Since the approval granted by the JCIT, the present case was without the independent application of mind, quashed the assessments for all five years and allowed the appeals partly.

Nidhi | Jan 22, 2026 |

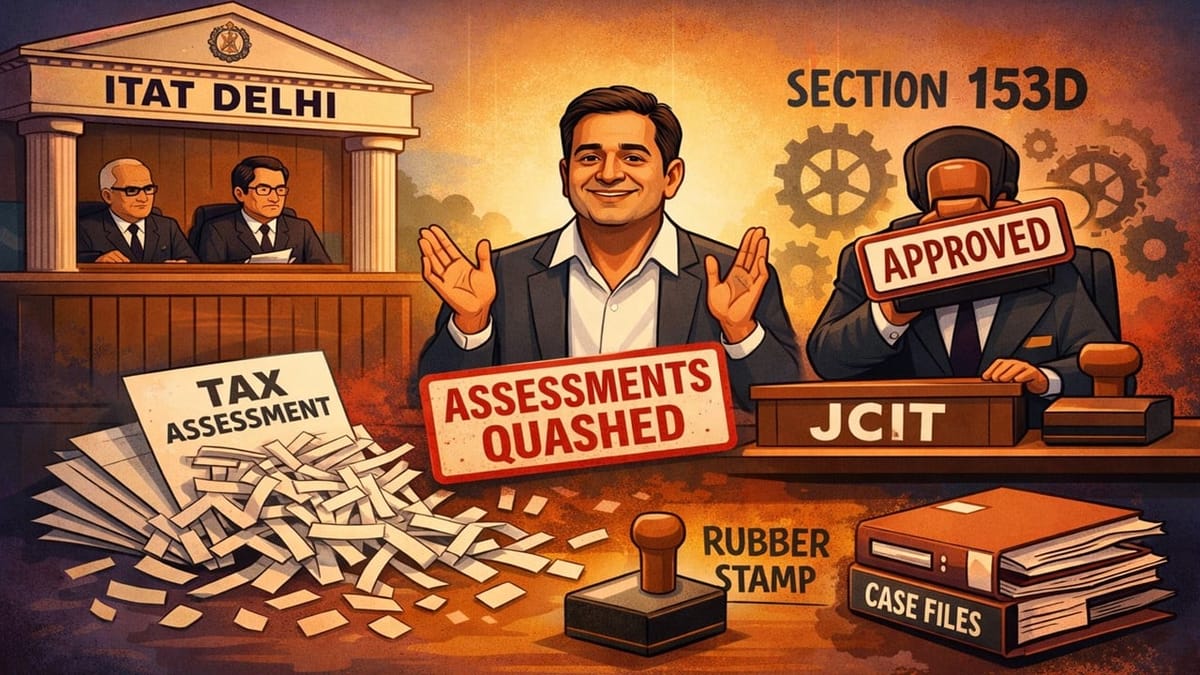

ITAT Delhi Quashes Assessments Due to JCIT’s Mechanical Approval Under Section 153D

The Income Tax Appellate Tribunal (ITAT), Delhi, quashed income tax assessments for several financial years due to the invalid and mechanical approval granted by the JCIT under Section 153D of the Income Tax Act, 1961.

The assessee, Sanjay Singhal, challenged the approval taken by the AO from the Joint Commission of Income Tax (JCIT) under Section 153D of the Income Tax Act before the ITAT, Delhi.

The assessee argued that the JCIT gave combined approval for 7 years instead of giving separate approval for each assessment year under section 153D. The assessee also submitted that the JCIT had given its approval on the same day for 7 cases, which was not possible.

Additionally, the assessee argued that the order did not mention that the JCIT had perused the draft orders or independently applied his mind, making the approval invalid and bad in law.

The ITAT agreed with the assessee’s contentions. Relying on previous judgements, the Tribunal upheld that a mechanical approval given by the superior authority defeats the purpose of obtaining approval under section 153D, and the same is bad in the eyes of the law.

Since the approval granted by the JCIT, the present case was without the independent application of mind, quashed the assessments for all five years and allowed the appeals partly.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"