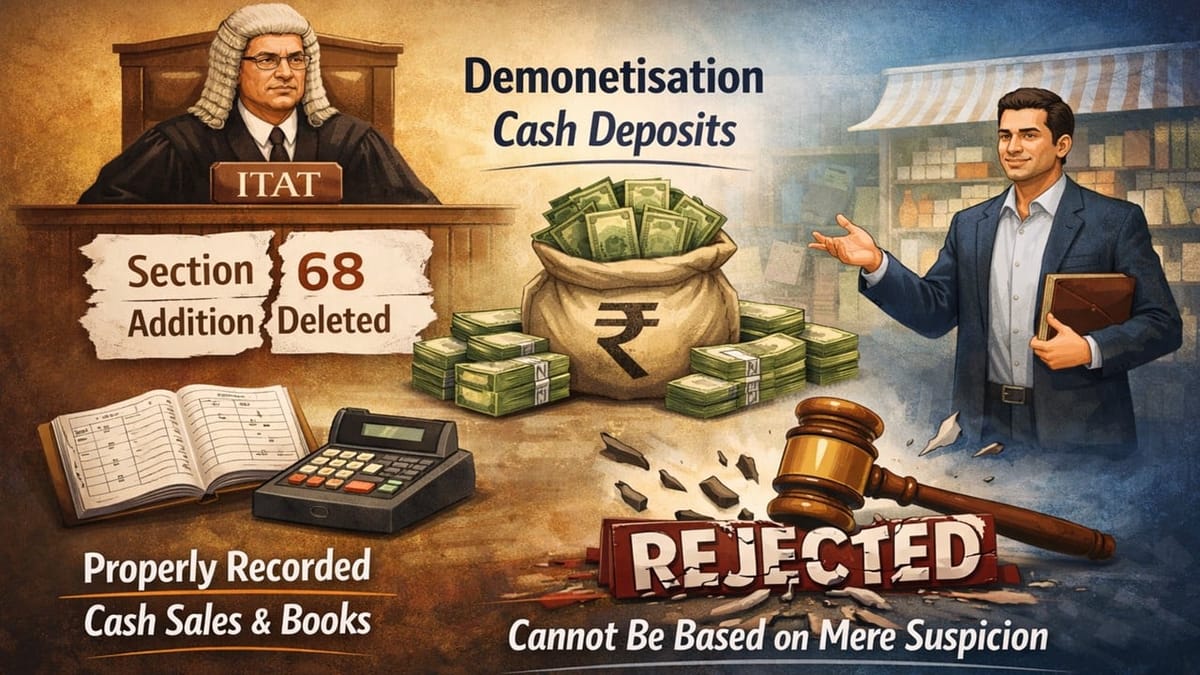

ITAT deleted the Section 68 addition on demonetisation cash deposits, holding that properly recorded cash sales and books cannot be rejected based on mere suspicion.

Saloni Kumari | Feb 7, 2026 |

ITAT Deletes Section 68 Addition in Demonetisation Cash Deposit Dispute; Says Suspicion Cannot Replace Evidence

Pankaj Jewellers Private Limited has filed the present appeal in ITAT Ahmedabad, challenging an order dated June 16, 2025, passed by the CIT(A) under section 250 of the Income Tax Act, 1961. The case concerns the Assessment Year 2017-18. The impugned order had sustained an addition of Rs. 62,52,929 made to the assessee’s income under Section 68 of the Act on the grounds of unexplained cash credits during the period of demonetisation.

The assessee filed its income tax return (ITR) for the year in consideration, declaring total income at Rs. 14,61,190. During assessment, the AO noted that the assessee deposited Rs. 1.88 crore in Specified Bank Notes (SBNs) during FY 2016-17, of which Rs. 1.35 crore was deposited between November 09 and December 31, 2016. When asked, the assessee explained that these deposits came from cash sales and submitted all the relevant documents explaining the same. However, the AO still inappropriately increased the income of the assessee by making an addition of Rs. 62.52 lakh as unexplained and taxing it under Section 115BBE at 60%.

The assessee further argued that the CIT(A) also ignored the facts of the case and upheld the addition. The company had a sufficient opening cash balance of Rs. 1.35 crore before demonetisation, recorded in books, and all transactions were properly invoiced and reflected in VAT returns. The increase in cash deposits was due to mandatory banking of demonetised currency, not undisclosed income.

The ITAT noted that the addition was based purely on suspicion and minor ratio differences, without any discrepancies in books or stock. Since the assessee had explicitly explained the sources of all the investments made, the Tribunal held the AO’s addition under Section 68 as unsustainable. As a result, the tribunal allowed the appeal and deleted the addition of Rs. 62,52,929.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"