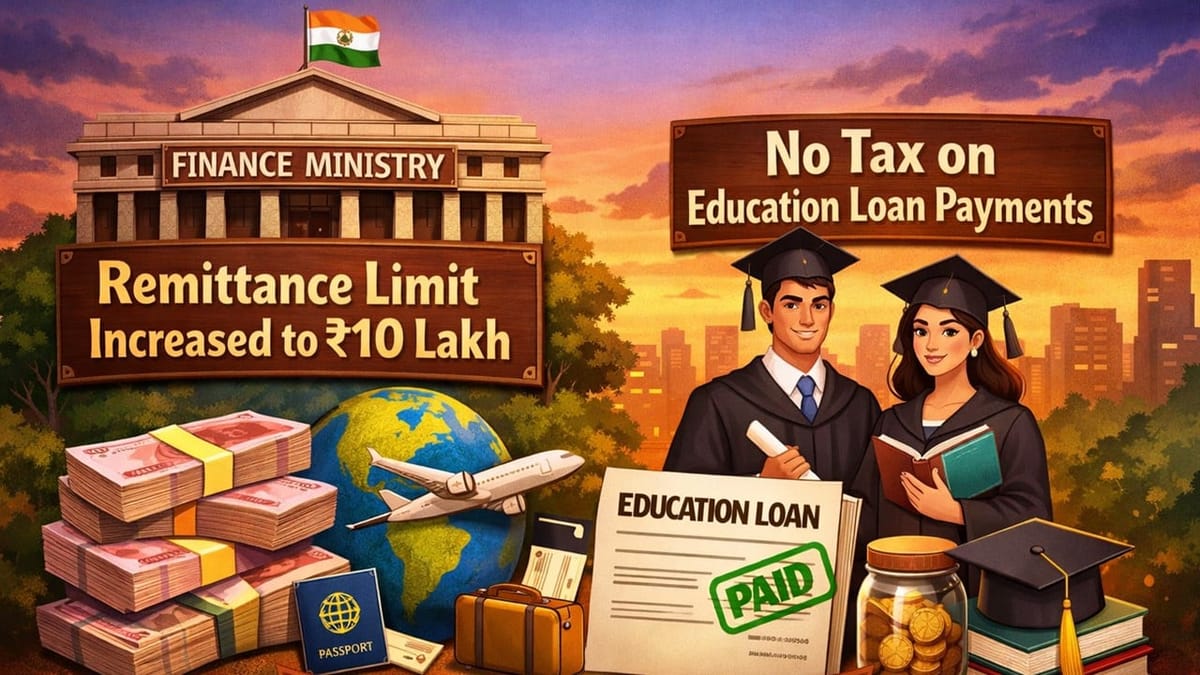

The Finance Ministry relaxes TCS rules under LRS by raising the remittance limit to Rs. 10 lakh and removing tax on education loan payments from April 2025.

Saloni Kumari | Jan 22, 2026 |

CBDT Proposes to Increase TCS Limit on RBI LRS and Fully Exempt on Education Loan Remittances

The Central Board of Direct Taxes (CBDT) under the Ministry of Finance has announced key relaxation proposals in Tax Collected at Source (TCS) under the Reserve Bank of India’s Liberalised Remittance Scheme (LRS) for the Financial Year 2025-26. These amendments are part of the government’s larger initiative to reduce the compliance burden on taxpayers and make overseas payments more affordable.

The Ministry of Finance has raised a proposal to raise the limit to collect Tax Collected at Source (TCS) on remittances under the Reserve Bank of India’s Liberalised Remittance Scheme (LRS) to Rs. 10 lakh. Previously, TCS was applicable when total remittances in a financial year exceeded Rs. 7 lakh.

As a result, tax will be collected only when the total amount sent abroad under LRS exceeds Rs. 10 lakh in a financial year. This amendment has been made by modifying the first proviso to Section 206C(1G) of the Income-tax Act, 1961. The said action was made effective from April 01, 2025. However, the limit does not apply to overseas tour packages; they will continue to follow a separate threshold.

It has also been suggested to remove TCS on remittances made out of an education loan obtained from a specified financial institution (as defined in Section 80E). If implemented, this will be a major relief for students who send money abroad for education using loans. Earlier, TCS at a 0.5% rate was applied to such transactions. Now, the government is planning to reduce this rate to zero (NIL). This amendment has been implemented by modifying clause (i) of subsection (1G) of Section 206C. This was made effective from April 01, 2025.

On one hand, the TCS rate has been increased on LRS remittances; on the other hand, it has been fully exempted on education loan remittances. This action has been taken with an aim to support students and families by lowering the financial burden of studying abroad and encouraging higher education in the country without additional tax costs.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"