ITAT partly upheld the tax addition on agricultural income due to lack of evidence, but quashed the reassessment under Section 68, holding it to be a mere change of opinion and legally invalid.

Saloni Kumari | Dec 18, 2025 |

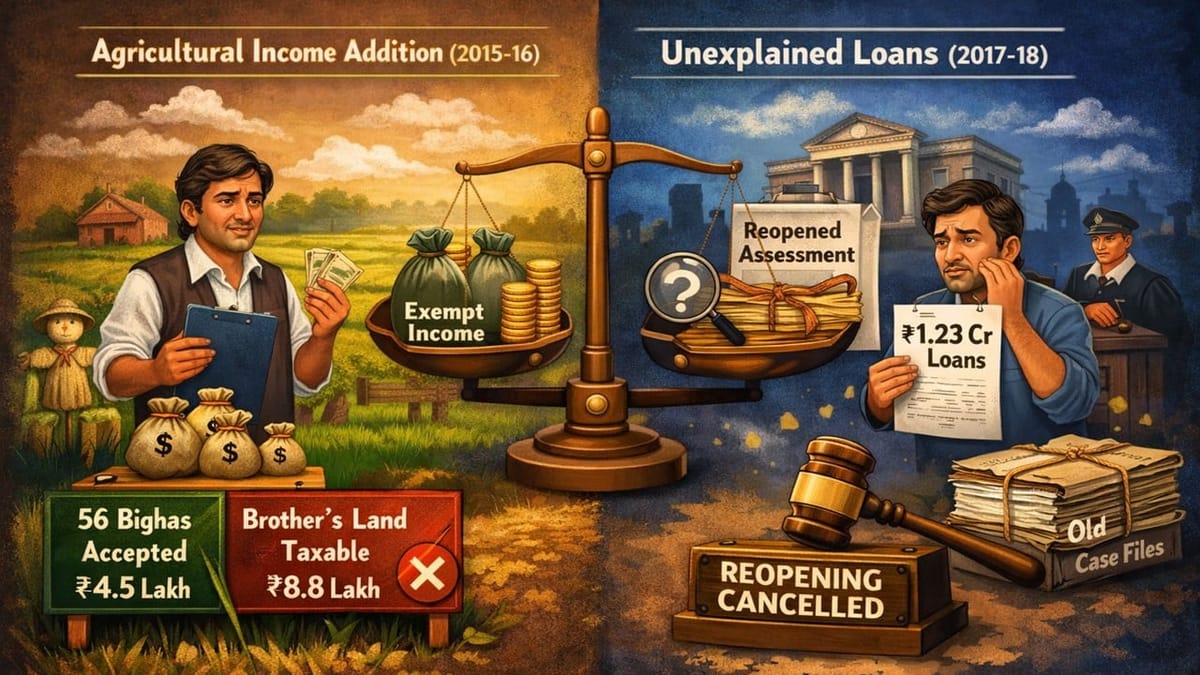

ITAT Partly Upholds Section 68 Agricultural Income Addition but Cancels Unexplained Loan Reopening

Manoj Kumar Agarwal had filed two appeals against the tax officer in the Income Tax Appellate Tribunal (ITAT), Agra, challenging an order passed by the CIT(A) Mumbai on December 12, 2024. As both the appeals were based on similar issues, the tribunal heard both the appeals simultaneously. The case is related to the assessment years 2015-16 and 2017-18.

The key issue in both the appeals was whether the CIT(A) was correct in confirming the addition of Rs. 15,63,030 to the taxpayer’s income made by the tax officer by treating the agricultural income as taxable income under the head income from other sources in the facts and circumstances of the instant case.

In assessment year 2015-16, Manoj had claimed a tax exemption of Rs. 20 lakh on agricultural income from 100 bighas of land. The land was partially owned by him and partially by his brother. During assessment proceedings, the tax officer did accept the complete exemption; however, they only accepted income from Manoj’s own 56 bighas at Rs. 8,000 per bigha, which is around Rs. 4.5 lakh, and made the addition of the rest of the amount to Manoj’s income as “other income.” On this matter, the tribunal endorsed the decision of the tax officer and only accepted the agricultural income generated from Manoj’s own income, i.e., allowed only a Rs. 11.3 lakh tax exemption, with Rs. 8.8 lakh is still taxable. The tribunal disallowed the tax exemption claimed on income generated from the brother’s land due to a lack of strong evidence, like the brother’s tax returns.

In assessment year 2017-18, the tax officer reopened the assessment based on an election affidavit displaying a liability of Rs. 1.23 crore on Manoj as old unsecured loans. In conclusion, the tax officer made an addition of the same amount of tax to Manoj’s income under Section 68 as unexplained income. On this matter, the tribunal set aside the opening of the case, finding the reasons behind reopening indefinite and unclear. The tribunal noted there were no details on when or from whom the loans came, and the approval was mechanical, citing the wrong law (Explanation 2(b) did not apply since a prior scrutiny assessment existed).

The loans were carried forward from earlier assessment years, hence were already scrutinised, so this was just a “change of opinion” and a fishing expedition, violating tax laws. To announce its final decision, the tribunal also cited earlier judgements of the Supreme Court and High Court ruling on a similar issue, all ruling in favour of the taxpayer and supporting the cancellation of the proceedings.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"